HSBC 2014 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Report of the Directors: Risk (continued)

50

time or have been assessed based on all available

evidence as having no remaining indicators of

impairment.

Loans that have been identified as renegotiated retain

this designation until maturity or derecognition. When a

loan is restructured as part of a forbearance strategy and

the restructuring results in derecognition of the existing

loan, such as in some debt consolidations, the new loan

is disclosed as renegotiated. When determining whether

a loan that is restructured should be derecognised and a

new loan recognised, we consider the extent to which

the changes to the original contractual terms result in

the renegotiated loan, considered as a whole, being a

substantially different financial instrument. The following

are examples of circumstances that are, individually or in

aggregate, likely to result in this test being met and

derecognition accounting being applied:

• an uncollateralised loan becomes fully collateralised;

• the addition or removal of cross-collateralisation

provisions;

• removal or addition of conversion features attached

to the loan agreement;

• a change in the currency in which the principal or

interest is denominated;

• a change in the liquidation preference or ranking of

the instrument; or

• the contract is altered in any other manner so that

the terms under the new or modified contract are

substantially different from those under the original

contract.

The following are examples of factors that we consider

may indicate that the revised loan is a substantially

different financial instrument, but are unlikely to be

conclusive in themselves:

• changes in guarantees or loan covenants provided;

• less significant changes to collateral arrangements; or

• the addition of repayment provisions or prepayment

premium clauses.

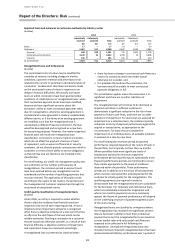

Renegotiated loans and recognition of impairment

allowances

(Audited)

For retail lending, renegotiated loans are segregated

from other parts of the loan portfolio for collective

impairment assessment to reflect the higher rates of

losses often encountered in these segments. When

empirical evidence indicates an increased propensity to

default and higher losses on such accounts, the use of

roll rate methodology ensures these factors are taken

into account when calculating impairment allowances by

applying roll rates specifically calculated on the pool of

loans subject to forbearance. When the portfolio size is

small or when information is insufficient or not reliable

enough to adopt a roll-rate methodology, a basic

formulaic approach based on historical loss rate

experience is used. As a result of our roll-rate

methodology, we recognise collective impairment

allowances on homogeneous groups of loans, including

renegotiated loans, where there is historical evidence

that there is a likelihood that loans in these groups will

progress through the various stages of delinquency, and

ultimately prove irrecoverable as a result of events

occurring before the balance sheet date. This treatment

applies irrespective of whether or not those loans are

presented as impaired in accordance with our impaired

loans disclosure convention. When we consider that

there are additional risk factors inherent in the portfolios

that may not be fully reflected in the statistical roll rates

or historical experience, these risk factors are taken into

account by adjusting the impairment allowances derived

solely from statistical or historical experience.

In the corporate and commercial sectors, renegotiated

loans are typically assessed individually. Credit risk

ratings are intrinsic to the impairment assessment. A

distressed restructuring is classified as an impaired loan.

The individual impairment assessment takes into account

the higher risk of the non-payment of future cash flows

inherent in renegotiated loans.

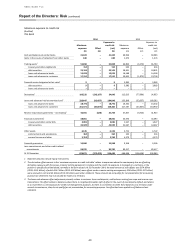

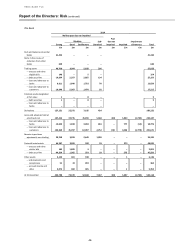

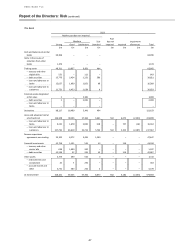

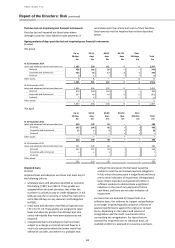

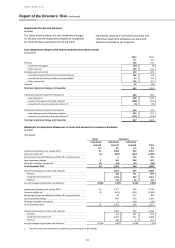

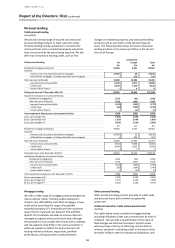

The following table shows the group’s holdings of

renegotiated loans and advances to customers by

industry sector and credit quality classification.

Renegotiated loans and advances to customers

(Audited)

2014

2013

Neither

past

due nor

impaired

Past due

but not

impaired

Impaired

Total

Neither

past

due nor

impaired

Past due

but not

impaired

Impaired

Total

£m

£m

£m

£m

£m

£m

£m

£m

Residential Mortgages

339

142

548

1,029

399

150

551

1,100

Other personal lending

102

26

64

192

144

23

85

252

Commercial real estate

378

1

875

1,254

396

23

1,148

1,567

Corporate and commercial

509

42

1,703

2,254

690

94

2,045

2,829

Financial

140

–

124

264

56

–

86

142

Total renegotiated loans and advances

at 31 December

1,468

211

3,314

4,993

1,685

290

3,915

5,890

Impairment allowance on renegotiated

loans

(930)

(1,128)

- renegotiated loans and advances as a

% of total gross loans

1.77%

1.98%