HSBC 2014 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Notes on the Financial Statements (continued)

138

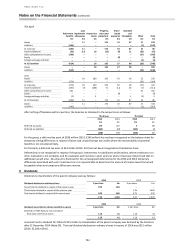

outcomes must be considered. In addition, the value of some products is dependent on more than one market factor, and in these

cases it will typically be necessary to consider how movements in one market factor may affect the other market factors. The model

inputs necessary to perform such calculations include interest rate yield curves, exchange rates, volatilities, correlations, prepayment

and default rates. For interest rate derivatives with collateralised counterparties and in significant currencies, HSBC uses a discounting

curve that reflects the overnight interest rate (‘OIS’).

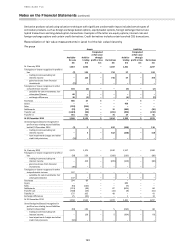

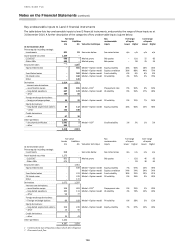

The majority of valuation techniques employ only observable market data. However, certain financial instruments are valued on the

basis of valuation techniques that feature one or more significant market inputs that are unobservable, and for them the

measurement of fair value is more judgemental. An instrument in its entirety is classified as valued using significant unobservable

inputs if, in the opinion of management, a significant proportion of the instrument’s inception profit or greater than 5% of the

instrument’s valuation is driven by unobservable inputs. ‘Unobservable’ in this context means that there is little or no current market

data available from which to determine the price at which an arm’s length transaction would be likely to occur. It generally does not

mean that there is no data available at all upon which to base a determination of fair value (consensus pricing data may, for example,

be used).

Control framework

Fair values are subject to a control framework designed to ensure that they are either determined, or validated, by a

function independent of the risk-taker.

For all financial instruments where fair values are determined by reference to externally quoted prices or observable

pricing inputs to models, independent price determination or validation is utilised. In inactive markets, direct observation

of a traded price may not be possible. In these circumstances, the group will source alternative market information to

validate the financial instrument’s fair value, with greater weight given to information that is considered to be more

relevant and reliable. The factors that are considered in this regard are, inter alia:

• the extent to which prices may be expected to represent genuine traded or tradable prices;

• the degree of similarity between financial instruments;

• the degree of consistency between different sources;

• the process followed by the pricing provider to derive the data;

• the elapsed time between the date to which the market data relates and the balance sheet date; and

• the manner in which the data was sourced.

For fair values determined using a valuation model, the control framework may include, as applicable, development or

validation by independent support functions of (i) the logic within valuation models; (ii) the inputs to those models;

(iii) any adjustments required outside the valuation models; and, where possible, (iv) model outputs. Valuation models

are subject to a process of due diligence and calibration before becoming data on an ongoing basis.

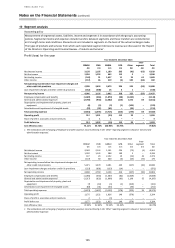

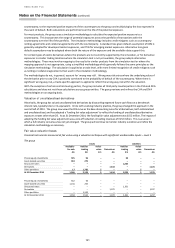

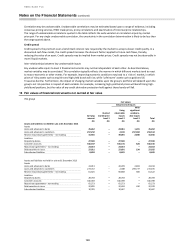

Financial liabilities measured at fair value

In certain circumstances, the group records its own debt in issue at fair value, based on quoted prices in an active market

for the specific instrument concerned, where available. An example of this is where own debt in issue is hedged with

interest rate derivatives. When quoted market prices are unavailable, the own debt in issue is valued using valuation

techniques, the inputs for which are either based upon quoted prices in an inactive market for the instrument, or are

estimated by comparison with quoted prices in an active market for similar instruments. In both cases, the fair value

includes the effect of applying the credit spread which is appropriate to the group’s liability. The change in fair value of

issued debt securities attributable to the group’s own credit spread is computed as follows: for each security at each

reporting date, an externally verifiable price is obtained or a price is derived using credit spreads for similar securities for

the same issuer. Then, using discounted cash flow, each security is valued using a LIBOR-based discount curve. The

difference in the valuations is attributable to the group’s own credit spread. This methodology is applied consistently

across all securities.

Structured notes issued and certain other hybrid instrument liabilities are included within trading liabilities and are

measured at fair value. The credit spread applied to these instruments is derived from the spreads at which the group

issues structured notes.

Gains and losses arising from changes in the credit spread of liabilities issued by the group reverse over the contractual

life of the debt, provided that the debt is not repaid at a premium or a discount.

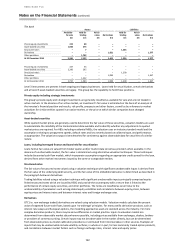

Changes in fair value are generally subject to a profit and loss analysis process. This process disaggregates changes in fair

value into three high level categories; (i) portfolio changes, such as new transactions or maturing transactions, (ii) market

movements, such as changes in foreign exchange rates or equity prices, and (iii) other, such as changes in fair value

adjustments, discussed below.

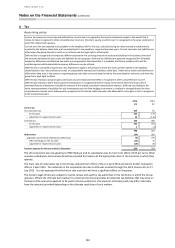

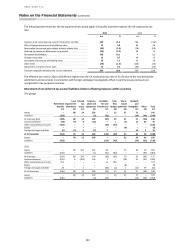

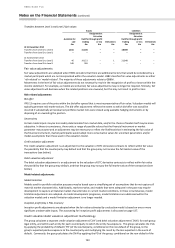

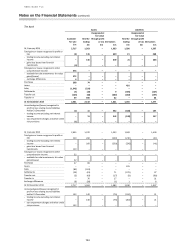

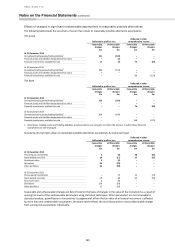

Fair value hierarchy

Fair values are determined according to the following hierarchy:

• Level 1 – quoted market price: financial instruments with quoted prices for identical instruments in active markets.

• Level 2 – valuation technique using observable inputs: financial instruments with quoted prices for similar instruments

in active markets or quoted prices for identical or similar instruments in inactive markets and financial instruments

valued using models where all significant inputs are observable.

• Level 3 – valuation technique with significant unobservable inputs: financial instruments valued using models where

one or more significant inputs are unobservable.