Haier 2006 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2006 Haier annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Financial Statements

財務報表附註 (31 December 2006)

(二零零六年十二月三十一日)

112

Haier Electronics Group Co., Ltd. Annual Report 2006

海爾電器集團有限公司 二零零六年年報

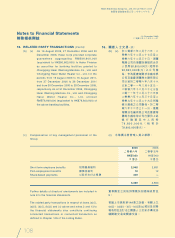

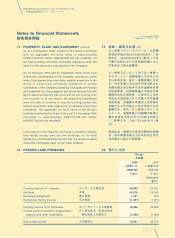

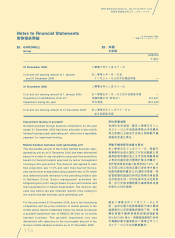

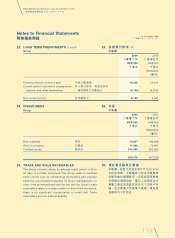

18. PREPAID LAND PREMIUMS

(Cont’d)

All leasehold land of the Group is under medium term leases

and is situated in Mainland China.

As at 31 December 2006, certain parcels of the Group’s land

with an aggregate unamortised prepaid land premium amount

of approximately HK$56,210,000 (2005: HK$24,440,000 (as

restated)) did not have land use right certificates registered

under the names of the respective subsidiaries of the

Company, of which approximately HK$10,516,000 (2005:

HK$10,653,000 (as restated)) was indemnified by Haier Corp

as at 31 December 2006. Details of the undertakings granted

by Haier Corp to the Company in relation to such title issues

are set out in note 17 to the financial statements.

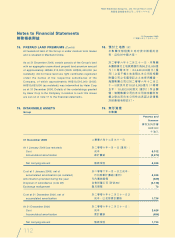

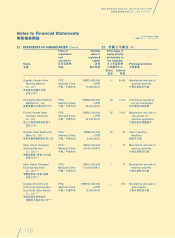

19. INTANGIBLE ASSETS

Group

18. 預付土地款

(續)

本集團全部租賃土地均按中期租約持

有,且位於中國大陸。

於二零零六年十二月三十一日,本集團

未攤銷預付土地款總額約為56,210,000港

元(二零零五年:24,440,000港元(重

列))之若干幅土地並無以本公司各相關

附屬公司之名義登記之土地使用權證,

海爾集團公司已於二零零六年十二月三

十一日就其中約10,516,000港元(二零零

五年:10,653,000港元(重列))作 出 彌

償。海爾集團公司向本公司就有關所有

權之發出而向本公司作出承諾之詳情載

於財務報表附註17。

19. 無形資產

本集團

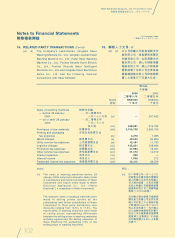

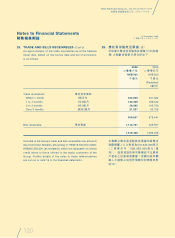

Patents and

licenses

專利及特許權

HK$’000

千港元

31 December 2006 二零零六年十二月三十一日

At 1 January 2006 (as restated): 於二零零六年一月一日(重列):

Cost 成本 8,312

Accumulated amortisation 累計攤銷 (2,874)

Net carrying amount 賬面淨值 5,438

Cost at 1 January 2006, net of 於二零零六年一月一日之成本,

accumulated amortisation (as restated) 已扣除累計攤銷(重列) 5,438

Amortisation provided during the year 年內攤銷撥備 (639)

Disposal of subsidiaries

(note 38)

出售附屬公司

(附註

38

)

(3,138)

Exchange realignment 匯兌調整 73

Cost at 31 December 2006, net of 於二零零六年十二月三十一日之

accumulated amortisation 成本,已扣除累計攤銷 1,734

At 31 December 2006: 於二零零六年十二月三十一日:

Cost 成本 2,428

Accumulated amortisation 累計攤銷 (694)

Net carrying amount 賬面淨值 1,734