HSBC 2014 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

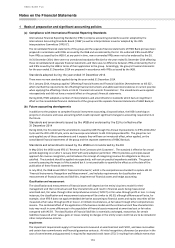

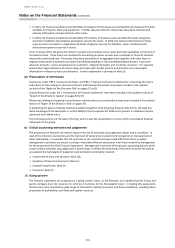

Notes on the Financial Statements (continued)

120

substantially a different financial instrument. Any new agreements arising due to derecognition events will continue

to be disclosed as renegotiated loans.

Impairment of available-for-sale financial assets

Available-for-sale financial assets are assessed at each balance sheet date for objective evidence of impairment. If

such evidence exists as a result of one or more events that occurred after the initial recognition of the financial asset

(a ‘loss event’) and that loss event has an impact, which can be reliably measured, on the estimated future cash flows

of the financial asset an impairment loss is recognised.

If the available-for-sale financial asset is impaired, the difference between its acquisition cost (net of any principal

repayments and amortisation) and its current fair value, less any previous impairment loss recognised in the income

statement, is recognised in the income statement.

Impairment losses are recognised in the income statement within ‘Loan impairment charges and other credit risk

provisions’ for debt instruments and within ‘Gains less losses from financial investments’ for equities. The

impairment methodologies for available-for-sale financial assets are set out in more detail below:

– Available-for-sale debt securities. In assessing objective evidence of impairment at the reporting date, the group

considers all available evidence, including observable data or information about events specifically relating to the

securities which may result in a shortfall in the recovery of future cash flows. Financial difficulties of the issuer, as

well as other factors such as information about the issuers’ liquidity, business and financial risk exposures, levels

of and trends in default for similar financial assets, national and local economic trends and conditions, and the fair

value of collateral and guarantees may be considered individually, or in combination, to determine if there is

objective evidence of impairment.

In addition, the performance of underlying collateral and the extent and depth of market price declines is relevant

when assessing objective evidence of impairment of available-for-sale ABSs. The primary indicators of potential

impairment are considered to be adverse fair value movements and the disappearance of an active market for a

security, while changes in credit ratings are of secondary importance.

– Available-for-sale equity securities. Objective evidence of impairment may include specific information about the

issuer as detailed above, but may also include information about significant changes in technology, markets,

economics or the law that provides evidence that the cost of the equity securities may not be recovered.

A significant or prolonged decline in the fair value of the equity below its cost is also objective evidence of

impairment. In assessing whether it is significant, the decline in fair value is evaluated against the original cost of

the asset at initial recognition. In assessing whether it is prolonged, the decline is evaluated against the

continuous period in which the fair value of the asset has been below its original cost at initial recognition.

Once an impairment loss has been recognised, the subsequent accounting treatment for changes in the fair value of

that asset differs depending on the type of asset:

– for an available-for-sale debt security, a subsequent decline in the fair value of the instrument is recognised in the

income statement when there is further objective evidence of impairment as a result of further decreases in the

estimated future cash flows of the financial asset. Where there is no further objective evidence of impairment,

the decline in the fair value of the financial asset is recognised in other comprehensive income. If the fair value of

a debt security increases in a subsequent period, and the increase can be objectively related to an event occurring

after the impairment loss was recognised in the income statement, or the instrument is no longer impaired, the

impairment loss is reversed through the income statement;

– for an available-for-sale equity security, all subsequent increases in the fair value of the instrument are treated as

a revaluation and are recognised in other comprehensive income. Impairment losses recognised on the equity

security are not reversed through the income statement. Subsequent decreases in the fair value of the available-

for-sale equity security are recognised in the income statement, to the extent that further cumulative impairment

losses have been incurred.

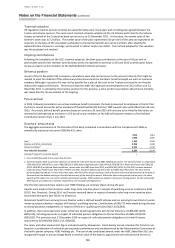

(k) Funding fair value adjustment

– In line with evolving market practice the group revised its estimation methodology for valuing the uncollateralised

derivative portfolios by introducing a funding fair value adjustment (‘FFVA’). The FFVA adjustment reflects the

estimated present value of the future market funding cost or benefit associated with funding uncollateralised

derivative exposure at rates other than the Overnight Index Swap (‘OIS’) rate. OIS is the benchmark rate used for

valuing collateralised derivatives. The impact of introducing FFVA in the 2014 consolidated financial statements is

a reduction in net trading income of £152 million. Further details have been provided in Note 12 to the Financial

Statements.

(l) Operating income

Interest income and expense

Interest income and expense for all financial instruments except for those classified as held for trading or designated

at fair value (except for debt securities issued by the group and derivatives managed in conjunction with those debt

securities) are recognised in ‘Interest income’ and ‘Interest expense’ in the income statement using the effective