HSBC 2014 Annual Report Download - page 185

Download and view the complete annual report

Please find page 185 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Notes on the Financial Statements (continued)

183

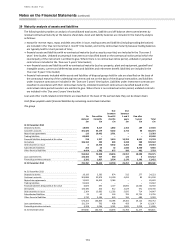

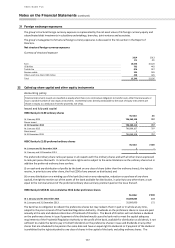

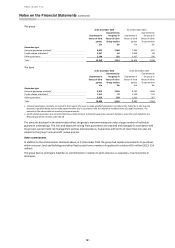

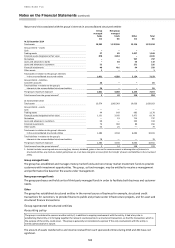

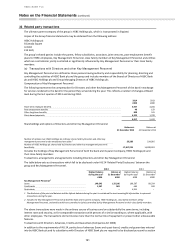

At 31 December 2014, unguaranteed residual values of £102 million (2013: £124 million) had been accrued, and the

accumulated allowance for uncollectible minimum lease payments receivable amounted to £4 million (2013: £7 million).

In 2014, £27 million (2013: £26 million) was received as contingent rents and recognised in the income statement.

Operating lease receivables

The group leases a variety of different assets to third parties under operating lease arrangements, including property,

aircraft and general plant and machinery.

Equipment

2014

2013

£m

£m

Future minimum lease payments under non-cancellable operating leases expiring

No later than one year

11

12

Later than one year and no later than five years

17

25

28

37

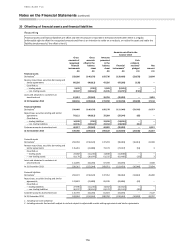

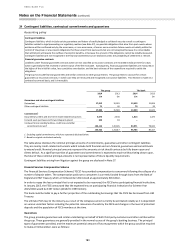

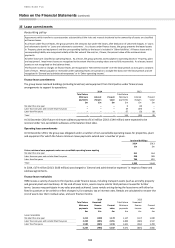

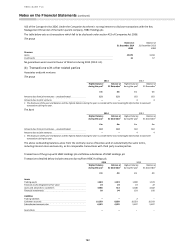

36 Structured entities

Accounting policy

A structured entity is an entity that has been designed so that voting or similar rights are not the dominant factor in deciding who

controls the entity, for example when any voting rights relate to administrative tasks only, and key activities are directed by

contractual arrangements. Structured entities often have restricted activities and a narrow and well defined objective.

Structured entities are assessed for consolidation in accordance with the accounting policy set out in Note 1(g).

The group is involved with structured entities, mainly through securitisation of financial assets, conduits and investment

funds.

The group’s arrangements that involve structured entities are authorised centrally when they are established to ensure

appropriate purpose and governance. The activities of structured entities administered by the group are closely

monitored by senior management. The group has involvement with both consolidated and unconsolidated structured

entities, which may be established by the group or by a third party, as detailed below.

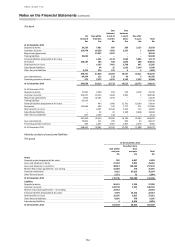

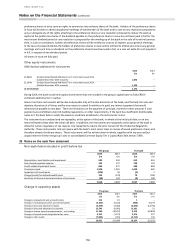

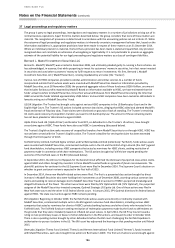

Consolidated structured entities

Total assets of the group’s consolidated structured entities, split by entity type

Conduits

Securitisations

Other

Total

£m

£m

£m

£m

At 31 December 2014

17,474

1,099

2,392

20,965

At 31 December 2013

23,324

1,253

5,826

30,403

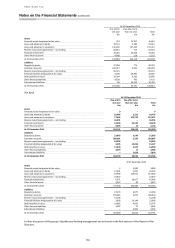

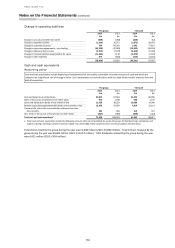

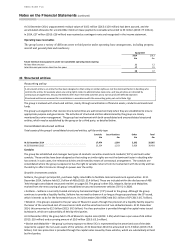

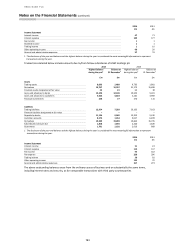

Conduits

The group has established and manages two types of conduits: securities investment conduits (‘SIC’s) and multi-seller

conduits. These entities have been designed so that voting or similar rights are not the dominant factor in deciding who

has control; in such cases, the relevant activities are directed by means of contractual arrangement. The conduits are

consolidated where the group is exposed or has the right to variable returns from its involvement with the entity and has

the ability to affect its returns through its power over the entity.

Securities investment conduits

Solitaire, the group’s principal SIC, purchases highly rated ABSs to facilitate tailored investment opportunities. At 31

December 2014, Solitaire held £5.1 billion of ABSs (2013: £5.4 billion). These are included within the disclosures of ABS

‘held through consolidated structured entities’ on pages 58. The group’s other SICs, Mazarin, Barion and Malachite,

evolved from the restructuring of group’s established structured investment vehicles (‘SIV’s) in 2008.

• Solitaire – Solitaire is currently funded entirely by Commercial Paper (‘CP’) issued to the group. Although the group

continues to provide a liquidity facility, Solitaire has no need to draw on it so long as the group purchases the CP issued,

which it intends to do for the foreseeable future. At 31 December 2014 HSBC held £6.1 billion of CP (2013: £6.7 billion).

• Mazarin – the group is exposed to the par value of Mazarin’s assets through the provision of a liquidity facility equal to

the lesser of the amortised cost of issued senior debt and the amortised cost of non-defaulted assets. At 31 December

2014, this amounted to £2.5 billion (2013: £4.5 billion). First loss protection is provided through the capital notes issued

by Mazarin, which are substantially all held by third parties.

At 31 December 2014, the group held 1.2% of Mazarin’s capital notes (2013: 1.3%) which have a par value of £6 million

(2013: £10 million) and a carrying amount of £0.9 million (2013: £0.2 million).

• Barion and Malachite – the group’s primary exposure to these SICs is represented by the amortised cost of the debt

required to support the non-cash assets of the vehicles. At 31 December 2014 this amounted to £1.9 billion (2013: £3.8

billion). First loss protection is provided through the capital notes issued by these vehicles, which are substantially all held

by third parties.