HSBC 2014 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Report of the Directors: Capital Management (continued)

89

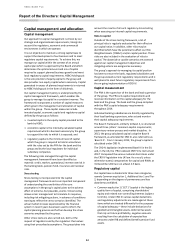

subsidiary bank, the ratio of structural exposures in a

given currency to risk-weighted assets denominated in

that currency is broadly equal to the capital ratio of the

subsidiary in question. We hedge structural foreign

exchange exposures only in limited circumstances.

2. Acquisitions and disposals

This is the movement in RWAs as a result of the disposal

or acquisition of business operations. This can be whole

businesses or parts of a business. The movement in

RWAs is quantified based on the credit risk exposures as

at the end of the month preceding a disposal or

following an acquisition.

3. Model updates

New/updated models

RWA movements arising from the implementation of

new models and from changes to existing parameter

models are allocated to this driver. This figure will also

include changes which arise following review of

modelling assumptions. Where a model recalibration

reflects an update to more recent performance data, the

resulting RWA changes are not assigned here, but

instead reported under book quality.

RWA changes are estimated based on the impact

assessments made in the testing phase prior to

implementation. These values are used to simulate the

effect of new or updated models on the portfolio at the

point of implementation, assuming there were no major

changes in the portfolio from the testing phase to

implementation phase.

Portfolios moving onto IRB approach

Where a portfolio moves from the standardised

approach to the IRB approach, the RWA movement by

key driver statement shows the increase in IRB RWAs,

but does not show the corresponding reduction in

standardised approach RWAs as its scope is limited to

IRB only.

The movement in RWAs is quantified at the date at

which the IRB approach is applied, and not during the

testing phase as with a new/updated model.

4. Methodology and policy

Internal regulatory updates

This captures the effect on RWAs of changing the

internal treatment of exposures. This may include, but is

not limited to, a portfolio or a part of one moving from

an existing IRB model onto a standardised model,

identification of netting and credit risk mitigation.

External regulatory updates

This specifies the effect of additional or changing

regulatory requirements. This includes, but is not limited

to, regulatory-prescribed changes to the RWA

calculation. The movement in RWAs is quantified by

comparing the RWAs calculated for that portfolio under

the old and the new requirements.

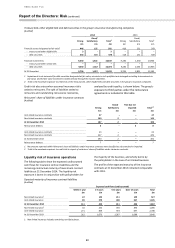

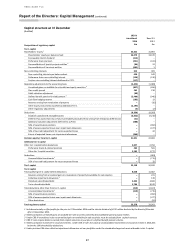

5. Book size

RWA movements attributed to this driver are those we

would expect to experience for the given movement in

exposure, as measured by EAD, assuming a stable risk

profile. These RWA movements arise in the normal

course of business, such as growth in credit exposures or

reduction in book size from run-offs and write-offs.

The RWA movement is quantified as follows:

• RWA and EAD changes captured in the four drivers

above are excluded from the total movements to

create an adjusted movement in EAD and RWA for

the period.

• The average RWA to EAD percentage is calculated for

the adjusted position and is applied to the adjusted

movement in EAD.

As the calculation relies on averaging, the output is

dependent upon the degree of portfolio aggregation and

the number of discrete time periods for which the

calculation is undertaken. For each quarter of 2014 this

calculation was performed for each HSBC company with

an IRB portfolio by global businesses, split by the main

Basel categories of credit exposures, as described in the

table below:

The total of the results is shown in book size within the

RWA movement by key driver table.

6. Book quality

This represents RWA movements resulting from changes

in the underlying credit quality of customers. These are

caused by changes to IRB risk parameters which arise

from actions such as, but not limited to, model

recalibration, change in counterparty external rating, or

the influence of new lending on the average quality of

the book. The change in RWAs attributable to book

quality is calculated as the balance of RWA movements

after taking account of all drivers described above.

The RWA movement by key driver statement includes

only movements which are calculated under the IRB

approach. Certain classes of credit risk exposure are

treated as capital deductions and therefore reductions

are not shown in this statement. If the treatment of a

credit risk exposure changes from RWA to capital

deduction in the period, then only the reduction in RWAs

would appear in the RWA movement by key driver

tables. In this instance, a reduction in RWAs does not

necessarily indicate an improvement in the capital

position.