HSBC 2014 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Report of the Directors: Risk (continued)

59

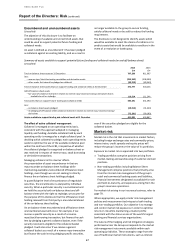

Liquidity and funding risk

Liquidity risk is the risk that the group does not have

sufficient financial resources to meet its obligations as

they fall due, or will have access to such resources only

at an excessive cost. This risk principally arises from

mismatches in the timing of cash flows. Funding risk (a

form of liquidity risk) arises when the liquidity needed to

fund illiquid asset positions cannot be obtained on the

expected terms and when required.

The objective of the group’s liquidity and funding

management framework is to ensure that all foreseeable

funding commitments can be met when due, and that

access to the wholesale markets is co-ordinated and

cost-effective. To this end, the group maintains a

diversified funding base comprising core retail and

corporate customer deposits and institutional balances.

This is augmented with wholesale funding and portfolios

of highly liquid assets diversified by currency and

maturity that are held to enable the group to respond

quickly and smoothly to unforeseen liquidity

requirements.

The group requires its operating entities to maintain

strong liquidity positions and to manage the liquidity

profiles of their assets, liabilities and commitments with

the objective of ensuring that their cash flows are

balanced appropriately and that all their anticipated

obligations can be met when due. The group adapts its

liquidity and funding risk management framework in

response to changes in the mix of business that it

undertakes, and to changes in the nature of the markets

in which it operates. The group also seeks to

continuously evolve and strengthen its liquidity and

funding risk management framework.

The group employs a number of measures to monitor

liquidity risk. The group also manages its intra-day

liquidity positions so that it is able to meet payment and

settlement obligations on a timely basis. Payment flows

in real time gross settlement systems, expected peak

payment flows and large time-critical payments are

monitored during the day and the intra-day collateral

position is managed so that there is liquidity available to

meet payments.

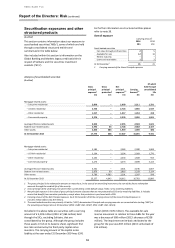

The management of liquidity and funding is primarily

undertaken locally in the group’s operating entities in

compliance with policies and limits set by the Risk

Management Meeting (‘RMM’). These limits vary

according to the depth and liquidity of the market in

which the entities operate. It is the group’s general

policy that each banking entity should manage its

liquidity and funding risk on a standalone basis.

Exceptions are permitted for certain short-term treasury

requirements and start-up operations or for branches

which do not have access to local deposit markets. These

entities are funded from the group’s largest banking

operations and within clearly defined internal and

regulatory guidelines and limits. The limits place formal

restrictions on the transfer of resources between group

entities and reflect the range of currencies, markets and

time zones within which the group operates.

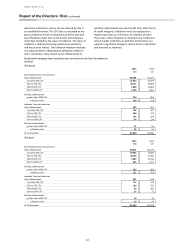

The group’s liquidity and funding management process

includes:

• projecting cash flows by major currency under various

stress scenarios and considering the level of liquid

assets necessary in relation to these;

• monitoring balance sheet liquidity and advances to

core funding ratios at both a consolidated and major

currency level against internal and regulatory

requirements;

• maintaining a diverse range of funding sources with

back-up facilities;

• managing the concentration and profile of debt

maturities;

• managing contingent liquidity commitment exposures

within pre-determined caps;

• maintaining debt financing plans;

• monitoring depositor concentration in order to avoid

undue reliance on large individual depositors and

ensure a satisfactory overall funding mix; and

• maintaining liquidity and funding contingency plans.

These plans identify early indicators of stress

conditions and describe actions to be taken in the

event of difficulties arising from systemic or other

crises, while minimising adverse long-term

implications for the business.

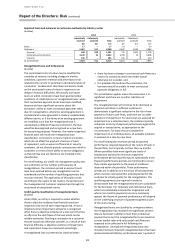

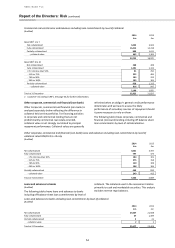

Primary sources of funding

(Audited)

Customer deposits in the form of current accounts and

savings deposits payable on demand or at short notice

form a significant part of our funding, and we place

considerable importance on maintaining their stability.

For deposits, stability depends upon maintaining

depositor confidence in our capital strength and

liquidity, and on competitive and transparent pricing.

We also access wholesale funding markets by issuing

senior secured and unsecured debt securities (publically

and privately) and borrowing from the secured repo

markets against high quality collateral, in order to obtain

funding for non-banking subsidiaries that do not accept

deposits, to align asset and liability maturities and

currencies and to maintain a presence in local wholesale

markets.

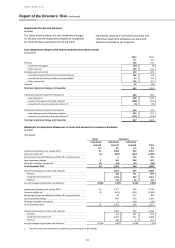

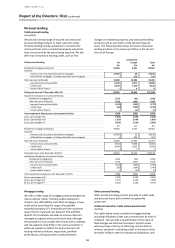

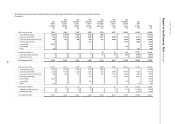

Liquidity and funding in 2014

(Unaudited)

The group maintained its liquidity position in 2014 and

continued to enjoy strong inflows of customer deposits

and maintained good access to wholesale markets. HSBC

UK recorded a decrease in its advances to core funding

(‘ACF’) ratio to 97 per cent at 31 December 2014 (2013:

100 per cent) mainly because core deposits increased

more than advances, and due to the reduction in legacy

assets.

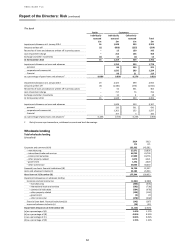

Liquidity regulation

(Unaudited)

The European adoption of the Basel Committee

framework (legislative texts known as the Capital

Requirements Regulation and Directive – CRR/CRD IV)

was published in June 2013, and required the reporting

of the liquidity coverage ratio (‘LCR’) and the net stable

funding ratio (‘NSFR’) to European regulators from

January 2014, which was subsequently delayed until 30