HSBC 2014 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Notes on the Financial Statements (continued)

148

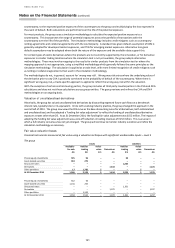

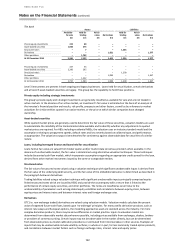

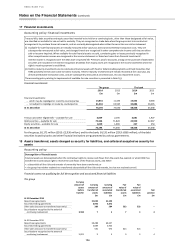

Correlation may be unobservable. Unobservable correlations may be estimated based upon a range of evidence, including

consensus pricing services, HSBC trade prices, proxy correlations and examination of historical price relationships.

The range of unobservable correlations quoted in the table reflects the wide variation in correlation inputs by market

price pair. For any single unobservable correlation, the uncertainty in the correlation determination is likely to be less than

the range quoted above.

Credit spread

Credit spread is the premium over a benchmark interest rate required by the market to accept a lower credit quality. In a

discounted cash flow model, the credit spread increases the discount factors applied to future cash flows, thereby

reducing the value of an asset. Credit spreads may be implied from market prices. Credit spreads may not be observable in

more illiquid markets.

Inter-relationships between key unobservable inputs

Key unobservable inputs to level 3 financial instruments may not be independent of each other. As described above,

market variables may be correlated. This correlation typically reflects the manner in which different markets tend to react

to macro-economic or other events. For example, improving economic conditions may lead to a ‘risk on’ market, in which

prices of risky assets such as equities and high yield bonds will rise, while ‘safe haven’ assets such as gold and US

Treasuries decline. Furthermore, the impact of changing market variables upon the group’s portfolio will depend upon the

group’s net risk position in respect of each variable. For example, increasing high-yield bond prices will benefit long high-

yield bond positions, but the value of any credit derivative protection held against those bonds will fall.

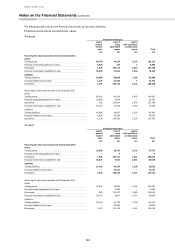

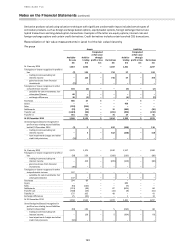

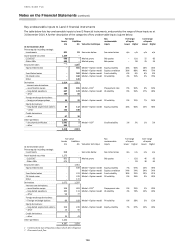

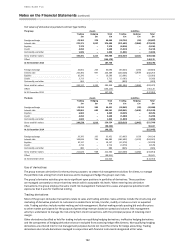

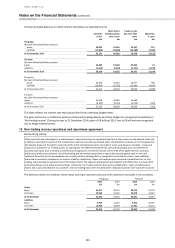

13 Fair values of financial instruments not carried at fair value

The group

Fair values

Valuation techniques

Carrying

amount

Quoted

market price

Level 1

Using

observable

inputs

Level 2

With

significant

unobserv-

able inputs

Level 3

Total

£m

£m

£m

£m

£m

Assets and liabilities not held for sale at 31 December 2014

Assets

Loans and advances to banks

25,262

–

24,061

1,201

25,262

Loans and advances to customers

257,252

–

2,130

257,384

259,514

Reverse repurchase agreements – non-trading

41,945

–

39,055

2,890

41,945

Liabilities

Deposits by banks

27,590

–

27,590

–

27,590

Customer accounts

346,507

–

345,721

824

346,545

Repurchase agreements – non-trading

23,353

–

23,353

–

23,353

Debt securities in issue

27,921

–

27,691

234

27,925

Subordinated liabilities

8,858

–

8,695

–

8,695

Assets and liabilities not held for sale at 31 December 2013

Assets

Loans and advances to banks

23,013

–

20,209

2,804

23,013

Loans and advances to customers

273,722

–

2,388

269,777

272,165

Reverse repurchase agreements – non-trading

61,525

–

60,838

684

61,522

Liabilities

Deposits by banks

28,769

–

28,769

–

28,769

Customer accounts

346,358

–

346,398

–

346,398

Repurchase agreements – non-trading

65,573

–

65,573

–

65,573

Debt securities in issue

32,895

–

32,499

430

32,929

Subordinated liabilities

10,785

–

10,487

–

10,487