HSBC 2014 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Strategic Report: Business Review (continued)

22

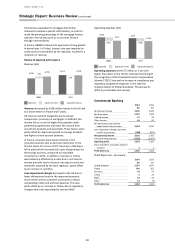

Global Banking and Markets

2014

2013

£m

£m

Net interest income1

1,180

1,101

Net fee income

643

588

Trading income1

1,637

2,192

Other income

219

400

Net operating income before

impairments and provisions

3,679

4,281

Loan impairment charges and other

credit risk provisions

16

(133)

Net operating income

3,695

4,148

Total operating expenses

(3,715)

(3,122)

Operating profit

(20)

1,026

Share of profit in associates and joint

ventures

1

(3)

Profit before tax

(19)

1,023

1 The bank’s Balance Sheet Management business, reported within

GB&M, provides funding to the trading businesses. To report

GB&M Trading income on a fully funded basis, Net interest

income and Trading income are grossed up to reflect internal

funding transactions prior to their elimination in the Inter

Segment column (refer to Note 10).

Profit before tax – by country

2014

2013

£m

£m

United Kingdom

(708)

667

France

212

227

Germany

99

115

Turkey

56

70

Malta

17

22

Other1

305

(78)

Profit before tax

(19)

1,023

1 Refer to Madoff related litigation costs in the significant items

table on pages 18 and 19 for details of year-on-year movement.

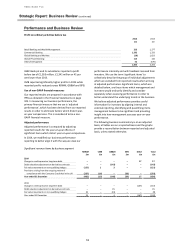

Review of performance

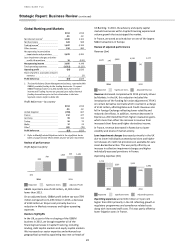

Profit before tax (£m)

GB&M reported a loss of £19 million, £1,042 million

lower than 2013.

On an adjusted basis, GB&M profit before tax was £799

million compared to £1,249 million in 2013, a decrease

of £450 million or 36 per cent primarily due to a

reduction in Markets revenues and higher operating

expenses.

Business highlights

In the UK, as part of the re-shaping of the GB&M

business in 2013, we brought together all of the

financing businesses in Capital Financing, including

lending, debt capital markets and equity capital markets.

We increased our sector expertise and enhanced our

geographical spread by appointing two new co-heads of

UK Banking. In 2014, the advisory and equity capital

markets businesses within Capital Financing experienced

volume growth that outstripped the market.

In France, we acted as sole advisor on one of the largest

M&A transactions in Europe.

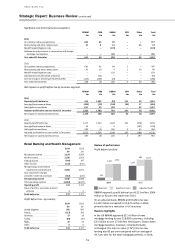

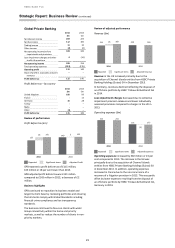

Review of adjusted performance

Revenue (£m)

Revenue decreased compared with 2013 primarily driven

by Markets. In the UK, this reduction included the

introduction of the funding fair value adjustment (‘FFVA’)

on certain derivative contracts which resulted in a charge

of £152 million, affecting Rates and Credit. Revenue also

fell in Foreign Exchange reflecting lower volatility and

reduced client flows. In addition, revenue decreased in

Equities as 2013 benefited from higher revaluation gains,

which more than offset the increase in revenue from

increased client flows and higher derivatives income.

In France, revenue decreased in Rates due to lower

volatility and levels of market activity.

Loan impairment charges decreased primarily in the UK

due to lower individually assessed provisions and higher

net releases of credit risk provisions on available-for-sale

Asset-Backed Securities. This was partly offset by an

increase in collective impairment charges and higher

individually assessed provisions in France.

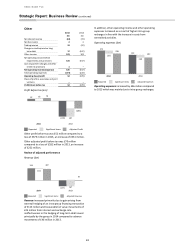

Operating expenses (£m)

Operating expenses were £145 million or 5 per cent

higher than 2013 primarily in the UK reflecting growth in

regulatory programmes and compliance related costs

along with increased staff costs. This was partly offset by

lower litigation costs in France.

(19)

1,023

818

799

226 1,249

2014

2013

Adjusted Profit

Reported

Significant items

3,679 4,281

140 3,819

(4)

4,277

2014

2013

Adjusted RevenueReported

Significant items

3,715

3,122

(678)

3,037

(230)

2,892

2014

2013

Adjusted ExpensesReported

Significant items