Haier 2006 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2006 Haier annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Financial Statements

財務報表附註 (31 December 2006)

(二零零六年十二月三十一日)

80

Haier Electronics Group Co., Ltd. Annual Report 2006

海爾電器集團有限公司 二零零六年年報

3.4 SUMMARY OF SIGNIFICANT ACCOUNTING

POLICIES

(Cont’d)

Employee benefits

(Cont’d)

Share-based payment transactions (Cont’d)

The Group has adopted the transitional provisions of HKFRS

2 in respect of equity-settled awards and has applied HKFRS

2 only to equity-settled awards granted after 7 November 2002

that had not vested by 1 January 2005 and to those granted

on or after 1 January 2005.

Pension schemes

The Group operates a defined contribution Mandatory

Provident Fund retirement benefits scheme (the “MPF

Scheme”) under the Mandatory Provident Fund Schemes

Ordinance, for those employees who are eligible to participate

in the MPF Scheme. Contributions are made based on a

percentage of the employees’ basic salaries and are charged

to the income statement as they become payable in

accordance with the rules of the MPF Scheme. The assets of

the MPF Scheme are held separately from those of the Group

in an independently administrated fund. The Group’s employer

contributions vest fully with the employees when contributed

into the MPF Scheme.

The employees of the Group’s subsidiaries in Mainland China

are required to participate in central pension scheme operated

by the local municipal government. These subsidiaries are

required to contribute a certain percentage of its payroll costs

to the central pension scheme. The contributions are charged

to the income statement as they become payable in

accordance with the rules of the central pension scheme.

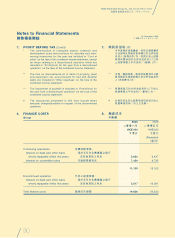

Borrowing costs

Borrowings costs directly attributable to the acquisition,

construction or production of qualifying assets, i.e., assets

that necessarily take a substantial period of time to get ready

for their intended use or sale, are capitalised as part of the

cost of those assets. The capitalisation of such borrowing

costs ceases when the assets substantially ready for their

intened use or sale. Investment income earned on the

temporary investment of specific borrowings pending their

expenditure on qualifying assets is deducted from the

borrowing costs capitalised.

Borrowing costs are recognised as expenses in the income

statement in the period in which they are incurred.

3.4 主要會計政策概要

(續)

僱員福利

(續)

以股份支付報酬之交易(續)

本集團已採納香港財務報告準則第2號有

關股本結算獎勵之過渡條文,並僅將香

港財務報告準則第2號應用於二零零二年

十一月七日後授出而於二零零五年一月

一日尚未歸屬以及二零零五年一月一日

或之後授出之股本結算獎勵。

退休金計劃

本集團根據強制性公積金計劃條例為合

資格參與強制性公積退休福利計劃(「強

積金計劃」)之僱員設立定額供款強積金

計劃。供款按僱員基本薪金之百分比計

算,於根據強積金計劃應付時自收益表

扣除。強積金計劃資產與本集團資產分

開持有,由獨立管理之基金持有。本集

團之僱主供款於向強積金計劃作出供款

時全數歸屬於僱員。

本集團中國大陸附屬公司僱員須參與由

地方市政府營運之中央退休金計劃。此

等附屬公司須向中央退休金計劃作出相

當於其工資成本某一百分比之供款。供

款於根據中央退休金計劃規則應付時自

收益表扣除。

借貸成本

由收購、建築或生產合資格資產(即需相

當長時間方可作擬定用途或出售之資產)

所直接產生之借貸成本乃資本化為該等

資產之部份成本。當資產大致可作擬定

用途或出售時,則不再將該等借貸成本

資本化。個別借貸於用作合資格資產開

支前之暫時性投資所賺取之投資收入,

乃於已資本化之借貸成本中扣除。

借貸成本於其產生期間在收益表列作開

支。