HSBC 2014 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Strategic Report: Business Review (continued)

15

independent financial advisor distribution channels in

the UK in 2013.

Other operating income was broadly in line with 2013. A

gain arising from external hedging of an intra-group

financing transaction was mostly offset by a decrease in

the Present Value of In-Force (‘PVIF’) long term

insurance business in France RBWM.

Net insurance claims, benefits paid and movement in

liabilities to policyholders decreased by £712 million or

24 per cent. This reflected a net trading loss on economic

hedges and a decrease in business volumes. In addition,

there was a decrease in investment returns on assets

held to support policyholder contracts where the

policyholder bears investment risk from weaker equity

market movements in 2014 compared to 2013 in the UK

and France.

Loan impairment charges and other credit risk provisions

decreased by £522 million or 54 per cent. This was due

to lower individually assessed provisions in UK CMB

reflecting improved portfolio quality and the economic

environment. GB&M in the UK recorded reduced loan

impairment charges due to lower individually assessed

provisions and higher net releases of credit risk

provisions on available-for-sale asset backed securities.

This was partly offset by an increase due to a revision in

certain estimates in our corporate collective loan

impairment calculation. In RBWM, loan impairment

charges decreased as a result of lower delinquency levels

in the improved economic environment and as

customers continued to reduce outstanding credit card

and loan balances.

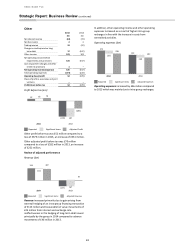

Total operating expenses increased by £912 million or 11

per cent. This was primarily due to a number of

significant items including settlements and provisions in

connection with foreign exchange investigations in

GB&M and the non-recurrence of a 2013 accounting gain

of £280 million arising from a change in basis of

delivering ill-health benefits in the UK. In addition

expenses were higher due to the timing of the

recognition of the Financial Services Compensation

Scheme (‘FSCS’) levy in the UK and from growth in

regulatory programmes and compliance related costs

across all of our businesses.

The increase in expenses was partially offset by lower

litigation costs. Customer redress provisions broadly

remained in line with 2013. Litigation related expenses

decreased by £365 million, reflecting an insurance

recovery recognised in 2014 relating to Madoff litigation

costs that had been recognised in 2013, and which did

not recur in 2014. Compared to 2013, redress provisions

did not include a £96 million charge relating to

investment advice redress, but included an additional

charge of £583 million (2013: £483 million) for estimated

redress for possible mis-selling in previous years of

payment protection insurance (‘PPI’) policies and £175

million (2013: £166 million) in respect of interest rate

protection products.

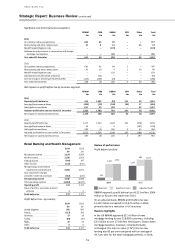

During 2014 the group maintained its strict cost control

discipline and benefited from the delivery of

organisational effectiveness programmes. The number of

employees, expressed in fulltime equivalent numbers at

the end of 2014 was 1 per cent higher compared to

2013. This was primarily as a result of the initiatives

related to Regulatory Programmes and Compliance in

part offset by sustainable savings programmes and

business disposals.

Tax expense totalled £564 million in 2014, compared to

£754 million in 2013. The effective tax rate for 2014 was

28.9 per cent, compared to 22.9 per cent in 2013.

The effective tax rate for 2014 of 28.9 per cent was

higher than the UK corporation tax rate of 21.5 per cent

due to the non-deductible settlements and provisions in

connection with foreign exchange investigations offset in

part by the recognition of losses previously not

recognised for tax purposes overseas.