Haier 2006 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2006 Haier annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

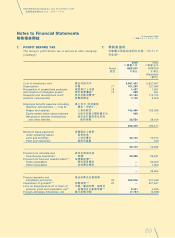

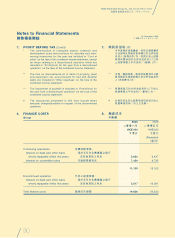

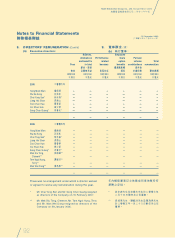

Notes to Financial Statements

財務報表附註 (31 December 2006)

(二零零六年十二月三十一日)

82

Haier Electronics Group Co., Ltd. Annual Report 2006

海爾電器集團有限公司 二零零六年年報

3.4 SUMMARY OF SIGNIFICANT ACCOUNTING

POLICIES

(Cont’d)

Foreign currencies

(Cont’d)

For the purpose of the consolidated cash flow statement, the

cash flows of Mainland China subsidiaries are translated into

Hong Kong dollars at the exchange rates ruling at the dates

of the cash flows. Frequently recurring cash flows of Mainland

China subsidiaries which arise throughout the year are

translated into Hong Kong dollars at the weighted average

exchange rates for the year.

4. SIGNIFICANT ACCOUNTING JUDGEMENTS AND

ESTIMATES

Judgements

In the process of applying the Group’s accounting policies,

management has made the following judgements, apart from

those involving estimations, which have the most significant

effect on the amounts recognised in the financial statements:

Operating lease commitments — Group as lessor

The Group has entered into commercial property leases on

its property portfolio. The Group has determined that it retains

all the significant risks and rewards of ownership of these

properties which are leased out on operating leases.

Classification between investment properties and owner-

occupied properties

The Group determines whether a property qualifies as an

investment property and has developed criteria in making that

judgement. Investment property is a property held to earn

rentals or for capital appreciation or both. Therefore, the Group

considers whether a property generates cash flows largely

independently of the other assets held by the Group.

Some properties comprise a portion that is held to earn rentals

or for capital appreciation and another portion that is held for

use in the production or supply of goods or services or for

administrative purposes. If these portions could be sold

separately (or leased out separately under a finance lease),

the Group accounts for the portions separately. If the portions

could not be sold separately, the property is an investment

property only if an insignificant portion is held for use in the

production or supply of goods or services or for administrative

purposes.

3.4 主要會計政策概要

(續)

外幣

(續)

就綜合現金流量表而言,中國內地附屬

公司之現金流量按現金流量日期之匯率

換算為港元。中國內地附屬公司於整個

年度經常產生之現金流量,按年內之加

權平均匯率換算為港元。

4. 重大會計判斷及估計

判斷

採用本集團之會計政策時,除涉及估計

者外,管理層作出以下對財務報表所確

認數額有最重大影響之判斷:

經營租約承擔-本集團為出租人

本集團已就其物業組合訂立商業物業租

約。本集團已決定保留該等根據經營租

約出租之物業擁有權之所有重大風險及

回報。

投資物業及擁有者自佔物業之分類

本集團須決定物業是否屬於投資物業,

並已制訂作出判斷之條件。投資物業指

持作賺取租金及或資本增值之物業。

因此,本集團須考慮物業所產生之現金

流量是否大致獨立於本集團所持之其他

資產。

若干物業包括持作賺取租金或資本增值

之部分及持作生產或供應貨品或服務或

管理用途之部分。若該等部分可分開出

售(或根據融資租約分開出租),則本集

團將各部分獨立入賬。若該等部分不可

分開出售,則物業僅於持作生產或供應

貨品或服務或管理用途之部分並不重大

時,方會列作投資物業。