Haier 2006 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2006 Haier annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Financial Statements

財務報表附註 (31 December 2006)

(二零零六年十二月三十一日)

138

Haier Electronics Group Co., Ltd. Annual Report 2006

海爾電器集團有限公司 二零零六年年報

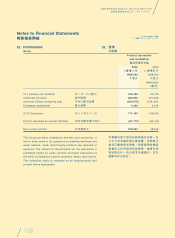

36. RESERVES

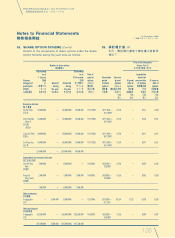

(a) Group

The amounts of the Group’s reserves and the movements

therein for the current and prior years are presented in

the combined statement of changes in equity on pages

50 and 51 of the financial statements.

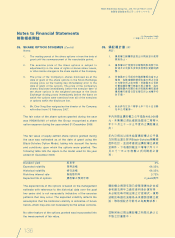

(i) Pursuant to the relevant PRC laws and regulations,

certain of the Group’s subsidiaries registered in

the PRC are required to transfer a portion of their

profits to reserve funds. These funds are non-

distributable in the form of cash dividends. For the

purpose of determining the appropriations to these

funds, the net profits of these subsidiaries are

determined in accordance with the applicable

financial rules and regulations of the PRC.

(ii) The consideration in connection with the Asset

Transfer set out in note 2 to the financial

statements was HK$900 million, which was

satisfied as to HK$240 million by the issuance of

1,000,000,000 ordinary shares of the Company at

HK$0.24 each and HK$660 million by the

Promissory Note and its accrued interest, the

Offsetting Receivables and the Deferred

Consideration (collectively referred to as the “Non-

share Consideration”).

As the Asset Transfer is accounted for using merger

accounting, it is treated as an equity transaction.

Accordingly, the Non-share Consideration is

regarded as a deemed distribution to the holding

companies of the Company for the year ended 31

December 2006.

36. 儲備

(a) 本集團

本年度及過往年度本集團之儲備數

額及其變動詳情,載於財務報表第

50及51頁之合併權益變動表。

(i) 根據相關中國法例及法規,本

集團若干於中國註冊之附屬公

司須將其部分溢利轉撥至儲備

基金。該等基金不可以現金股

息之形式分派。在釐定向該等

基金之分配時,會根據適用之

中國財務規則及法規釐定該等

附屬公司之純利。

(ii) 財務報表附註2所載與資產轉

讓有關之代價為900,000,000

港元,其中240,000,000港元

透過按每股0.24港元發行

1,000,000,000股本公司普通

股之方式支付,而

660,000,000港元則透過承付

票據及其應計利息、抵銷應收

賬款及遞延代價(統稱「非股份

代價」)之方式支付。

由於資產轉讓乃採用合併會計

法入賬,故其獲視為一項股本

交易。因此,非股份代價乃視

為於截至二零零六年十二月三

十一日止年度向本公司控股公

司作出之分派。