HSBC 2014 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Report of the Directors: Risk (continued)

51

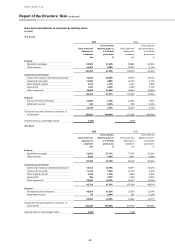

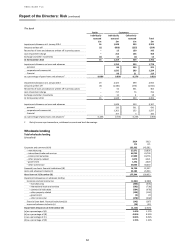

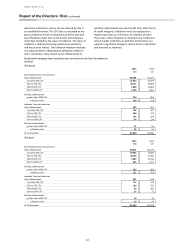

Impairment of loans and advances

(Audited)

The tables below analyses the loan impairment charges

for the year and the impairment allowances recognised

for impaired loans and advances that are either

individually assessed or collectively assessed, and

collective impairment allowances on loans and

advances classified as not impaired.

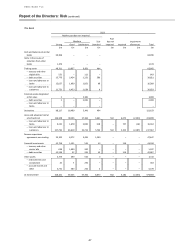

Loan impairment charge to the income statement by industry sector

(Unaudited)

2014

2013

£m

£m

Personal

148

215

– residential mortgages

(45)

(9)

– other personal

193

224

Corporate and commercial

472

921

– manufacturing and international trade and services

306

518

– commercial real estate and other property-related

50

276

– other commercial

116

127

Financial

27

(34)

Total loan impairment charge at 31 December

647

1,102

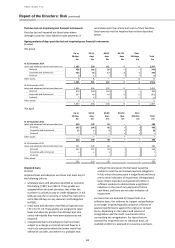

Individually assessed impairment allowances

363

859

– new allowances

656

1,148

– release of allowances no longer required

(288)

(257)

– recoveries of amounts previously written off

(5)

(32)

Collectively assessed impairment allowances

284

243

– new allowances net of allowance releases

460

617

– recoveries of amounts previously written off

(176)

(374)

Total loan impairment charge at 31 December

647

1,102

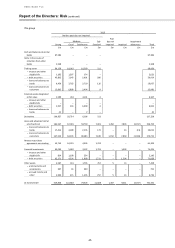

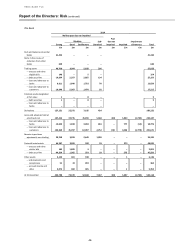

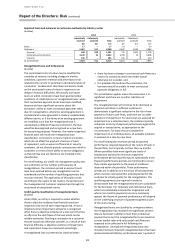

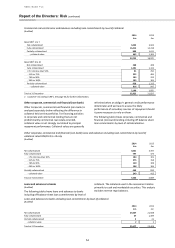

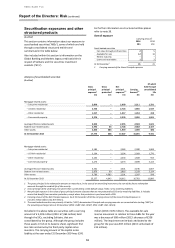

Movement in impairment allowances on loans and advances to customers and banks

(Audited)

The group

Banks

Customers

Individually

assessed

Individually

assessed

Collectively

assessed

Total

£m

£m

£m

£m

Impairment allowance at 1 January 2014

21

2,402

934

3,357

Amounts written off

(1)

(827)

(457)

(1,285)

Recoveries of loans and advances written off in previous years

–

5

176

181

Loan impairment charge

2

361

284

647

Exchange and other movements

(2)

(67)

(11)

(80)

At 31 December 2014

20

1,874

926

2,820

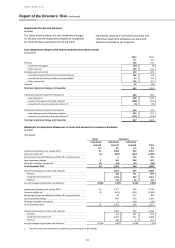

Impairment allowance on loans and advances

1,874

926

2,800

- personal

186

511

697

- corporate and commercial

1,572

389

1,961

- financial

116

26

142

as a percentage of gross loans and advances1

0.08%

0.72%

0.36%

0.99%

Impairment allowance at 1 January 2013

24

2,327

919

3,270

Amounts written off

(3)

(822)

(561)

(1,386)

Recoveries of loans and advances written off in previous years

–

32

374

406

Loan impairment charge

–

859

243

1,102

Exchange and other movements

–

6

(41)

(35)

At 31 December 2013

21

2,402

934

3,357

Impairment allowance on loans and advances

2,402

934

3,336

- personal

256

585

841

- corporate and commercial

1,947

341

2,288

- financial

199

8

207

as a percentage of gross loans and advances1

0.09%

0.87%

0.34%

1.12%

1 Net of reverse repo transactions, settlement accounts and stock borrowings.