HSBC 2014 Annual Report Download - page 179

Download and view the complete annual report

Please find page 179 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Notes on the Financial Statements (continued)

177

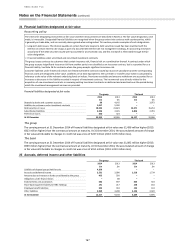

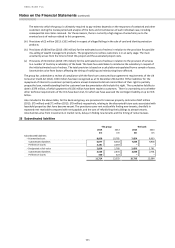

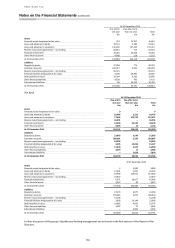

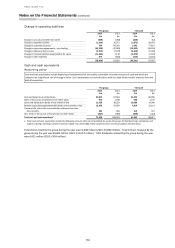

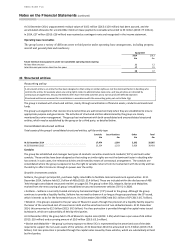

31 Foreign exchange exposures

The group’s structural foreign currency exposure is represented by the net asset value of its foreign currency equity and

subordinated debt investments in subsidiary undertakings, branches, joint ventures and associates.

The group’s management of structural foreign currency exposures is discussed in the risk section in the Report of

Directors.

Net structural foreign currency exposures

Currency of structural exposure

2014

2013

£m

£m

Euro

10,036

10,126

US dollars

792

442

Turkish lira

876

927

Russian rouble

104

185

Others, each less than £150 million

438

426

Total

12,246

12,106

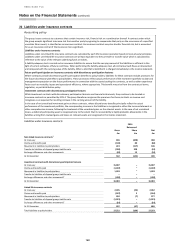

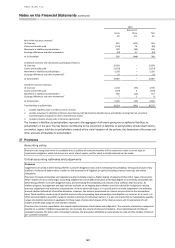

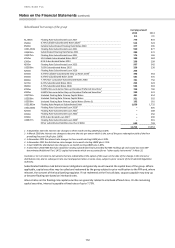

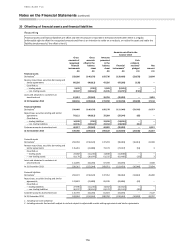

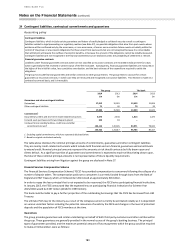

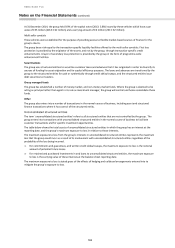

32 Called up share capital and other equity instruments

Accounting policy

Financial instruments issued are classified as equity when there is no contractual obligation to transfer cash, other financial assets or

issue a variable number of own equity instruments. Incremental costs directly attributable to the issue of equity instruments are

shown in equity as a deduction from the proceeds, net of tax.

Issued and fully paid capital

HSBC Bank plc £1.00 ordinary shares

Number

£m

At 1 January 2014

796,969,108

797

Shares issued

2

–

At 31 December 2014

796,969,110

797

At 1 January 2013

796,969,107

797

Share issued

1

–

At 31 December 2013

796,969,108

797

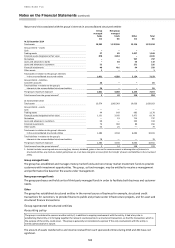

HSBC Bank plc £1.00 preferred ordinary shares

Number

£’000

At 1 January and 31 December 2014

1

–

At 1 January and 31 December 2013

1

–

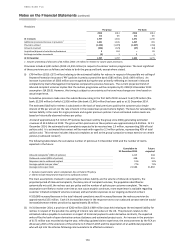

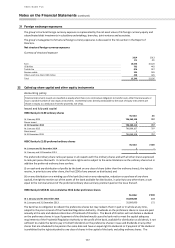

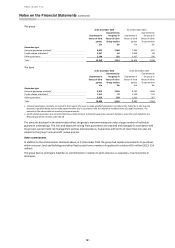

The preferred ordinary share ranks pari passu in all respects with the ordinary shares and with all other shares expressed

to rank pari passu therewith. It carries the same rights and is subject to the same limitations as the ordinary shares but in

addition the preferred ordinary share confers:

(i) on each and any distribution of profits by the bank on any class of share (other than the ordinary shares), the right to

receive, in priority to any other share, the first £100 of any amount so distributed; and

(ii) on any distribution on a winding-up of the bank (but not on any redemption, reduction or purchase of any share

capital), the right to receive out of the assets of the bank available for distribution, in priority to any other share, a sum

equal to the nominal amount of the preferred ordinary share and any premium paid on the issue thereof.

HSBC Bank plc US$0.01 non-cumulative third dollar preference shares

Number

£’000

At 1 January and 31 December 2014

35,000,000

172

At 1 January and 31 December 2013

35,000,000

172

The bank has no obligation to redeem the preference shares but may redeem them in part or in whole at any time,

subject to the prior consent of the Prudential Regulation Authority. Dividends on the preference shares in issue are paid

annually at the sole and absolute discretion of the Board of Directors. The Board of Directors will not declare a dividend

on the preference shares in issue if payment of the dividend would cause the bank not to meet the capital adequacy

requirements of the Prudential Regulation Authority or the profit of the bank, available for distribution as dividends, is not

sufficient to enable the bank to pay in full both dividends on the preference shares in issue and dividends on any other

shares that are scheduled to be paid on the same date and have an equal right to dividends or if payment of the dividend

is prohibited by the rights attached to any class of shares in the capital of the bank, excluding ordinary shares. The