Haier 2006 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2006 Haier annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Financial Statements

財務報表附註 (31 December 2006)

(二零零六年十二月三十一日)

126

Haier Electronics Group Co., Ltd. Annual Report 2006

海爾電器集團有限公司 二零零六年年報

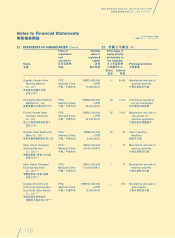

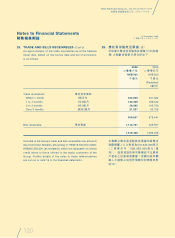

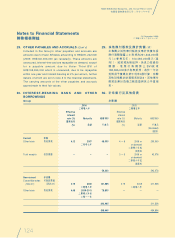

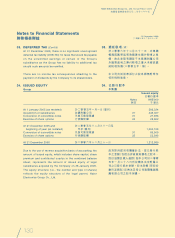

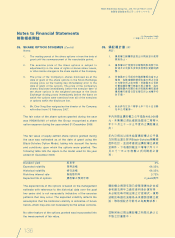

30. INTEREST-BEARING BANK AND OTHER

BORROWINGS

(Cont’d)

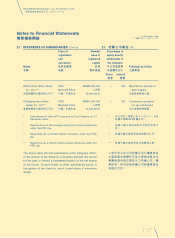

All interest-bearing bank and other borrowings are unsecured.

The other loans represented loans borrowed from Haier

Finance, which are guaranteed by Haier Corp, bear interest

at a rate of approximately 6% per annum and are repayable

within one year, except for borrowings of HK$78,800,000 which

are repayable between 2009 and 2011. Further details of the

interest expenses attributable to the loans borrowed from Haier

Finance are set out in note 16 to the financial statements.

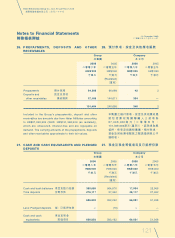

Except for the convertible notes, all other borrowings of the

Group bear interest at floating interest rates. The Group’s

other loans are denominated in RMB and the convertible notes

are denominated in Hong Kong dollars.

The carrying amounts of the Group’s other borrowings

approximate to their fair values. The fair value of the liability

portion of the convertible notes is estimated at approximately

HK$150 million (2005: HK$200 million), which is calculated

by discounting the expected future cash flows at the prevailing

interest rates.

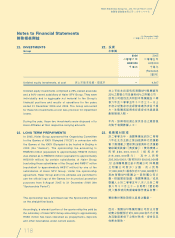

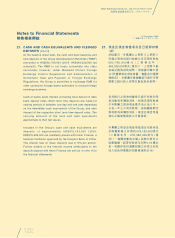

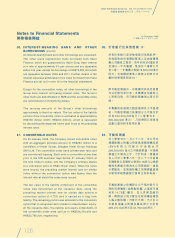

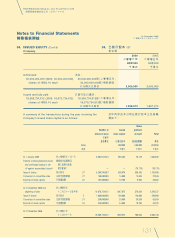

31. CONVERTIBLE NOTES

On 28 January 2005, the Company issued convertible notes

with an aggregate principal amount of HK$260 million to a

subsidiary of Haier Group, Qingdao Haier Group Holdings

(BVI) Ltd. The convertible notes have a three-year term and

are non-interest-bearing. Each note is convertible at any time

prior to the fifth business days before 27 January 2008, at

the note holder’s option, into the Company’s ordinary shares

at a conversion price of HK$0.18 per share. When the notes

were issued, the prevailing market interest rate for similar

notes without the conversion option was higher than the

interest rate at which the notes were issued.

The fair value of the liability component of the convertible

notes was determined at the issuance date, using the

prevailing market interest rate for similar debt without a

conversion option of 4.75% and is carried as a long term

liability. The remaining portion was allocated to the conversion

option that is recognised and included in shareholders’ equity.

At the issuance date, the liability and equity components of

the convertible notes were split as to HK$226,210,000 and

HK$33,790,000, respectively.

30. 計息銀行及其他借貸

(續)

所有計息銀行及其他借貸均為無抵押。

其他貸款指向海爾財務借入並由海爾集

團公司擔保之貸款,按年利率約6厘計息

及須於一年內償還,惟須於二零零九年

至二零一一年償還之借貸78,800,000港元

除外。向海爾財務借入貸款之利息支出

載於財務報表附註16。

除可換股票據外,本集團所有其他借貸

均以浮動利率計息。本集團其他貸款以

人民幣列值,而可換股票據則以港元列

值。

本集團其他借貸之賬面值與其公平值相

若。可換股票據之負債部分公平值估計

約為150,000,000港元(二零零五年:

200,000,000 港元),乃按預期日後現金

流量以當時利率貼現計算。

31. 可換股票據

於二零零五年一月二十八日,本公司向

海爾集團之附屬公司青島海爾集團控股

(BVI)有限公司發行本金額合共

260,000,000 港元之可換股票據。可換股

票據之年期為三年,不計利息。票據持

有人可於二零零八年一月二十七日前第

五個營業日前隨時以每股0.18港元之換股

價將各票據兌換為本公司普通股。當發

行票據後,並無換股權之同類票據當時

市場利率較票據發行當時之利率為高。

可換股票據之負債部分公平值於發行日

期按同類債務(並無換股權)之當時市場

利率(4.75厘)釐定,並以長期負債列

賬。剩餘部分則分配至在股東權益確認

入賬之換股權。於發行日期,已分拆之

可換股票據之負債及權益部分分別為

226,210,000港元及33,790,000港元。