HSBC 2014 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Notes on the Financial Statements (continued)

143

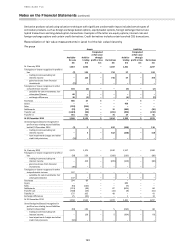

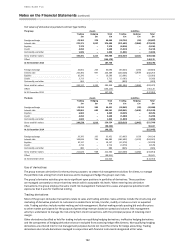

Derivative products valued using valuation techniques with significant unobservable inputs included certain types of

correlation products, such as foreign exchange basket options, equity basket options, foreign exchange interest rate

hybrid transactions and long-dated option transactions. Examples of the latter are equity options, interest rate and

foreign exchange options and certain credit derivatives. Credit derivatives include certain tranched CDS transactions.

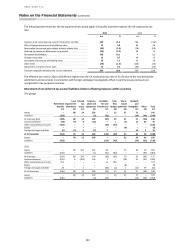

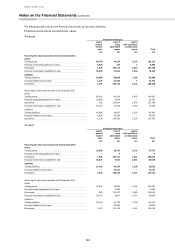

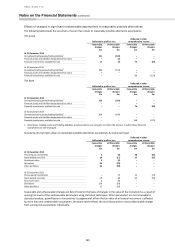

Reconciliation of fair value measurements in Level 3 of the fair value hierarchy

The group

Assets

Liabilities

Available

-

for-sale

Held for

trading

Designated

at fair value

through

profit or loss

Derivatives

Held for

trading

Designated

at fair value

through

profit or loss

Derivatives

£m

£m

£m

£m

£m

£m

£m

At 1 January 2014

1,653

1,562

–

1,072

1,361

–

1,297

Total gains or losses recognised in profit or

loss

(7)

123

–

734

57

–

193

- trading income excluding net

interest income

–

123

–

734

57

–

193

- gains less losses from financial

investments

(7)

–

–

–

–

–

–

Total gains or losses recognised in other

comprehensive income

104

(2)

–

–

(4)

–

(2)

- available-for-sale investments: fair

value gains/(losses)

66

–

–

–

–

–

–

- exchange differences

38

(2)

–

–

(4)

–

(2)

Purchases

666

27

5

–

–

5

–

Issues

–

–

–

–

439

–

–

Sales

(259)

(204)

–

–

–

–

–

Settlements

(79)

(16)

–

15

(385)

–

(90)

Transfer out

(1,023)

(58)

–

(281)

(202)

–

(233)

Transfer in

491

721

–

74

27

–

56

At 31 December 2014

1,546

2,153

5

1,614

1,293

5

1,221

Unrealised gains/(losses) recognised in

profit or loss relating to and liabilities

held at 31 December 2014

(1)

5

–

612

(108)

–

118

- trading income excluding net

interest income

–

5

–

612

(108)

–

118

- loan impairment charges and other

credit risk provisions

(1)

–

–

–

–

–

–

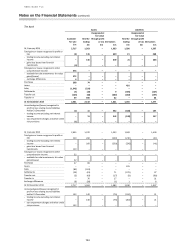

At 1 January 2013

2,071

1,375

–

1,160

1,517

–

1,308

Total gains or losses recognised in profit or

loss

(39)

259

–

(209)

(220)

–

(88)

- trading income excluding net

interest income

–

259

–

(209)

(220)

–

(88)

- gains less losses from financial

investments

(39)

–

–

–

–

–

–

Total gains or losses recognised in other

comprehensive income

107

–

–

–

–

–

–

- available-for-sale investments: fair

value gains/(losses)

107

–

–

–

–

–

–

Purchases

294

89

–

–

–

–

–

Issues

–

–

–

–

683

–

–

Sales

(91)

(110)

–

–

(9)

–

–

Settlements

(251)

(48)

–

87

(603)

–

84

Transfer out

(638)

(43)

–

(14)

(8)

–

(61)

Transfer in

175

105

–

48

–

–

41

Exchange differences

25

(65)

–

–

1

–

13

At 31 December 2013

1,653

1,562

–

1,072

1,361

–

1,297

Unrealised gains/(losses) recognised in

profit or loss relating to and liabilities

held at 31 December

(93)

139

–

5

(264)

–

68

- trading income excluding net

interest income

–

139

–

5

(264)

–

68

- loan impairment charges and other

credit risk provisions

(93)

–

–

–

–

–

–