HSBC 2014 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Notes on the Financial Statements (continued)

122

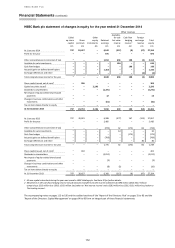

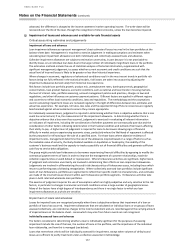

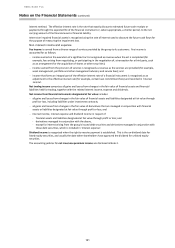

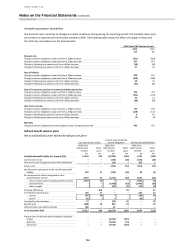

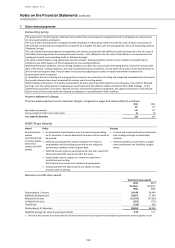

2 Net insurance premium income

Accounting policy

Premiums for life insurance contracts are accounted for when receivable, except in unit-linked insurance contracts where premiums

are accounted for when liabilities are established.

Reinsurance premiums are accounted for in the same accounting period as the premiums for the direct insurance contracts to which

they relate.

Net earned insurance premium income

Non-linked

Insurance

1

Linked life

insurance

Investment

contracts with

DPF

2

features

Total

£m

£m

£m

£m

Gross insurance premium income

262

183

1,498

1,943

Reinsurers’ share of gross premium income

(116)

(4)

–

(120)

Year ended 31 December 2014

146

179

1,498

1,823

Gross insurance premium income

310

314

1,526

2,150

Reinsurers’ share of gross premium income

(124)

(4)

–

(128)

Year ended 31 December 2013

186

310

1,526

2,022

1 Includes non-life insurance.

2 Discretionary participation features.

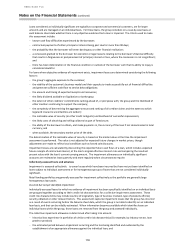

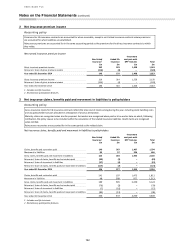

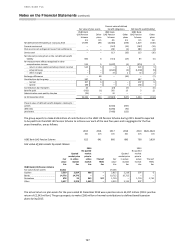

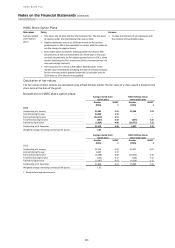

3 Net insurance claims, benefits paid and movement in liabilities to policyholders

Accounting policy

Gross insurance claims for life insurance contracts reflect the total cost of claims arising during the year, including claim handling costs

and any policyholder bonuses allocated in anticipation of a bonus declaration.

Maturity claims are recognised when due for payment. Surrenders are recognised when paid or at an earlier date on which, following

notification, the policy ceases to be included within the calculation of the related insurance liabilities. Death claims are recognised

when notified.

Reinsurance recoveries are accounted for in the same period as the related claim.

Net insurance claims, benefits paid and movement in liabilities to policyholders

Non-linked

Insurance

1

Linked life

Insurance

Investment

contracts with

DPF

2

features

Total

£m

£m

£m

£m

Claims, benefits and surrenders paid

140

247

1,407

1,794

Movement in liabilities

83

37

526

646

Gross claims, benefits paid and movement in liabilities

223

284

1,933

2,440

Reinsurers’ share of claims, benefits and surrenders paid

(80)

(3)

–

(83)

Reinsurers’ share of movement in liabilities

(37)

(4)

–

(41)

Reinsurers’ share of claims, benefits paid and movement in liabilities

(117)

(7)

–

(124)

Year ended 31 December 2014

106

277

1,933

2,316

Claims, benefits and surrenders paid

141

197

1,473

1,811

Movement in liabilities

48

388

877

1,313

Gross claims, benefits paid and movement in liabilities

189

585

2,350

3,124

Reinsurers’ share of claims, benefits and surrenders paid

(76)

(3)

–

(79)

Reinsurers’ share of movement in liabilities

(7)

(10)

–

(17)

Reinsurers’ share of claims, benefits paid and movement in liabilities

(83)

(13)

–

(96)

Year ended 31 December 2013

106

572

2,350

3,028

1 Includes non-life insurance.

2 Discretionary participation features.