HSBC 2014 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Strategic Report: Business Review (continued)

14

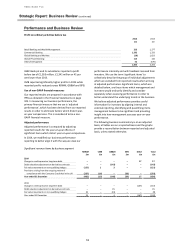

Review of business performance

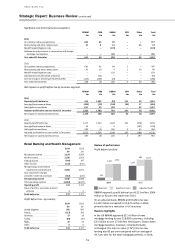

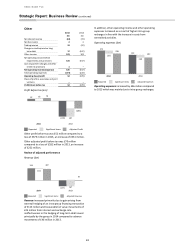

HSBC Bank plc and its subsidiary undertakings reported

profit before tax of £1,953 million, £1,341 million or 41

per cent lower than 2013.

The decrease in profit before tax was primarily due to a

number of significant items including provisions arising

from the on-going review of compliance with the

Consumer Credit Act (‘CCA’) in the UK and settlements

and provisions in connection with foreign exchange

investigations. In addition, there was a reduction in

Markets revenues in GB&M and lower insurance

revenues in RBWM.

Progress continues to be made in streamlining our

processes and procedures. This is designed to reduce

complexity and lower costs in a sustainable way. Total

restructuring costs of £72 million were incurred as a

result of streamlining these businesses and other

initiatives which delivered sustainable cost savings of

approximately £312 million.

In RBWM we expanded our mortgage distribution

channels to include a specific intermediary, in order to

reach the growing proportion of the mortgage market in

the UK that wish to source its finance through

intermediaries. In France, we continued to experience

strong growth in home loans. In Turkey, the regulator

imposed interest rates caps on overdrafts and credit

cards which affected revenue.

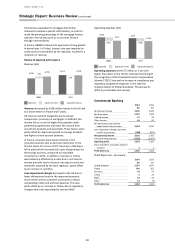

In CMB, overall UK lending, both new lending and re-

financing, continued to grow compared to 2013. In

addition, Business Banking launched a campaign to offer

further support and lending to SME customers. Lending

in Global Trade and Receivables Finance also grew. In

France, the Payments and Cash Management business

implemented the Single Euro Payments Area platform

(‘SEPA’) for euro-denominated credit transfer and direct

debit payments across European locations. In addition,

following the success of the SME fund in 2013, CMB

allocated a further fund to support customers seeking

international growth.

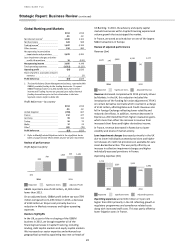

In GB&M, as part of the re-shaping of the business in

2013, we brought together all our financing businesses in

Capital Financing in the UK. We increased our sector

expertise and enhanced our geographic spread by

appointing two new co-heads of UK Banking. In 2014, the

advisory and equity capital markets businesses within

Capital Financing experienced volume growth that

outstripped the market. In France, GB&M acted as sole

advisor on one of the largest M&A transactions in

Europe.

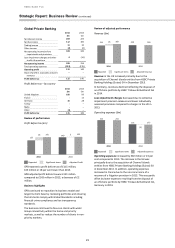

GPB continued to reposition its business model and

focus its client base by reviewing portfolios and ensuring

that all clients comply with Global Standards including

financial crime compliance and tax transparency

standards.The business continued to focus on clients

with wider Group connectivity within the home and

priority markets, as well as reducing the number of

clients in non-priority markets.

Items which are significant in a comparison of 2014

results to 2013 have been summarised on pages 18 to

19.

Net interest income decreased by £332 million or 5 per

cent. The decrease was primarily due to provisions of

£379 million arising from the on-going review of

compliance with the CCA in 2014. Excluding this, net

interest income increased by £47 million mainly due to

increased spreads in term lending and growth in deposit

volumes in Payments and Cash Management in the UK.

Net fee income decreased by £70 million or 2 per cent. In

RBWM the reduction in fee income in the UK was due to

a higher level of fees payable under partnership

agreements as well as lower overdrafts and investment

fees. This was partially offset by an increase in GB&M

due to lower fees paid to HSBC entities in other regions

relating to reduced Foreign Exchange trading activities

undertaken on behalf of their clients.

Trading income decreased by £764 million or 32 per

cent. The reduction includes a number of significant

items including negative fair value adjustments on non-

qualifying hedges in our French home loan portfolio in

RBWM of £155 million and an adverse movement in the

derivatives debit valuation adjustment (‘DVA’) of

£143 million in GB&M. Excluding this, net trading

revenue decreased in GB&M primarily driven by

Markets. This included the introduction of the funding

fair value adjustment (‘FFVA’) on certain derivative

contracts which resulted in a charge of £152 million

affecting Rates and Credit.

Revenues also fell in Foreign Exchange reflecting lower

volatility and reduced client flows. In addition, revenue

decreased in Equities as 2013 benefited from higher

revaluation gains, which more than offset the increase in

revenue from increased client flows and higher

derivatives income.

This decrease was partially offset by favourable foreign

exchange movements on trading assets held as

economic hedges against issued foreign currency debt

designated at fair value, compared to 2013. These offset

adverse foreign exchange movements on the foreign

currency debt reported in “Net income from financial

instruments designated at fair value”.

Net income from financial instruments designated at fair

value decreased by £529 million compared to 2013. Of

this, £296 million was due to adverse foreign exchange

movements on economically hedged foreign currency

debt in GB&M. In addition, income arising from financial

assets held to meet liabilities under insurance and

investment contracts decreased reflecting lower net

investment returns in 2014 compared to 2013. These

returns reflected weaker equity market movements in

the UK and France.

This was partially offset by favourable credit spread-

related movements in the fair value of the group’s own

long-term debt of £17 million compared to adverse fair

value movements of £167 million in 2013.

Gains less losses from financial investments increased by

£221 million, primarily due to higher net disposal gains in

the legacy portfolio partly offset by lower available-for-

sale gains in GB&M Balance Sheet Management, notably

in the UK.

Net insurance premium income decreased by £199

million or 10 per cent. This was mainly as a result of

lower volumes following the run-off of business from