HSBC 2014 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Notes on the Financial Statements (continued)

123

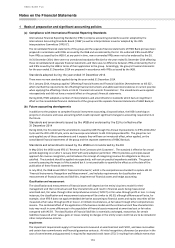

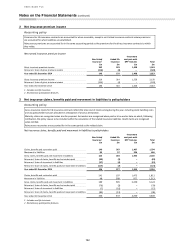

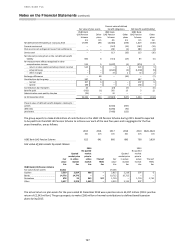

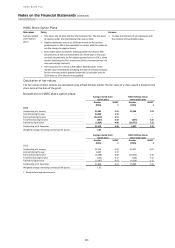

4 Operating profit

Operating profit is stated after the following items of income, expense, gains and losses, and loan impairment charges and

other credit risk provisions:

2014

2013

£m

£m

Income

Interest recognised on impaired financial assets

70

47

Fees earned on financial assets or liabilities not held for trading nor designated at fair value, other than fees

included in effective interest rate calculations on these types of assets and liabilities

2,822

3,043

Fees earned on trust and other fiduciary activities where the group holds or invests assets on behalf of its

customers

680

703

Expense

Interest on financial instruments, excluding interest on financial liabilities held for trading or designated at

fair value

2,508

2,714

Fees payable on financial assets or liabilities not held for trading nor designated at fair value, other than

fees included in effective interest rate calculations on these types of assets and liabilities

523

511

Fees payable on trust and other fiduciary activities where the group holds or invests assets on behalf of its

customers

1

1

Payments under lease and sublease agreements

174

186

Minimum lease payments

172

184

Contingent rents and sublease payments

2

2

Gains/(losses)

Impairment of available-for-sale equity shares

(26)

(36)

Gains on disposal or settlement of loans and advances

–

3

Gains/(losses) on financial liabilities measured at amortised cost

60

(5)

Losses recognised on assets held for sale

(8)

–

Gains/(losses) on disposal of property, plant and equipment, intangible assets and non-financial

investments

11

(7)

Loan impairment charges and other credit risk provisions

(449)

(971)

Net impairment charge on loans and advances

(647)

(1,102)

Net impairment of available-for-sale debt securities

203

136

Net impairment in respect of other credit risk provisions

(5)

(5)

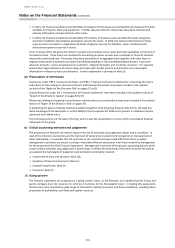

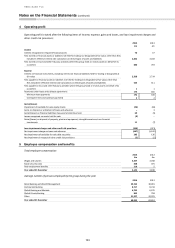

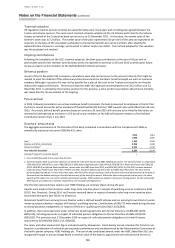

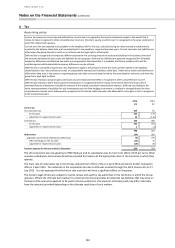

5 Employee compensation and benefits

Total employee compensation

2014

2013

£m

£m

Wages and salaries

3,357

3,358

Social security costs

468

475

Post-employment benefits

319

5

Year ended 31 December

4,144

3,838

Average number of persons employed by the group during the year

2014

2013

Retail Banking and Wealth Management

29,763

30,991

Commercial Banking

8,717

8,744

Global Banking and Markets

6,795

6,975

Global Private Banking

833

738

Other

21,927

22,376

Year ended 31 December

68,035

69,824