HSBC 2014 Annual Report Download - page 174

Download and view the complete annual report

Please find page 174 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Notes on the Financial Statements (continued)

172

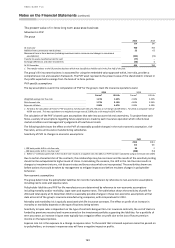

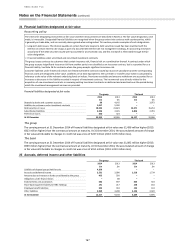

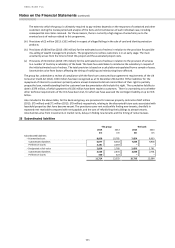

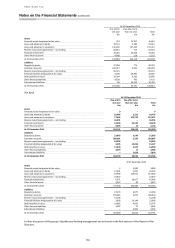

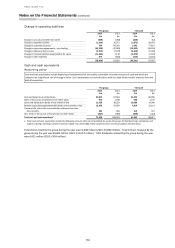

Subordinated borrowings of the group

Carrying amount

2014

2013

£m

£m

€1,000m

Floating Rate Subordinated Loan 2017

779

833

£500m

4.75% Callable Subordinated Notes 20201

514

524

€500m

Callable Subordinated Floating Rate Notes 2020

377

396

US$1,450m

Floating Rate Subordinated Loan 2021

930

877

US$450m

Subordinated Floating Rate Notes 2021

289

272

US$275m

Floating Rate Subordinated Loan 2021

176

166

£350m

5% Callable Subordinated Notes 20232

388

384

£300m

6.5% Subordinated Notes 2023

299

299

€650m

Floating Rate Subordinated Loan 2023

507

542

US$300m

7.65% Subordinated Notes 2025

256

230

€260m

Floating Rate Subordinated Loan 2029

203

-

£350m

5.375% Callable Subordinated Step-up Notes 20303

398

364

£500m

5.375% Subordinated Notes 2033

581

535

€900m

7.75% Non-cumulative Subordinated Notes 2040

701

750

£225m

6.25% Subordinated Notes 2041

224

224

£600m

4.75% Subordinated Notes 2046

593

593

£700m

5.844% Non-cumulative Step-up Perpetual Preferred Securities4

700

700

£300m

5.862% Non-cumulative Step-up Perpetual Preferred Securities5

330

323

US$750m

Undated Floating Rate Primary Capital Notes

481

454

US$500m

Undated Floating Rate Primary Capital Notes

321

302

US$300m

Undated Floating Rate Primary Capital Notes (Series 3)

192

181

US$2,862m

Floating Rate Perpetual Subordinated Debt

1,836

1,732

US$1,000m

Floating Rate Subordinated Loan 20206

–

605

€250m

Floating Rate Subordinated Loan 20216

–

208

£350m

Floating Rate Subordinated Loan 20226

–

350

£390m

6.9% Subordinated Loan 20336

–

390

US$977m

Floating Rate Subordinated Loan 20406

–

591

Other subordinated liabilities less than £100m

639

728

11,714

13,553

1 In September 2015 the interest rate changes to three month sterling LIBOR plus 0.82%.

2 In March 2018 the interest rate changes to become the rate per annum which is the sum of the gross redemption yield of the then

prevailing five year UK gilt plus 1.80%.

3 In November 2025 the interest rate changes to three month sterling LIBOR plus 1.50%.

4 In November 2031 the distribution rate changes to six month sterling LIBOR plus 1.76%.

5 In April 2020 the distribution rate changes to six month sterling LIBOR plus 1.85%.

6 In December 2014 HSBC Bank plc repaid five existing subordinated loans provided by HSBC Holdings plc and issued two new GBP

denominated Additional Tier 1 (AT1) capital instruments which are accounted for as “other equity instruments” in Note 32.

Footnotes 1 to 5 all relate to instruments that are redeemable at the option of the issuer on the date of the change in the interest or

distribution rate, and on subsequent rate reset and payment dates in some cases, subject to prior consent of the Prudential Regulation

Authority.

Subordinated liabilities rank behind senior obligations and generally count towards the capital base of the group. Where

applicable, capital securities may be called and redeemed by the group subject to prior notification to the PRA and, where

relevant, the consent of the local banking regulator. If not redeemed at the first call date, coupons payable may step-up

or become floating rate based on interbank rates.

Interest rates on the floating rate capital securities are generally related to interbank offered rates. On the remaining

capital securities, interest is payable at fixed rates of up to 7.75%.