HSBC 2014 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Report of the Directors: Risk (continued)

41

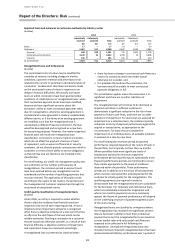

Concentration of credit risk exposure

(Unaudited)

Concentrations of credit risk arise when a number of

counterparties or exposures have comparable economic

characteristics, or such counterparties are engaged in

similar activities, or operate in the same geographical

areas or industry sectors, so that their collective ability

to meet contractual obligations is uniformly affected by

changes in economic, political or other conditions. The

group uses a number of controls and measures to

minimise undue concentration of exposure in the

group’s portfolios across industry, country and customer

groups. These include portfolio and counterparty limits,

approval and review controls, and stress testing.

Wrong-way risk occurs when a counterparty’s exposures

are adversely correlated with its credit quality. There are

two types of wrong-way risk:

• general wrong-way risk occurs when the probability

of counterparty default is positively correlated with

general risk factors such as, for example, where the

counterparty is resident and/or incorporated in a

higher-risk country and seeks to sell a non-domestic

currency in exchange for its home currency; and

• specific wrong-way risk occurs when the exposure to

a particular counterparty is positively correlated with

the probability of counterparty default such as a

reverse repo on the counterparty’s own bonds. It is

HSBC policy that specific wrong-way transactions are

approved on a case-by-case basis.

We use a range of procedures to monitor and control

wrong-way risk, including requiring entities to obtain

prior approval before undertaking wrong-way risk

transactions outside pre-agreed guidelines.

Cross-border exposures

We assess the vulnerability of countries to foreign

currency payment restrictions, including economic and

political factors, when considering impairment

allowances on cross-border exposures. Impairment

allowances are assessed in respect of all qualifying

exposures within vulnerable countries unless these

exposures and the inherent risks are:

• performing, trade-related and of less than one year’s

maturity;

• mitigated by acceptable security cover which is, other

than in exceptional cases, held outside the country

concerned;

• in the form of securities held for trading purposes for

which a liquid and active market exists, and which are

measured at fair value daily; and

• performing facilities with a principal (excluding

security) of US$1 million or below and/or with

maturity dates shorter than three months.

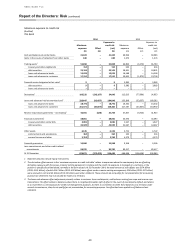

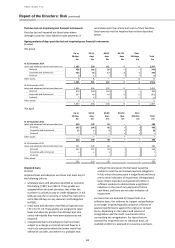

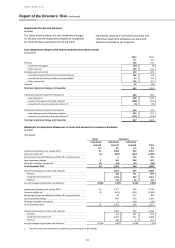

Financial Investments

Our holdings of available-for-sale government and

government agency debt securities, corporate debt

securities, asset-backed securities (‘ABSs’) and other

securities were spread across a wide range of issuers in

2014, with 61 per cent invested in government or

government agency debt securities.

Trading assets

Trading securities remained the largest concentration

within trading assets of the group at 73 per cent

compared with 71 percent in 2013.

Derivatives

HSBC participates in transactions exposing it

counterparty credit risk. Counterparty credit risk is the

risk of financial loss if the counterparty to a transaction

defaults before completing the satisfactory settlement of

the transaction, which varies in value by reference to a

market factor such as interest rate, exchange rate or

asset price. It arises principally from OTC derivatives and

securities financing transactions (‘SFTs’) and is calculated

in both the trading and non-trading books.

Derivative assets were £188 billion at 31 December 2014

(2013: £137 billion).

Items in the course of collection from other banks

Settlement risk arises in any situations where a payment

in cash, securities or equities is made with the

expectation of a corresponding receipt of cash, securities

or equities. Daily settlement limits are established for

counterparties to cover the aggregate of transactions

with each counterparty on any single day.

The group substantially mitigates settlement risk on

many transactions, particularly those involving securities

and equities, by settling through assured payment

systems, or on a delivery-versus-payment basis.

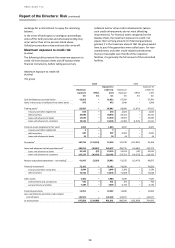

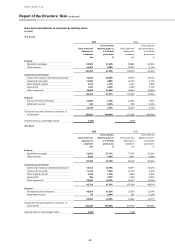

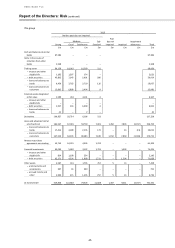

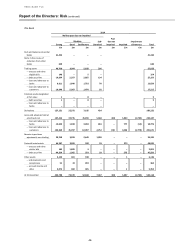

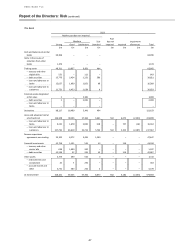

Loans and advances

The following tables analyse loans and advances by

industry sector.