Haier 2006 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2006 Haier annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

83

Haier Electronics Group Co., Ltd. Annual Report 2006

海爾電器集團有限公司 二零零六年年報

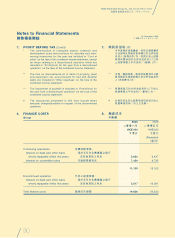

Notes to Financial Statements

財務報表附註 (31 December 2006)

(二零零六年十二月三十一日)

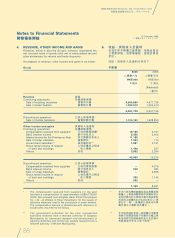

4. SIGNIFICANT ACCOUNTING JUDGEMENTS AND

ESTIMATES

(Cont’d)

Judgements

(Cont’d)

Classification between investment properties and owner-

occupied properties (Cont’d)

Judgement is made on an individual property basis to

determine whether ancillary services are so significant that a

property does not qualify as an investment property.

Estimation uncertainty

The key assumptions concerning the future and other key

sources of estimation uncertainty at the balance sheet date,

that have a significant risk of causing a material adjustment

to the carrying amounts of assets and liabilities within the

next financial year, are discussed below.

Deferred tax assets

Deferred tax assets are recognised for all deductible temporary

differences, carryforward of unused tax credits and unused

tax losses, to the extent that it is probable that taxable profit

will be available against which the deductible temporary

differences, and the carryforward of unused tax credits and

unused tax losses can be utilised. Where the actual or

expected tax positions of the relevant companies of the Group

in future are different from the original estimate, such

differences will impact the recognition of deferred tax assets

and income tax charge in the period in which such estimate

has been changed.

Write-down of inventories to net realisable value

Write-down of inventories to net realisable value is made

based on the ageing and estimated net realisable value of

inventories. The assessment of the write-down amount involves

management’s judgements and estimates. Where the actual

outcome or expectation in future is different from the original

estimate, such differences will impact the carrying value of

the inventories and the write-down charge/reversal in the

period in which such estimate has been changed.

4. 重大會計判斷及估計

(續)

判斷

(續)

投資物業及擁有者自佔物業之分類(續)

管理層須判斷個別物業之附帶設施是否

重大而導致物業不合資格列為投資物

業。

估計之不明朗因素

以下為大有可能導致下一財政年度之資

產及負債賬面值須作重大調整之未來主

要假設及結算日其他主要估計不明朗因

素主要來源。

遞延稅項資產

在有可扣稅暫時差額、承前之未動用稅

項資產及未動用稅項虧損可供用於抵銷

應課稅溢利之情況下,遞延稅項資產乃

就所有可扣稅之暫時差額、承前之未動

用稅項資產及未動用稅項虧損確認。倘

本集團有關公司未來之實際或預期稅務

狀況與原先估計不同,則上述差額將會

對在有關估計改變期間確認遞延稅項資

產及所得稅支出構成影響。

撇減存貨至可變現淨值

撇減存貨至可變現淨值乃按存貨賬齡及

估計可變現淨值而作出。評估撇減額涉

及管理層之判斷及估計。倘實際結果或

未來期望與原先估計不同,則上述差額

將會對在有關估計改變期間之存貨賬面

值及撇減支出撥回構成影響。