HSBC 2014 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Notes on the Financial Statements (continued)

140

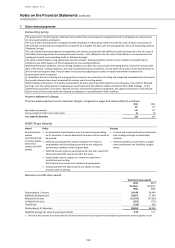

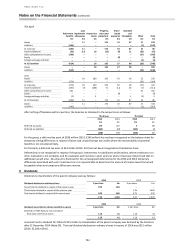

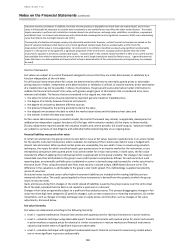

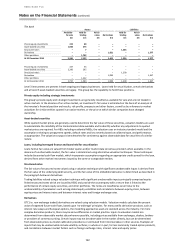

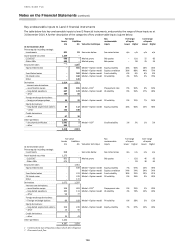

Transfers between Level 1 and Level 2 fair values:

Assets

Liabilities

Available for

sale

Held for

trading

Designated at

fair value

through profit

or loss

Derivatives

Held for

trading

Designated at

fair value

through profit

or loss

Derivatives

£m

£m

£m

£m

£m

£m

£m

At 31 December 2014

Transfers from Level 1 to Level 2

1,641

11,024

–

–

18,989

–

–

Transfers from Level 2 to Level 1

–

–

–

–

–

–

–

At 31 December 2013

Transfers from Level 1 to Level 2

46

14,151

–

1

21,848

–

–

Transfers from Level 2 to Level 1

548

368

–

–

–

–

–

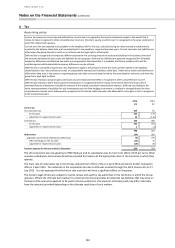

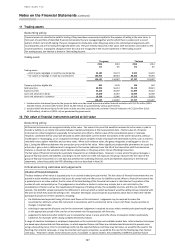

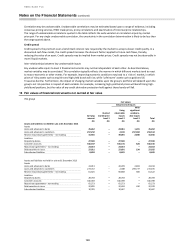

Fair value adjustments

Fair value adjustments are adopted when HSBC considers that there are additional factors that would be considered by a

market participant which are not incorporated within the valuation model. HSBC classifies fair value adjustments as either

‘risk-related’ or ‘model-related’. The majority of these adjustments relate to GB&M.

Movements in the level of fair value adjustments do not necessarily result in the recognition of profits or losses within the

income statement. For example, as models are enhanced, fair value adjustments may no longer be required. Similarly, fair

value adjustments will decrease when the related positions are unwound, but this may not result in profit or loss.

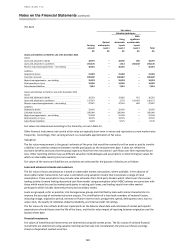

Risk-related adjustments

Bid-offer

IFRS 13 requires use of the price within the bid-offer spread that is most representative of fair value. Valuation models will

typically generate mid-market values. The bid-offer adjustment reflects the extent to which bid-offer cost would be

incurred if substantially all residual net portfolio market risks were closed using available hedging instruments or by

disposing of or unwinding the position.

Uncertainty

Certain model inputs may be less readily determinable from market data, and/or the choice of model itself may be more

subjective. In these circumstances, there exists a range of possible values that the financial instrument or market

parameter may assume and an adjustment may be necessary to reflect the likelihood that in estimating the fair value of

the financial instrument, market participants would adopt more conservative values for uncertain parameters and/or

model assumptions than those used in the valuation model.

Credit valuation adjustment

The credit valuation adjustment is an adjustment to the valuation of OTC derivative contracts to reflect within fair value

the possibility that the counterparty may default and that the group may not receive the full market value of the

transactions (see below).

Debit valuation adjustment

The debit valuation adjustment is an adjustment to the valuation of OTC derivative contracts to reflect within fair value

the possibility that the group may default, and that the group may not pay the full market value of the transactions (see

below).

Model-related adjustments

Model limitation

Models used for portfolio valuation purposes may be based upon a simplifying set of assumptions that do not capture all

material market characteristics. Additionally, markets evolve, and models that were adequate in the past may require

development to capture all material market characteristics in current market conditions. In these circumstances, model

limitation adjustments are adopted. As model development progresses, model limitations are addressed within the

valuation models and a model limitation adjustment is no longer needed.

Inception profit (Day 1 P&L reserves)

Inception profit adjustments are adopted when the fair value estimated by a valuation model is based on one or more

significant unobservable inputs. The accounting for inception profit adjustments is discussed on page 137.

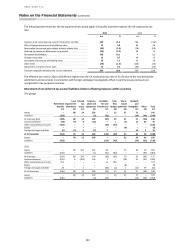

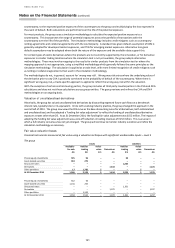

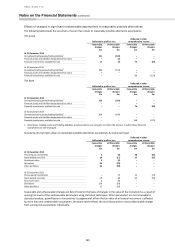

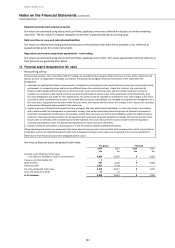

Credit valuation/debit valuation adjustment methodology

The group calculates a separate credit valuation adjustment (‘CVA’) and debit valuation adjustment (‘DVA’) for each group

legal entity, and within each entity for each counterparty to which the entity has exposure. The group calculates the CVA

by applying the probability of default (‘PD’) of the counterparty, conditional on the non-default of the group, to the

group’s expected positive exposure to the counterparty and multiplying the result by the loss expected in the event of

default. Conversely, the group calculates the DVA by applying the PD of the group, conditional on the non-default of the