HSBC 2014 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Strategic Report: Business Review (continued)

23

Global Private Banking

2014

2013

£m

£m

Net interest income

203

224

Net fee income

112

100

Trading income

11

10

Other income

(2)

(4)

Net operating income be

-fore

impairments and provisions

324

330

Loan impairment charges and other

credit risk provisions

4

(14)

Net operating income

328

316

Total operating expenses

(213)

(176)

Operating profit

115

140

Share of profit in associates and joint

ventures

–

–

Profit before tax

115

140

Profit before tax – by country

2014

2013

£m

£m

United Kingdom

100

99

France

-

13

Germany

16

28

Turkey

-

–

Malta

-

–

Other

(1)

–

Profit before tax

115

140

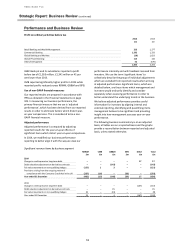

Review of performance

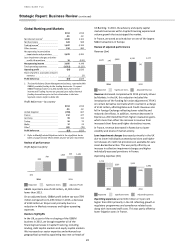

Profit before tax (£m)

GPB reported a profit before tax of £115 million,

£25 million or 18 per cent lower than 2013.

GPB adjusted profit before tax was £141 million

compared to £143 million in 2013, a decrease of £2

million.

Business highlights

GPB continued to reposition its business model and

target its client base by reviewing portfolios and ensuring

that all clients comply with Global Standards including

financial crime compliance and tax transparency

standards.

The business continued to focus on clients with wider

Group connectivity within the home and priority

markets, as well as reduce the number of clients in non-

priority markets.

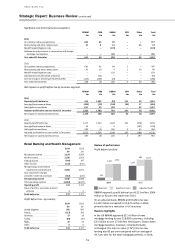

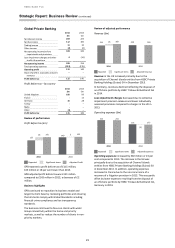

Review of adjusted performance

Revenue (£m)

Revenue in the UK increased primarily due to the

acquisition of Channel Islands entities from HSBC Private

Banking Holdings (Suisse) SA in December 2013.

In Germany, revenues declined reflecting the disposal of

an off-shore portfolio by HSBC Trinkaus & Burkhardt AG

in 2014.

Loan impairment charges decreased due to collective

impairment provision releases and lower individually

assessed provisions compared to charges in the UK in

2013.

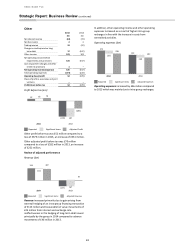

Operating expenses (£m)

Operating expenses increased by £40 million or 23 per

cent compared to 2013. The increase in the UK was

principally due to the acquisition of Channel Islands

entities from HSBC Private Banking Holdings (Suisse) SA

in December 2013. In addition, operating expenses

increased in France due to the non-recurrence of a

recovery of a litigation provision in 2013. This was partly

offset by lower expenses resulting from the disposal of

an off-shore portfolio by HSBC Trinkaus & Burkhardt AG,

Germany in 2014.

115

140

26 141 3143

2014

2013

Adjusted Profit

Reported

Significant items

324 330

26 350 330

2014

2013

Adjusted RevenueReported

Significant items

213

176

213

(3)

173

2014

2013

Adjusted ExpensesReported

Significant items