Haier 2006 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2006 Haier annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Financial Statements

財務報表附註 (31 December 2006)

(二零零六年十二月三十一日)

146

Haier Electronics Group Co., Ltd. Annual Report 2006

海爾電器集團有限公司 二零零六年年報

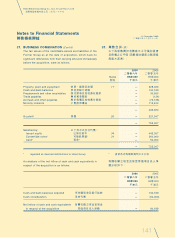

42. FINANCIAL RISK MANAGEMENT OBJECTIVES

AND POLICIES

(Cont’d)

Credit risk

(Cont’d)

The credit risk of the Group’s other financial assets, which

comprise cash and cash equivalents, arises from default of

the counterparty, with a maximum exposure equal to the

carrying amounts of these financial assets.

Since the Group trades only with recognised and creditworthy

customers, there is no requirement for collateral.

Liquidity risk

The Group’s objective is to maintain a balance between

continuity of funding and flexibility through the use of bank

loans and other borrowings. It is the Group’s policy to renew

its loan agreements with Haier Finance or major local banks

in Mainland China upon the maturity of the Group’s short

term loans or borrowings.

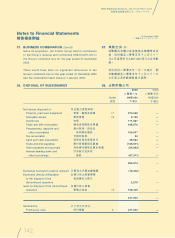

43. POST BALANCE SHEET EVENTS

(a) Subsequent to the balance sheet date, there were

102,500,000 share options exercised, further details of

which are set out in note 35 to the financial statements.

(b) On 8 March 2007, the nominal value of each of the

Company’s shares was reduced from HK$0.10 to

HK$0.01 and every 10 shares of the Company were

consolidated into one consolidated share, further details

of which are set out in note 34 to the financial

statements.

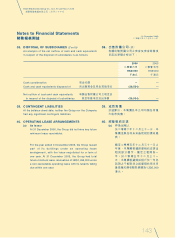

(c) During the 5th Session of the 10th National People’s

Congress, which was concluded on 16 March 2007, the

PRC Corporate Income Tax Law (the “New Corporate

Income Tax Law”) was approved and will become

effective on 1 January 2008. The New Corporate Income

Tax Law introduces a wide range of changes which

include, but are not limited to, the unification of the

income tax rate for domestic-invested and foreign-

invested enterprises at 25%. Since the detailed

implementation and administrative rules and regulations

have not yet been announced, the financial impact of

the New Corporate Income Tax Law to the Group cannot

be reasonably estimated at this stage.

42. 財務風險管理目標及政策

(續)

信貸風險

(續)

就本集團其他財務資產(包括現金及現金

等值項目)之信貸風險而言,本集團之信

貸風險來自交易對手違約,最高金額以

相關財務資產之賬面值為限。

由於本集團僅與著名及信譽良好的客戶

進行交易,因此並無要求提供抵押。

流動資金風險

本集團旨在透過銀行貸款及其他借貸維

持資金之持續性及彈性之平衡。本集團

之政策為在本集團之短期貸款或借貸期

滿時,續訂與海爾財務或中國內地主要

地方銀行訂立之貸款協議。

43. 結算日後事項

(a) 於結算日後,102,500,000份購股權

已獲行使,其他詳情載於財務報表

附註35。

(b) 於二零零七年三月八日,本公司每

股股份面值由0.10港元削減至0.01

港元及每10股本公司股份合併為一

股合併股份,其他詳情載於財務報

表附註34。

(c) 於二零零七年三月十六日結束之第

10屆全國人民代表大會第5次會議

上,中國企業所得稅法(「新企業所

得稅法」)已獲批准,並將於二零零

八年一月一日生效。新企業所得稅

法引入多項變動,包括但不限於將

內資及外資企業之所得稅率統一為

25%。由於施行詳情及行政規則及

法規尚未公佈,故現階段無法合理

估計新企業所得稅法對本集團之財

務影響。