HSBC 2014 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Notes on the Financial Statements (continued)

115

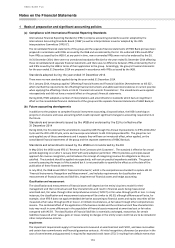

• In 2013, the financial statements included Note 14 Analysis of financial assets and liabilities by measurement basis

and Note 22 Property, Plant and equipment. In 2014, separate notes for these areas have been removed and

relevant information incorporated into other notes.

• In 2013, the financial statements included Note 19 Transfers of financial assets and Note 36 Assets charged as

security for liabilities and collateral accepted as security for assets. In 2014, the relevant information for these

areas has been included in a single Note 18 Assets charged as security for liabilities, assets transferred and

collateral accepted as security for assets.

From 1 January 2014, the group has chosen to present non-trading reverse repos and repos separately on the face of

the balance sheet. These items are classified for accounting purposes as loans and receivables or financial liabilities

measured at amortised cost. Previously, they were presented on an aggregate basis together with other loans or

deposits measured at amortised cost under the following headings in the consolidated balance sheet: ‘Loans and

advances to banks’, ‘Loans and advances to customers’, ‘Deposits by banks’ and ‘Customer accounts’. The separate

presentation aligns disclosure of reverse repos and repos with market practice and provides more meaningful

information in relation to loans and advances. Further explanation is provided in Note 16.

(d) Presentation of information

Disclosures under IFRS 4 ‘Insurance Contracts’ and IFRS 7 ‘Financial Instruments: Disclosures’ concerning the nature

and extent of risks relating to insurance contracts and financial instruments have been included in the audited

sections of the ‘Report of the Directors: Risk’ on pages 31 to 83.

Capital disclosures under IAS 1 ‘Presentation of Financial Statements’ have been included in the audited sections of

‘Report of the Directors: Capital’ on pages 84 to 93.

Disclosures relating to the group’s securitisation activities and structured products have been included in the audited

section of ‘Report of the Directors: Risk’ on pages 58.

In publishing the parent company financial statements together with the group financial statements, the bank has

taken advantage of the exemption in section 408(3) of the Companies Act 2006 not to present its individual income

statement and related notes.

The functional currency of the bank is Sterling, which is also the presentation currency of the consolidated financial

statements of the group.

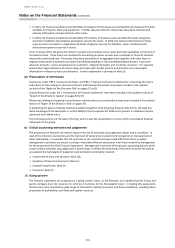

(e) Critical accounting estimates and judgements

The preparation of financial information requires the use of estimates and judgements about future conditions. In

view of the inherent uncertainties and the high level of subjectivity involved in the recognition or measurement of

items listed below, it is possible that the outcomes in the next financial year could differ from those on which

management’s estimates are based, resulting in materially different conclusions from those reached by management

for the purposes of the 2014 Financial Statements. Management’s selection of the group’s accounting policies which

contain critical estimates and judgements is listed below; it reflects the materiality of the items to which the policies

are applied, the high degree of judgement and estimation uncertainty involved:

• Impairment of loans and advances: Note 1(j);

• Valuation of financial instruments: Note 12;

• Goodwill impairment: Note 21;

• Provisions: Note 27;

(f) Going concern

The financial statements are prepared on a going concern basis, as the Directors are satisfied that the Group and

parent company have the resources to continue in business for the foreseeable future. In making this assessment,

the Directors have considered a wide range of information relating to present and future conditions, including future

projections of profitability, cash flows and capital resources.