HSBC 2014 Annual Report Download - page 196

Download and view the complete annual report

Please find page 196 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Notes on the Financial Statements (continued)

194

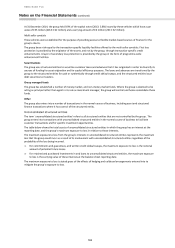

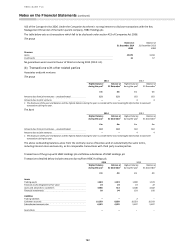

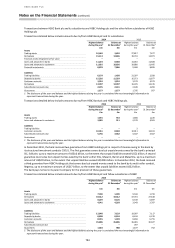

Transactions between HSBC Bank plc and its subsidiaries and HSBC Holdings plc and the other fellow subsidiaries of HSBC

Holdings plc

Transactions detailed below include amounts due to/from HSBC Bank plc and its subsidiaries.

2014

2013

Highest balance

during the year1

Balance at

31 December1

Highest balance

during the year1

Balance at

31 December1

£m

£m

£m

£m

Assets

Trading assets

10,462

3,659

27,817

7,677

Derivatives

15,114

14,836

18,734

12,971

Financial assets designated at fair value

–

–

–

–

Loans and advances to banks

11,223

8,568

14,010

11,928

Loans and advances to customers

11,610

10,830

18,880

11,495

Financial investments

8,878

7,866

9,069

8,895

Liabilities

Trading liabilities

6,179

1,458

21,397

2,928

Deposits by banks

15,320

11,359

16,573

11,877

Customer accounts

3,524

3,224

3,573

3,573

Derivatives

14,907

14,907

16,476

12,415

Subordinated amounts due

2,276

2,181

2,928

2,283

Guarantees

1,177

1,177

1,795

957

1 The disclosure of the year-end balance and the highest balance during the year is considered the most meaningful information to

represent transactions during the year.

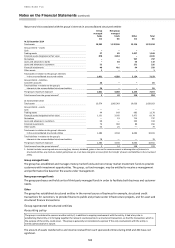

Transactions detailed below include amounts due to/from HSBC Bank plc and HSBC Holdings plc.

2014

2013

Highest balance

during the year1

Balance at

31 December1

Highest balance

during the year1

Balance at

31 December1

£m

£m

£m

£m

Assets

Trading assets

1,691

954

1,884

1,220

Loans and advances to customers

3,965

511

4,579

3,581

Liabilities

Trading liabilities

–

–

2

–

Customer accounts

10,961

8,669

10,011

10,011

Subordinated amounts due

5,756

3,562

5,567

5,567

Guarantees

–

–

–

–

1 The disclosure of the year-end balance and the highest balance during the year is considered the most meaningful information to

represent transactions during the year.

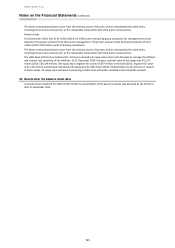

In December 2010, the bank received two guarantees from HSBC Holdings plc in respect of monies owing to the bank by

its structured investment conduits (‘SICs’). The first guarantee covers due but unpaid monies owed by the bank’s principal

SIC, Solitaire, up to a maximum amount of US$16 billion, to the extent that unpaid liabilities exceed US$1 billion. A second

guarantee covers due but unpaid monies owed by the bank’s other SICs, Mazarin, Barion and Malachite, up to a maximum

amount of US$22 billion, to the extent that unpaid liabilities exceed US$200 million. In December 2012, the bank received

a third guarantee from HSBC Holdings plc that covers due but unpaid monies owed to the bank by its multi-seller conduit,

Regency, up to a maximum amount of US$17 billion, to the extent that unpaid liabilities exceed US$2 billion.

The bank pays no fee to its parent company for the provision of these guarantees.

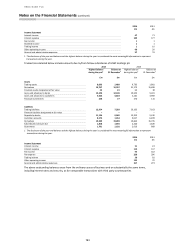

Transactions detailed below include amounts due to/from HSBC Bank plc and fellow subsidiaries of HSBC

2014

2013

Highest balance

during the year1

Balance at

31 December1

Highest balance

during the year1

Balance at

31 December1

£m

£m

£m

£m

Assets

Trading assets

7,940

1,390

9,594

1,734

Derivatives

33,412

33,412

37,701

27,618

Loans and advances to banks

8,229

8,126

6,533

5,897

Loans and advances to customers

4,941

4,203

3,943

3,787

Liabilities

Trading liabilities

12,848

7,129

19,997

7,117

Deposits by banks

8,808

8,118

8,624

6,219

Customer accounts

8,355

1,339

8,893

6,755

Derivatives

35,806

35,806

36,465

30,027

Subordinated amount due

–

–

297

–

Guarantees

1,683

988

1,877

752

1 The disclosure of the year-end balance and the highest balance during the year is considered the most meaningful information to

represent transactions during the year.