HSBC 2014 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Report of the Directors: Risk (continued)

62

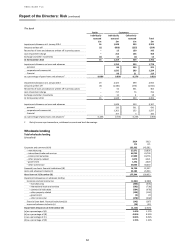

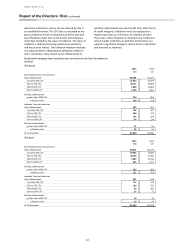

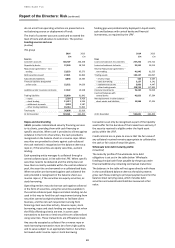

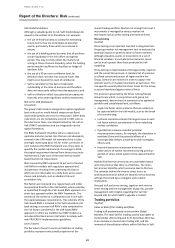

Stressed one-month and three-month coverage ratios1

(Audited)

Stressed one-month coverage

ratios at 31 December

Stressed three-month coverage

ratios at 31 December

2014

(%)

2013

(%)

2014

(%)

2013

(%)

HSBC UK

Year end

117

106

109

109

Maximum

117

114

109

109

Minimum

102

100

103

101

Average

107

106

104

103

HSBC France

Year end

117

110

101

103

Maximum

117

112

106

104

Minimum

104

103

101

100

Average

107

108

102

103

Total of other principal group entities

Year end

110

106

108

102

Maximum

115

113

108

106

Minimum

104

104

102

102

Average

109

108

105

103

1 This ratio measures the liquid assets available to meet net cash outflows over a 30 day/ 90 day period. The higher the percentage, the greater

the liquidity.

The one-month stressed coverage ratio for HSBC UK

increased mainly due to lower contractual repos

positions. The three-month stressed coverage ratio

remained broadly unchanged.

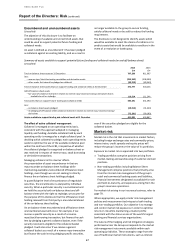

Stressed scenario analysis

(Unaudited)

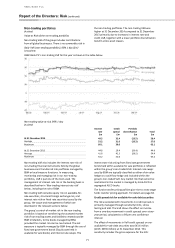

The group uses a number of standard Group stress

scenarios designed to model:

• combined market-wide and HSBC-specific liquidity

crisis scenarios; and

• market-wide liquidity crisis scenarios.

The appropriateness of the assumptions for each

scenario is reviewed by ALCM regularly and formally

approved by the RMM and the Board annually as part of

the liquidity and funding risk appetite approval process.

Stressed cash outflows are determined by applying a

standard set of prescribed stress assumptions to the

Group’s cash flow model. The group’s framework

prescribes the use of two market-wide scenarios and two

further combined market-wide and HSBC-specific stress

scenarios of increasing severity. In addition to the

group’s standard stress scenarios, individual operating

entities are required to design their own scenarios to

reflect specific local market conditions, products and

funding bases.

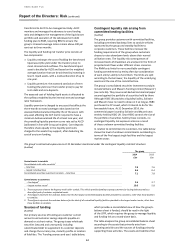

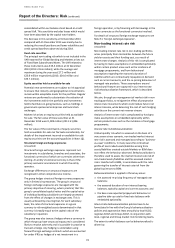

The two combined market-wide and HSBC-specific

scenarios model a more severe scenario than the

market-wide scenarios. The relevant combined market-

wide and HSBC-specific stress scenario that an operating

entity manages to is based upon its inherent liquidity risk

categorisation. The key assumptions factored into the

combined market-wide and HSBC-specific stress

scenarios are summarised as follows:

• all non-core deposits are deemed to be withdrawn

within three months (80 per cent within one month),

with the level of non-core deposits dependent on the

operating entity’s inherent liquidity risk

categorisation;

• the ability to access interbank funding and unsecured

term debt markets ceases for the duration of the

scenario;

• the ability to generate funds from illiquid asset

portfolios (securitisation and secured borrowing) is

restricted to 25-75 per cent of the lower of issues in

the last six months or expected issues in the next six

months. The restriction is based on current market

conditions and is dependent on the operating entity’s

inherent liquidity risk categorisation;

• the ability to access repo funding ceases for any asset

not classified as liquid under our liquid asset policy for

the duration of the scenario;

• drawdowns on committed lending facilities must be

consistent with the severity of the market stress

being modelled and dependent on the inherent

liquidity risk categorisation of the operating entity;

• outflows are triggered by a defined downgrade in

long-term ratings. We maintain an ongoing

assessment of the appropriate number of notches to

reflect;

• customer loans are assumed to be renewed at

contractual maturity;

• interbank loans and reverse repos are assumed to run

off contractually; and

• assets defined as liquid assets are assumed to be

realised in cash ahead of their contractual maturity,

after applying a defined stressed haircut of up to 20

per cent.

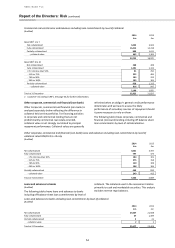

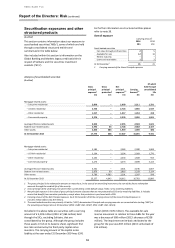

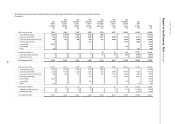

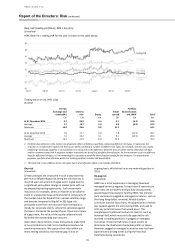

Liquid assets

(Audited)

The table of the liquid assets shows the estimated

liquidity value (before haircuts) of assets categorised as

liquid used for the purposes of calculating the three

month stressed coverage ratio, as defined under the

Group’s LFRF.