HSBC 2014 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Report of the Directors: Risk (continued)

56

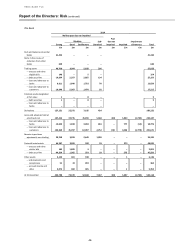

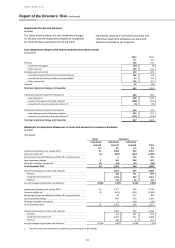

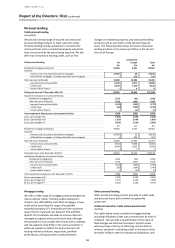

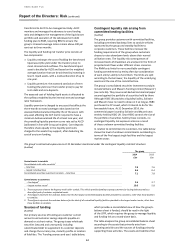

Personal lending

Total personal lending

(Unaudited)

We provide a broad range of secured and unsecured

personal lending products to meet customer needs.

Personal lending includes advances to customers for

asset purchases such as residential property where the

loans are secured by the assets being acquired. We also

offer loans secured on existing assets, such as first

charges on residential property, and unsecured lending

products such as overdrafts, credit cards and payroll

loans. The following table shows the levels of personal

lending products in the various portfolios in the UK and

the rest of Europe.

Total personal lending

UK

Continental

Europe

Total

£m

£m

£m

Residential mortgage lending (A)

79,066

3,941

83,007

Of which:

– Interest-only (including endowment) mortgages

27,984

29

28,013

– Affordability mortgages, including adjustable rate mortgages

–

216

216

Other personal lending (B)

13,489

10,894

24,383

– personal loans and overdrafts

6,655

9,411

16,066

– credit cards

6,834

1,479

8,313

– motor vehicle finance

–

4

4

Total gross loans at 31 December 2014 (C)

92,555

14,835

107,390

Impairment allowances on personal lending

Residential mortgages (a)

(155)

(41)

(196)

Other personal lending (b)

(209)

(292)

(501)

– personal loans and overdrafts

(145)

(132)

(277)

– credit cards

(64)

(159)

(223)

– motor vehicle finance

–

(1)

(1)

Total impairment allowances at 31 December 2014 (c)

(364)

(333)

(697)

(a) as a percentage of A

0.20%

1.04%

0.24%

(b) as a percentage of B

1.55%

2.68%

2.05%

(c) as a percentage of C

0.39%

2.24%

0.65%

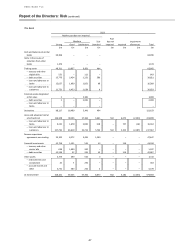

£m

£m

£m

Residential mortgage lending (D)

79,955

3,927

83,882

Of which:

– Interest-only (including endowment) mortgages

29,585

33

29,618

– Affordability mortgages, including adjustable rate mortgages

1

306

307

Other personal lending (E)

13,860

11,397

25,257

– personal loans and overdrafts

6,916

9,565

16,481

– credit cards

6,944

1,825

8,769

– motor vehicle finance

–

7

7

Total gross loans at 31 December 2013 (F)

93,815

15,324

109,139

Impairment allowances on personal lending

Residential mortgages (d)

(222)

(43)

(265)

Other personal lending (e)

(274)

(302)

(576)

– personal loans and overdrafts

(194)

(136)

(330)

– credit cards

(80)

(164)

(244)

– motor vehicle finance

–

(2)

(2)

Total impairment allowances at 31 December 2013 (f)

(496)

(345)

(841)

(d) as a percentage of D

0.28%

1.09%

0.32%

(e) as a percentage of E

1.97%

2.65%

2.28%

(f) as a percentage of F

0.53%

2.25%

0.77%

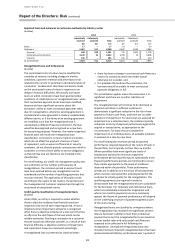

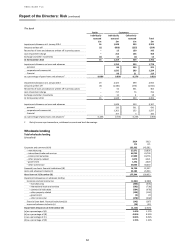

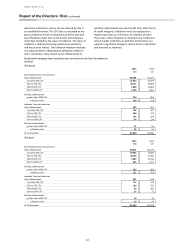

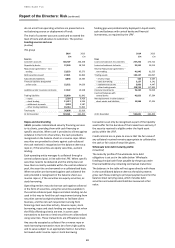

Mortgage lending

We offer a wide range of mortgage products designed to

meet customer needs, including capital repayment,

interest-only, affordability and offset mortgages. Group

credit policy prescribes the range of acceptable

residential property LTV thresholds with the maximum

upper limit for new loans set between 75% and 95%.

Specific LTV thresholds and debt-to-income ratios are

managed at regional and country levels and, although

the parameters must comply with Group policy, strategy

and risk appetite, they differ in the various locations in

which we operate to reflect the local economic and

housing market conditions, regulations, portfolio

performance, pricing and other product features.

Other personal lending

Other personal lending consists primarily of credit cards

and personal loans, both of which are generally

unsecured.

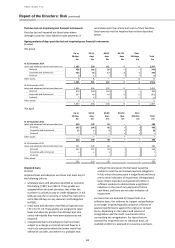

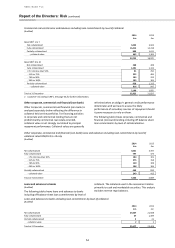

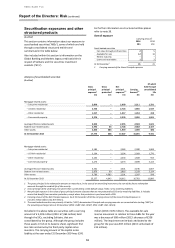

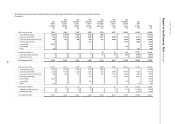

Collateral and other credit enhancements held

(Audited)

The tables below show residential mortgage lending

including off-balance sheet loan commitments by level of

collateral. They provide a quantification of the value of

fixed charges we hold over borrowers’ specific assets

where we have a history of enforcing, and are able to

enforce, collateral in satisfying a debt in the event of the

borrower failing to meet its contractual obligations, and