HSBC 2014 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Strategic Report: Business Review (continued)

16

Review of business position

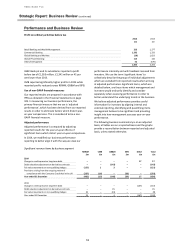

Summary consolidated balance sheet as at 31 December

2014

2013

£m

£m

Total assets

797,289

811,695

Cash and balances at central banks

42,853

67,584

Trading assets

130,127

134,097

Financial assets designated at fair value

6,899

16,661

Derivative assets

187,736

137,239

Loans and advances to banks

25,262

23,013

Loans and advances to customers

257,252

273,722

Reverse repurchase agreements – non-trading

41,945

61,525

Financial investments

76,194

75,030

Other

29,021

22,824

Total liabilities

760,591

778,776

Deposits by banks

27,590

28,769

Customer accounts

346,507

346,358

Repurchase agreements – non-trading

23,353

65,573

Trading liabilities

82,600

91,842

Financial liabilities designated at fair value

22,552

34,036

Derivative liabilities

188,278

137,352

Debt securities in issue

27,921

32,895

Liabilities under insurance contracts issued

17,522

19,228

Other

24,268

22,723

Total equity

36,698

32,919

Total shareholders’ equity

36,078

32,370

Non-controlling interests

620

549

Movements in 2014

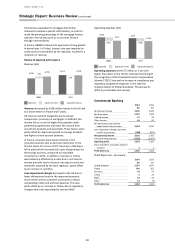

Total reported assets were £797 billion, 2 per cent lower

than at 31 December 2013.

The group maintained a strong and liquid balance sheet

with the ratio of customer advances to customer

accounts slightly decreasing to 74.2 per cent (2013: 79.0

per cent). This was due to customer advances decreasing

by 6 per cent whilst the amount of customer deposits

remained stable.

The group’s Common Equity Tier 1 ratio was 8.7 per cent

(2013: Core Tier 1 ratio: 12.1 per cent). Risk-weighted

assets of £243,652 million were 31 per cent higher than

at 31 December 2013, principally reflecting the transition

to CRD IV.

Assets

Cash and balances at central banks decreased by 37 per

cent reflecting a reduction in excess liquidity.

Trading assets decreased by 3 per cent predominantly

due to maturing reverse repos held for trading. New

reverse repo transactions are now classified as ‘non-

trading’ if they are mainly for funding purposes. This was

partially offset by an increased holding of equity

securities in the UK where there has been a rise in equity

positions in respect of forward trading, driven by

increased client activity, predominantly in the Equity

Finance business.

Financial assets designated at fair value decreased by 59

per cent, primarily reflecting the decision to sell the

pension insurance business in the UK as part of a

strategic decision to cease manufacturing pensions in the

UK insurance business. These assets have been classified

as ‘Held for sale’ and reported as part of ‘Other assets’.

In addition, the termination and derecognition of back-

to-back structured trades led to a decline in the amount

of financial assets designated at fair value. A

corresponding decline is reported in ‘financial liabilities

designated at fair value’.

Derivative assets increased by 37 per cent, principally as

a result of shifts in yield curves which led to an increase

in the fair value of interest rate contracts. In addition,

the fair value of foreign exchange contracts increased as

a result of favourable exchange rate movements in the

currency markets.

Loans and advances to banks increased by 10 per cent

principally driven by higher placements with financial

institutions.

Loans and advances to customers decreased by 6 per

cent, as we aligned our approach in our Payments and

Cash Management business to be more globally

consistent, resulting in a reduction in corporate

overdraft balances as clients reduced their overdraft and

deposit balances which were previously subject to net

interest arrangements. This was partially offset by an

increase in term lending to corporate and commercial

customers, notably in the second half of the year.

Reverse repurchase agreements – non trading decreased

by 32 per cent due to an underlying reduction in reverse

repo trades and an increased level of netting.

Financial investments were stable, with no major

movement period-on-period.