HSBC 2014 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Report of the Directors: Risk (continued)

69

VaR model limitations

Although a valuable guide to risk, VaR should always be

viewed in the context of its limitations. For example:

• the use of historical data as a proxy for estimating

future events may not encompass all potential

events, particularly those which are extreme in

nature;

• the use of a holding period assumes that all positions

can be liquidated or the risks offset during that

period. This may not fully reflect the market risk

arising at times of severe illiquidity, when the holding

period may be insufficient to liquidate or hedge all

positions fully;

• the use of a 99 per cent confidence level, by

definition does not take into account losses that

might occur beyond this level of confidence;

• VaR is calculated on the basis of exposures

outstanding at the close of business and therefore

does not necessarily reflect intra-day exposures; and

• VaR is unlikely to reflect loss potential on exposures

that only arise under significant market movements.

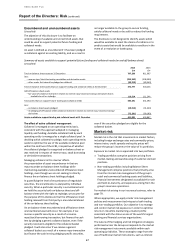

Risk not in VAR framework

(Unaudited)

The group’s VAR model is designed to capture significant

basis risks such as credit default swaps versus Bond,

asset swap spreads and cross-currency basis. Other basis

risks which are not completely covered in VAR, such as

the Libor tenor basis, are complemented by risk-not-in-

VaR (‘RNIV’) calculations and are integrated into the

capital framework.

The RNIV framework therefore aims to capture and

capitalise material market risks that are not adequately

covered in the VAR model. An example of this is Libor

overnight index swap basis risk for minor currencies. In

such instances the RNIV framework uses stress tests to

quantify the capital requirement. On average in 2014,

the capital requirement derived from these stress tests

represented 2.0 per cent of the total internal model-

based market risk requirement.

Risks covered by RNIV represent 15 per cent of market

risk RWAs for models with regulatory approval and

include those resulting from underlying risk factors

which are not observable on a daily basis across asset

classes and products, such as dividend risk and

correlation risks.

Risk factors are reviewed on a regular basis and either

incorporated directly in the VaR models, where possible,

or quantified through the VaR -based RNIV approach or a

stress test approach within the RNIV framework. The

severity of the scenarios is calibrated to be in line with

the capital adequacy requirements. The outcome of the

VaR -based RNIV is included in the VaR calculation and

back-testing; a stressed VaR RNIV is also computed for

the risk factors considered in the VaR-based RNIV

approach. In 2014, we modified our RNIV model on a

non-diversified basis across risk factors to comply with

new PRA CRD IV implementation guidelines.

Level 3 assets

The fair value of Level 3 assets and liabilities in trading

portfolios represent only a small proportion of the

overall trading portfolio. Market risk arising from Level 3

instruments is managed by various market risk

techniques such as stress testing and notional limits.

Stress testing

(Audited)

Stress testing is an important tool that is integrated into

the groups market risk management tool to evaluate the

potential impact on portfolio values of more extreme,

although plausible, events or movements in a set of

financial variables. In such abnormal scenarios, losses

can be much greater than those predicted by VaR

modelling.

Stress testing is implemented at the legal entity, regional

and the overall Group levels. A standard set of scenarios

is utilised consistently across all regions within the

Group. Scenarios are tailored in order to capture the

relevant events or market movements at each level. The

risk appetite around potential stress losses for the Group

is set and monitored against referral limits.

The process is governed by the Stress Testing Review

Group forum which, in conjunction with group risk

management, determines the scenarios to be applied at

portfolio and consolidated level, as follows:

• single risk factor stress scenarios that are unlikely to

be captured within the VaR models, such as the break

of a currency peg;

• technical scenarios consider the largest move in each

risk factor without consideration of any underlying

market correlation;

• hypothetical scenarios consider potential

macroeconomic events, for example, the slowdown in

mainland China and the potential effects of a

sovereign debt default, including its wider contagion

effects; and

• historical scenarios incorporate historical

observations of market movements during previous

periods of stress which would not be captured within

VaR.

Market Risk Reverse stress tests are undertaken based

upon the premise that there is a fixed loss. The stress

test process identifies which scenarios lead to this loss.

The rationale behind the reverse stress test is to

understand scenarios which are beyond normal business

settings that could have contagion and systemic

implications.

Stressed VaR and stress testing, together with reverse

stress testing and the management of gap risk, provide

management with insights regarding the ‘tail risk’

beyond VaR for which HSBC’s appetite is limited.

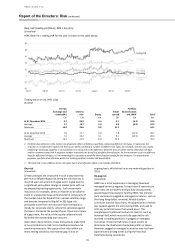

Trading portfolios

(Audited)

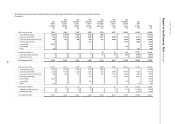

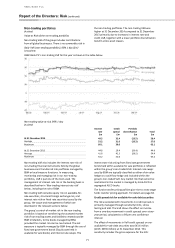

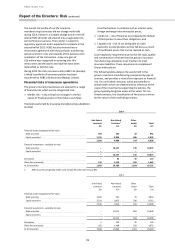

Value at Risk of the trading portfolios

Trading VaR predominantly resides within Global

Markets. The total VaR for trading activity was higher at

31 December 2014 compared to 31 December 2013 due

to an increase in interest rate trading VaR, and the

removal of diversification effects within Risk Not in VaR.