HSBC 2014 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Financial Statements (continued)

111

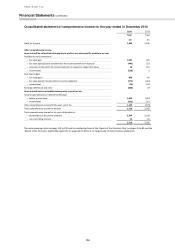

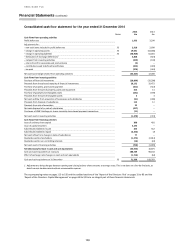

HSBC Bank plc cash flow statement for the year ended 31 December 2014

2014

2013

Notes

£m

£m

Cash flows from operating activities

Profit before tax

1,367

2,913

Adjustments for:

– non-cash items included in profit before tax

33

2,527

2,008

– change in operating assets

33

18,204

(52,222)

– change in operating liabilities

33

(43,561)

67,495

– elimination of exchange differences1

1,703

1,407

– net gain from investing activities

(433)

(117)

– contributions paid to defined benefit plans

(242)

(387)

– tax paid

(308)

(169)

Net cash (used in)/generated from operating activities

(20,743)

20,928

Cash flows from investing activities

Purchase of financial investments

(19,253)

(28,472)

Proceeds from the sale and maturity of financial investments

16,188

19,488

Purchase of property, plant and equipment

(260)

(227)

Proceeds from the sale of property, plant and equipment

401

3

Purchase of goodwill and intangible assets

(182)

(184)

Net cash outflow from acquisition of businesses and subsidiaries

(61)

(406)

Proceeds from disposal and liquidation of businesses

112

447

Net cash used in investing activities

(3,055)

(9,351)

Cash flows from financing activities

Issue of ordinary share capital

306

402

Issue of capital securities

2,196

–

Subordinated liabilities issued

–

542

Subordinated liabilities repaid

(2,203)

(542)

Net cash outflow from increase in stake of subsidiaries

(244)

(207)

Dividends paid to shareholders

(1,271)

(2,011)

Net cash used in financing activities

(1,216)

(1,816)

Net (decrease)/increase in cash and cash equivalents

(25,014)

9,761

Cash and cash equivalents at 1 January

88,017

78,661

Effect of exchange rate changes on cash and cash equivalents

(1,061)

(405)

Cash and cash equivalents at 31 December

33

61,942

88,017

1 Adjustment to bring changes between opening and closing balance sheet amounts to average rates. This is not done on a line-by-line basis, as

details cannot be determined without unreasonable expense.

The accompanying notes on pages 113 to 195 and the audited sections of the ‘Report of the Directors: Risk’ on pages 31 to 83 and the

‘Report of the Directors: Capital Management’ on pages 84 to 93 form an integral part of these financial statements.