HSBC 2014 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Report of the Directors: Risk (continued)

68

rate swaps, to more sophisticated hedging strategies to

address a combination of risk factors arising at portfolio

level.

Market risk governance

(Audited)

Market risk is managed and controlled through limits

approved by the RMM of the Group Management Board

(‘GMB’) for HSBC Holdings and the global businesses.

These limits are allocated across business lines and

agreed with the Group’s legal entities, including HSBC

Bank plc.

The management of market risk is principally undertaken

in Markets using risk limits allocated from the risk

appetite, which is subject to the Group RMM ratification.

Limits are set for portfolios, products and risk types, with

market liquidity being a primary factor in determining

the level of limits set.

Group Risk, as an independent, is responsible for HSBC’s

market risk management policies and measurement

techniques. Each major operating entity has an

independent market risk management and control

function which is responsible for measuring market risk

exposures in accordance with the policies defined by

Group Risk, and monitoring and reporting these

exposures against the prescribed limits on a daily basis.

Each operating entity is required to assess the market

risks arising on each product in its business and to

transfer them to either its local Markets unit for

management, or to separate books managed under the

supervision of the local ALCO.

The aim is to ensure that all market risks are

consolidated within operations which have the necessary

skills, tools, management and governance to manage

them professionally. In certain cases where the market

risks cannot be fully transferred, the group identifies the

impact of varying scenarios on valuations or on net

interest income resulting from any residual risk

positions.

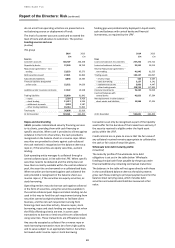

Monitoring and limiting market risk

exposure

(Audited)

Our objective is to manage and control market risk

exposures while maintaining a market profile consistent

with the group’s risk appetite.

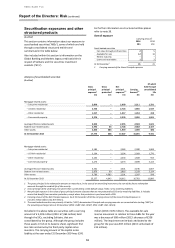

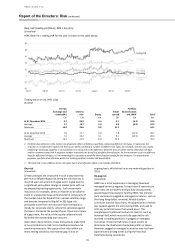

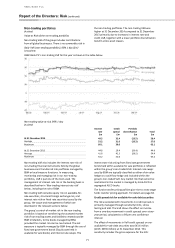

We use a range of tools to monitor and limit market risk

exposures including sensitivity analysis, value at risk

(‘VaR’), and stress testing.

Sensitivity analysis

(Unaudited)

Sensitivity analysis measures the impact of individual

market factor movements on specific instruments or

portfolios including interest rates, foreign exchange rates

and equity prices for example the impact of a one basis

point change in yield. We use sensitivity measures to

monitor the market risk positions within each risk type,

for example, the present value of a basis point

movement in interest rates for interest rate risk.

Sensitivity limits are set for portfolios, products and risk

types, with the depth of the market being one of the

principal factors in determining the level of limits set.

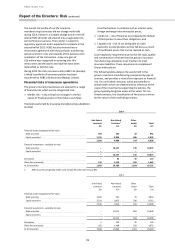

Value at risk

(Audited)

Value at Risk (‘VaR’) is a technique that estimates the

potential losses on risk positions as a result of

movements in market rates and prices over a specified

time horizon and to a given level of confidence. The use

of VaR is integrated into market risk management and is

calculated for all trading positions regardless of how the

group capitalises those exposures. Where there is not an

approved internal model, the group uses the appropriate

local rules to capitalise exposures.

In addition, the group calculates VaR for non-trading

portfolios in order to have a complete picture of risk. The

models are predominantly based on historical

simulation. VaR is calculated at a 99 per cent confidence

level for a one-day holding period. Where VaR is not

calculated explicitly, alternative tools are used.

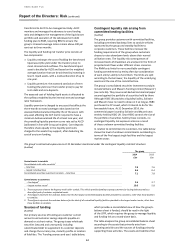

The VaR models used by us are based predominantly on

historical simulation. These models derive plausible

future scenarios from past series of recorded market

rates and prices, taking into account inter-relationships

between different markets and rates such as interest

rates and foreign exchange rates. The models also

incorporate the effect of option features on the

underlying exposures.

The historical simulation models used incorporate the

following features:

• historical market rates and prices are calculated with

reference to foreign exchange rates and commodity

prices, interest rates, equity prices and the associated

volatilities;

• potential market movements utilised for VaR are

calculated with reference to data from the past two

years; and

• VaR measures are calculated to a 99 per cent

confidence level and use a one-day holding period.

The nature of the VaR models means that an increase in

observed market volatility will lead to an increase in VaR

without any changes in the underlying positions.

The group routinely validates the accuracy of the VAR

models by back-testing the hypothetical daily profit and

loss results, adjusted to remove non-modelled items

such as fees and commissions, against the corresponding

VaR numbers. The expectation is, on average, to see

losses in excess of VAR 1 per cent of the time over a one-

year period.

The actual number of losses in excess of VAR over this

period can therefore be used to gauge how well the

models are performing. In 2014, there were two loss

exceptions for the group (unaudited).