HSBC 2014 Annual Report Download - page 178

Download and view the complete annual report

Please find page 178 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Notes on the Financial Statements (continued)

176

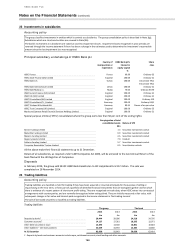

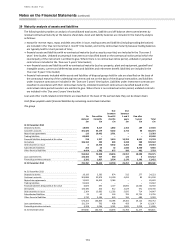

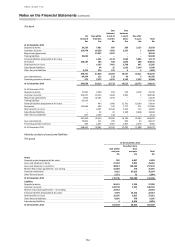

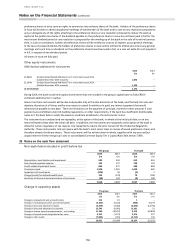

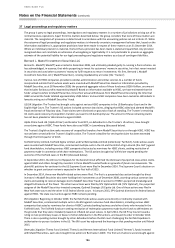

30 Offsetting of financial assets and financial liabilities

Accounting

Financial assets and financial liabilities are offset and the net amount is reported in the balance sheet when there is a legally

enforceable right to offset the recognised amounts and there is an intention to settle on a net basis, or realise the asset and settle the

liability simultaneously (‘the offset criteria’).

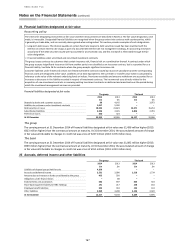

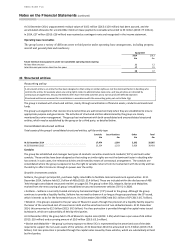

Gross

amounts of

recognised

financial

instruments

Gross

amounts

offset in the

balance

sheet

Amounts

presented

in the

balance

sheet

Amounts not offset in the

balance sheet

Net

amount

Financial

instruments

1

Cash

collateral

received/

pledged

£m

£m

£m

£m

£m

£m

Financial assets

Derivatives2

333,906

(146,170)

187,736

(150,460)

(23,672)

13,604

Reverse repurchase, securities borrowing and

similar agreements

88,338

(40,812)

47,526

(47,368)

(158)

–

Classified as:

– trading assets

5,831

(250)

5,581

(5,581)

–

–

– non-trading assets

82,507

(40,562)

41,945

(41,787)

(158)

–

Loans and advances to customers at

amortised cost

61,912

(22,182)

39,730

(35,920)

–

3,810

At 31 December 2014

484,156

(209,164)

274,992

(233,748)

(23,830)

17,414

Financial liabilities

Derivatives2

334,448

(146,170)

188,278

(151,340)

(23,581)

13,357

Repurchase, securities lending and similar

agreements

78,121

(40,812)

37,309

(37,244)

(65)

–

Classified as:

– trading liabilities

14,206

(250)

13,956

(13,956)

–

–

– non-trading liabilities

63,915

(40,562)

23,353

(23,288)

(65)

–

Customer accounts at amortised cost

66,217

(22,182)

44,035

(35,920)

–

8,115

At 31 December 2014

478,786

(209,164)

269,622

(224,504)

(23,646)

21,472

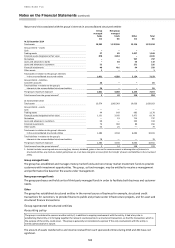

Financial assets

Derivatives2

293,359

(156,120)

137,239

(96,018)

(16,913)

24,308

Reverse repurchase, securities borrowing and

similar agreements

115,261

(41,888)

73,373

(73,337)

(33)

3

Classified as:

– trading assets

23,082

(11,234)

11,848

(11,848)

–

–

– non-trading assets

92,179

(30,654)

61,525

(61,489)

(33)

3

Loans and advances to customers at

amortised cost

111,695

(54,236)

57,459

(54,076)

–

3,383

At 31 December 2013

520,315

(252,244)

268,071

(223,431)

(16,946)

27,694

Financial liabilities

Derivatives2

293,472

(156,120)

137,352

(96,462)

(14,610)

26,280

Repurchase, securities lending and similar

agreements

123,823

(41,888)

81,935

(81,886)

(49)

–

Classified as:

– trading liabilities

27,596

(11,234)

16,362

(16,362)

–

–

– non-trading liabilities

96,227

(30,654)

65,573

(65,524)

(49)

–

Customer accounts at amortised cost

115,739

(54,236)

61,503

(54,076)

–

7,427

At 31 December 2013

533,034

(252,244)

280,790

(232,424)

(14,659)

33,707

1 Including non-cash collateral.

2 Including amounts that are both subject to and not subject to enforceable master netting agreements and similar agreements.