HSBC 2014 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Notes on the Financial Statements (continued)

168

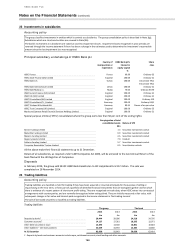

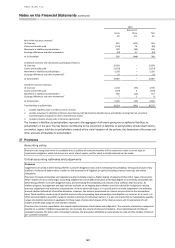

26 Liabilities under insurance contracts

Accounting policy

The group issues contracts to customers that contain insurance risk, financial risk or a combination thereof. A contract under which

the group accepts significant insurance risk from another party by agreeing to compensate that party on the occurrence of a specified

uncertain future event, is classified as an insurance contract. An insurance contract may also transfer financial risk, but is accounted

for as an insurance contract if the insurance risk is significant.

Liabilities under insurance contracts

Liabilities under non-linked life insurance contracts are calculated by each life insurance operation based on local actuarial principles.

Liabilities under unit-linked life insurance contracts are at least equivalent to the surrender or transfer value which is calculated by

reference to the value of the relevant underlying funds or indices.

A liability adequacy test is carried out on insurance liabilities to ensure that the carrying amount of the liabilities is sufficient in the

light of current estimates of future cash flows. When performing the liability adequacy test, all contractual cash flows are discounted

and compared with the carrying value of the liability. When a shortfall is identified it is charged immediately to the income statement.

Future profit participation on insurance contracts with discretionary participation features

Where contracts provide discretionary profit participation benefits to policyholders, liabilities for these contracts include provisions for

the future discretionary benefits to policyholders. These provisions reflect actual performance of the investment portfolio to date and

management expectation on the future performance in connection with the assets backing the contracts, as well as other experience

factors such as mortality, lapses and operational efficiency, where appropriate. This benefit may arise from the contractual terms,

regulation, or past distribution policy.

Investment contracts with discretionary participation features

While investment contracts with discretionary participation features are financial instruments, they continue to be treated as

insurance contracts as permitted by IFRS 4. The group therefore recognises the premiums for those contracts as revenue and

recognises as an expense the resulting increase in the carrying amount of the liability.

In the case of net unrealised investment gains on these contracts, whose discretionary benefits principally reflect the actual

performance of the investment portfolio, the corresponding increase in the liabilities is recognised in either the income statement or

other comprehensive income, following the treatment of the unrealised gains on the relevant assets. In the case of net unrealised

losses, a deferred participating asset is recognised only to the extent that its recoverability is highly probable. Movements in the

liabilities arising from realised gains and losses on relevant assets are recognised in the income statement.

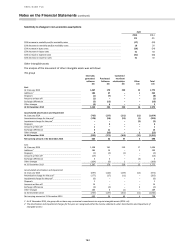

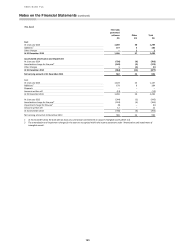

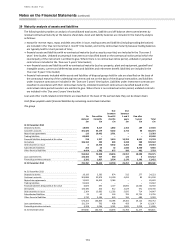

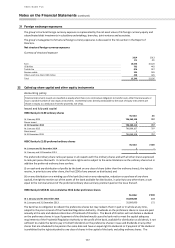

Liabilities under insurance contracts

2014

Gross

Reinsurers’

Share

Net

£m

£m

£m

Non-linked insurance contracts1

At 1 January

836

(448)

388

Claims and benefits paid

(140)

80

(60)

Movement in liabilities to policyholders

223

(117)

106

Transfer to liabilities of disposal groups held for sale

(338)

328

(10)

Exchange differences and other movements

(49)

15

(34)

At 31 December

532

(142)

390

Investment contracts with discretionary participation features

At 1 January

15,987

–

15,987

Claims and benefits paid

(1,407)

–

(1,407)

Movement in liabilities to policyholders

1,933

–

1,933

Transfer to liabilities of disposal groups held for sale

–

–

–

Exchange differences and other movements2

(430)

–

(430)

At 31 December

16,083

–

16,083

Linked life insurance contracts

At 1 January

2,405

(43)

2,362

Claims and benefits paid

(247)

3

(244)

Movement in liabilities to policyholders

284

(7)

277

Transfer to liabilities of disposal groups held for sale

(1,521)

–

(1,521)

Exchange differences and other movements3

(14)

–

(14)

At 31 December

907

(47)

860

Total liabilities to policyholders

17,522

(189)

17,333