HSBC 2014 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Report of the Directors: Capital Management (continued)

88

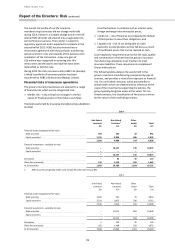

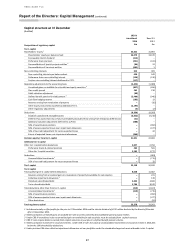

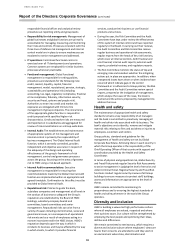

Reconciliation of regulatory capital from CRD IV transitional basis to an estimated CRD IV end point basis

(Unaudited)

At 31 Dec 2014

£m

Common equity tier 1 capital on a transitional basis

21,091

Unrealised gains in available for sale reserves

837

Common equity tier 1 capital end point basis

21,928

Additional tier 1 capital on a transitional basis

4,047

Grandfathered instruments:

Preference share premium

(345)

Other tier 1 capital securities

(1,507)

Additional tier 1 capital end point basis

2,195

Tier 1 capital end point basis

24,123

Tier 2 capital on a transitional basis

8,418

Grandfathered instruments:

Term subordinated debt

(2,326)

Tier 2 capital end point basis

6,092

Total regulatory capital end point basis

30,215

Risk Weighted Assets (‘RWAs’)

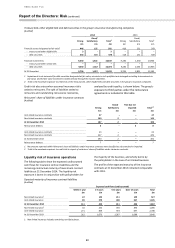

RWA movement by business by key driver – non-counterparty credit risk – IRB only

(Unaudited)

RBWM

CMB

GB&M

GPB

Other

Total

£bn

£bn

£bn

£bn

£bn

£bn

RWAs at 1 January 2014 on

Basel 2.5 basis

14.6

38.7

42.7

3.3

0.9

100.2

Foreign exchange movement

(0.1)

(0.6)

0.9

–

–

0.2

Acquisitions and disposals

–

–

(0.1)

–

(0.2)

(0.3)

Book size

0.6

4.2

(1.8)

(0.6)

(0.2)

2.2

Book quality

(1.4)

0.7

(1.9)

(0.2)

0.4

(2.4)

Model new/updated

(0.1)

–

–

–

–

(0.1)

Methodology and policy

0.7

6.0

29.4

0.2

1.1

37.4

– external updates – regulatory

–

7.6

5.2

0.2

–

13.0

– CRD IV impact

(0.6)

(1.9)

23.6

–

0.1

21.2

– NCOA moving from STD to IRB

1.3

0.3

0.6

–

1.0

3.2

Total RWA movement

(0.3)

10.3

26.5

(0.6)

1.1

37.0

RWAs at 31 December 2014 on

CRD IV basis

14.3

49.0

69.2

2.7

2.0

137.2

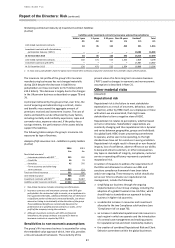

Methodology and policy changes – capital and RWA

Methodology and policy updates mainly related to the

implementation of the CRD IV rules at 1 January 2014,

and increased RWAs by approximately £37 billion. The

main movement arose from non-investment grade

securitisation positions which were previously deducted

from capital. These are now included in RWAs with a

1,250 per cent risk weight, causing a rise of £22.5 billion.

Further increases in capital requirements stem from

other changes such as the need to hold capital against

credit valuation adjustment of £9.2 billion, the risk of

failure of central counterparties of £2 billion and the

£4.9 billion increase in RWAs caused by the asset value

correlation multiplier applied to exposures to large or

unregulated counterparties in the financial sector.

The change in treatment of non-investment grade

securitisation positions was also responsible for an

increase in capital of £1.8 billion. This was offset by other

CRD IV changes, notably the £1.1 billion impact of a

progressive cap on grandfathered capital instruments

and a £0.9 billion deduction for a prudential valuation

adjustment.

In addition, with effect from 31 March 2014, a 45 per

cent loss given default floor has applied to bank

exposures and UK corporate portfolios which did not

fully meet modelling requirements, resulting in an

increase of RWAs of £12.9 billion.

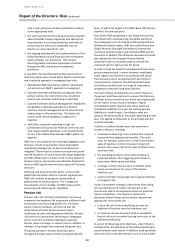

RWAs by key driver – basis of preparation

and supporting notes

Credit risk drivers – definitions and quantification

The causal analysis of RWA movements splits the total

movement in IRB RWAs into six drivers, described below.

The first four relate to specific, identifiable and

measurable changes. The remaining two, book size and

book quality, are derived after accounting for

movements in the first four specific drivers.

1. Foreign exchange movements

This is the movement in RWAs as a result of changes in

the exchange rate between the functional currency of

the HSBC company owning each portfolio and Sterling,

being our presentation currency for consolidated

reporting. Our structural foreign exchange exposures are

managed with the primary objective of ensuring, where

practical, that our consolidated capital ratios and the

capital ratios of individual banking subsidiaries are

largely protected from the effect of changes in exchange

rates. This is usually achieved by ensuring that, for each