HSBC 2014 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Report of the Directors: Risk (continued)

36

Key risks associated with an exit by a Eurozone member

include:

• Foreign exchange losses: an exit would probably be

accompanied by the passing of laws in the country

concerned establishing a new local currency and

providing for a redenomination of euro assets into

the new local currency. The value of assets and

liabilities in the country would immediately fall

assuming the value of the redenominated currency

is less than the original euros when translated into

the carrying amounts. It is not possible to predict

what the total consequential loss might be as it is

uncertain which assets and liabilities would be

legally redenominated or the extent of the

devaluation.

• External contracts redenomination risk: contracts

entered into between HSBC businesses based

outside a country exiting the euro with in-country

counterparties or those otherwise closely

connected with the relevant country may be

affected by redenomination. The effect remains

subject to a high level of uncertainty. Factors such

as the country law under which the contract is

documented, the HSBC entity involved and the

payment mechanism may all be relevant to this

assessment, as will the precise exit scenario as the

consequences for external contracts of a disorderly

exit may differ from one sanctioned under EU law.

In addition, capital controls could be introduced

which may affect the group’s ability to repatriate

funds including currencies not affected by the

redenomination event.

The group continues to identify and monitor potential

redenomination risks and, where possible, has taken and

will continue to take steps to mitigate them and/or

reduce its overall exposure to losses that might arise in

the event of a redenomination. Management recognises,

however, that a euro exit could take different forms,

depending on the scenario. These could have distinct

legal consequences which could significantly alter the

potential effectiveness of any mitigation initiatives, and

it is accordingly not possible to predict how effective

particular measures may be until they are tested against

the precise circumstances of a redenomination event

and the specific in-country assets and liabilities at the

date of the event.

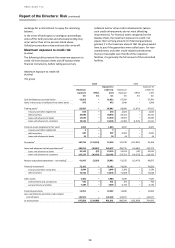

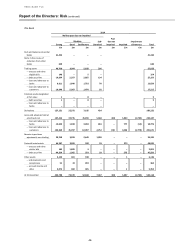

We have set out below the group’s in-country exposure

to Greece as the country with the highest level of

redenomination risk. These assets and liabilities

predominantly comprise loans and deposits arising from

the group’s commercial banking operations in these

countries, and the net assets represent the net funding

exposure. The table also identifies in-country off-balance

sheet exposures as these are at risk of redenomination

should they be called, giving rise to a balance sheet

exposure. It is to be noted that this analysis can only be

an indication as it does not include euro-denominated

exposures booked by HSBC outside the countries at risk

which are connected with those countries.

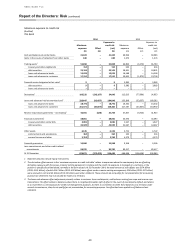

In-country funding exposure

31 December 2014

Denominated in:

Euros

US Dollars

Other

Currencies

Total

£bn

£bn

£bn

£bn

Greece

In-country assets

0.9

0.1

–

1.0

In-country liabilities

(0.9)

(0.3)

–

(1.2)

Net in-country funding

–

(0.2)

–

(0.2)

Off balance sheet exposure/hedging

–

–

–

–

31 December 2013

Denominated in:

Euros

US Dollars

Other

Currencies

Total

£bn

£bn

£bn

£bn

Greece

In-country assets

0.9

0.1

–

1.0

In-country liabilities

(0.8)

(0.5)

–

(1.3)

Net in-country funding

0.1

(0.4)

–

(0.3)

Off balance sheet exposure/hedging

(0.1)

–

0.2

0.1