HSBC 2014 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Notes on the Financial Statements (continued)

137

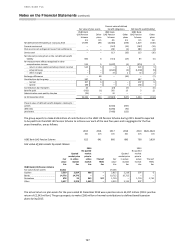

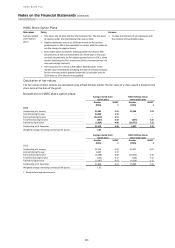

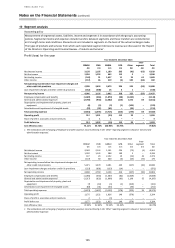

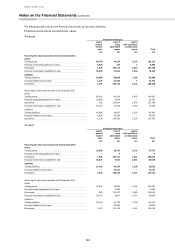

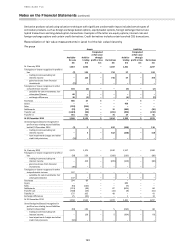

11 Trading assets

Accounting policy

Financial assets are classified as held for trading if they have been acquired principally for the purpose of selling in the near term, or

form part of a portfolio of identified financial instruments that are managed together and for which there is evidence of a recent

pattern of short-term profit-taking. They are recognised on trade date, when the group enters into contractual arrangements with

counterparties and are normally derecognised when sold. They are initially measured at fair value, with transaction costs taken to the

income statement. Subsequent changes in their fair value are recognised in the income statement in ‘Net trading income’.

For trading assets, the interest is shown in ‘Net trading income’.

Trading assets

The group

The bank

2014

2013

2014

2013

£m

£m

£m

£m

Trading assets:

– which may be repledged or resold by counterparties

24,182

53,174

9,555

31,232

– not subject to repledge or resale by counterparties

105,945

80,923

88,202

70,055

130,127

134,097

97,757

101,287

Treasury and other eligible bills

653

2,623

154

643

Debt securities

49,996

56,414

25,150

28,821

Equity securities

44,242

36,007

41,899

34,422

Loans and advances to banks

15,640

16,067

13,039

16,568

Loans and advances to customers

19,596

22,986

17,515

20,833

130,127

134,097

97,757

101,287

1 Included within the above figures for the group are debt securities issued by banks and other financial institutions of £11,278 million (2013:

£12,062 million), of which £1,857 million (2013: £2,382 million) are guaranteed by various governments.

2 Included within the above figures for the bank are debt securities issued by banks and other financial institutions of £7,228 million (2013:

£6,456 million), of which nil (2013: nil) are guaranteed by governments.

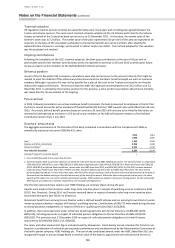

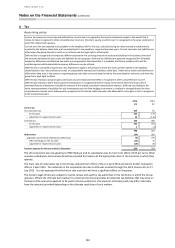

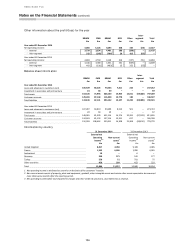

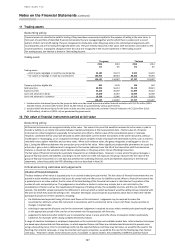

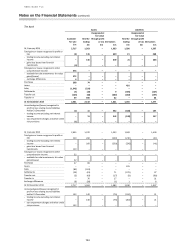

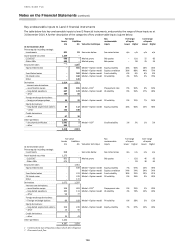

12 Fair value of financial instruments carried at fair value

Accounting policy

All financial instruments are recognised initially at fair value. Fair value is the price that would be received to sell an asset or paid to

transfer a liability in an orderly transaction between market participants at the measurement date. The fair value of a financial

instrument on initial recognition is generally its transaction price (that is, the fair value of the consideration given or received).

However, sometimes the fair value will be based on other observable current market transactions in the same instrument, without

modification or repackaging, or on a valuation technique whose variables include only data from observable markets, such as interest

rate yield curves, option volatilities and currency rates. When such evidence exists, the group recognises a trading gain or loss on

day 1, being the difference between the transaction price and the fair value. When significant unobservable parameters are used, the

entire day 1 gain or loss is deferred and is recognised in the income statement over the life of the transaction until the transaction

matures, is closed out, the valuation inputs become observable, or the group enters into an offsetting transaction.

The fair value of financial instruments is generally measured on an individual basis. However, in cases where the group manages a

group of financial assets and liabilities according to its net market or credit risk exposure, the group measures the fair value of the

group of financial instruments on a net basis but presents the underlying financial assets and liabilities separately in the financial

statements, unless they satisfy the IFRS offsetting criteria as described in Note 30.

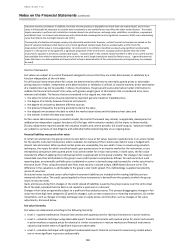

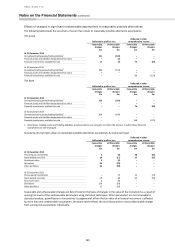

Critical accounting estimates and judgements

Valuation of financial instruments

The best evidence of fair value is a quoted price in an actively traded principal market. The fair values of financial instruments that are

quoted in active markets are based on bid prices for assets held and offer prices for liabilities issued. Where a financial instrument has

a quoted price in an active market, the fair value of the total holding of the financial instrument is calculated as the product of the

number of units and quoted price. The judgement as to whether a market is active may include, but is not restricted to, the

consideration of factors such as the magnitude and frequency of trading activity, the availability of prices and the size of bid/offer

spreads. The bid/offer spread represents the difference in prices at which a market participant would be willing to buy compared with

the price at which they would be willing to sell. Valuation techniques may incorporate assumptions about factors that other market

participants would use in their valuations, including:

• the likelihood and expected timing of future cash flows on the instrument. Judgement may be required to assess the

counterparty’s ability to service the instrument in accordance with its contractual terms. Future cash flows may be sensitive to

changes in market rates;

• selecting an appropriate discount rate for the instrument: Judgement is required to assess what a market participant would regard

as the appropriate spread of the rate for an instrument over the appropriate risk-free rate;

• judgement to determine what model to use to calculate fair value in areas where the choice of valuation model is particularly

subjective, for example, when valuing complex derivative products.

A range of valuation techniques is employed, dependent on the instrument type and available market data. Most valuation techniques

are based upon discounted cash flow analyses, in which expected future cash flows are calculated and discounted to present value

using a discounting curve. Prior to considering credit risk, the expected future cash flows may be known, as would be the case for the

fixed leg of an interest rate swap, or may be uncertain and require projection, as would be the case for the floating leg of an interest

rate swap. ‘Projection’ utilises market forward curves, if available. In option models, the probability of different potential future