HSBC 2014 Annual Report Download - page 173

Download and view the complete annual report

Please find page 173 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Notes on the Financial Statements (continued)

171

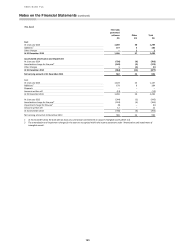

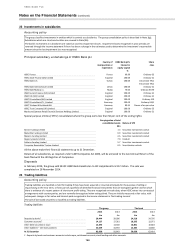

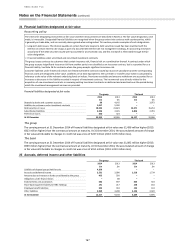

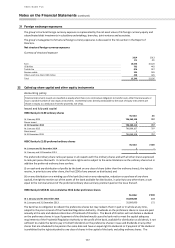

The extent to which the group is ultimately required to pay redress depends on the responses of contacted and other

customers during the review period and analysis of the facts and circumstances of each individual case, including

consequential loss claims received. For these reasons, there is currently a high degree of uncertainty as to the

eventual costs of redress related to this programme.

(iii) Provisions of £2 million (2013: £102 million) in respect of alleged failings in the sale of card and identity protection

products.

(iv) Provisions of £80 million (2013: £96 million) for the estimated cost of redress in relation to the provision for possible

mis-selling of wealth management products. The programme to redress customers is in an early stage. The main

uncertainty arises from the time to finish this project and the associated project costs.

(v) Provisions of £24 million (2013: £55 million) for the estimated cost of redress in relation to the provision of services

to a number of trusts by a subsidiary of the bank. The bank has undertaken to reimburse the subsidiary in respect of

the initial estimated cost of redress. The total provision is based on a calculation extrapolated from a sample of cases.

Uncertainties arise from factors affecting the timing of notifying and reimbursing those affected.

The group has undertaken a review of compliance with the fixed-sum unsecured loan agreement requirements of the UK

Consumer Credit Act (CCA). £243 million has been recognised as at 31 December 2014 within ‘Other liabilities’ for the

repayment of interest to customers primarily where annual statements did not remind them of their right to partially

prepay the loan, notwithstanding that the customer loan documentation did include this right. The cumulative liability to

date is £379 million, of which payments of £136 million have been made to customers. There is uncertainty as to whether

other technical requirements of the CCA have been met, for which we have assessed the contingent liability at up to £0.6

billion.

Also included in the above table, for the bank and group, are provisions for onerous property contracts of £67 million

(2013: £75 million) and £71 million (2013: £79 million) respectively, relating to the discounted future costs associated with

leasehold properties that have become vacant. The provisions cover rent voids while finding new tenants, shortfalls in

expected rent receivable compared with rent payable, and the cost of refurbishing the buildings to attract tenants.

Uncertainties arise from movements in market rents, delays in finding new tenants and the timing of rental reviews.

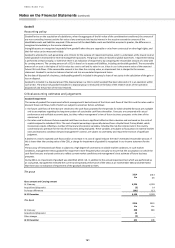

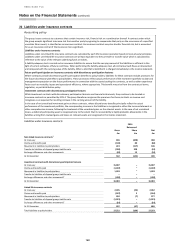

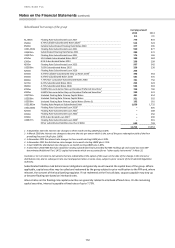

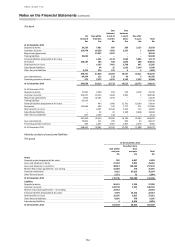

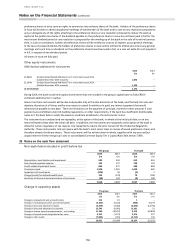

28 Subordinated liabilities

The group

The bank

2014

2013

2014

2013

£m

£m

£m

£m

Subordinated liabilities:

– At amortised cost

8,858

10,785

7,854

9,903

Subordinated liabilities

6,677

8,502

7,854

9,903

Preference shares

2,181

2,283

–

–

– Designated at fair value

2,856

2,768

2,856

2,781

Subordinated liabilities

2,526

2,445

2,856

2,781

Preference shares

330

323

–

–

11,714

13,553

10,710

12,684