HSBC 2014 Annual Report Download - page 177

Download and view the complete annual report

Please find page 177 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Notes on the Financial Statements (continued)

175

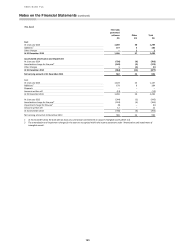

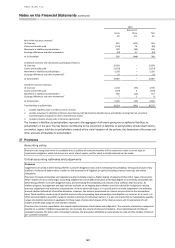

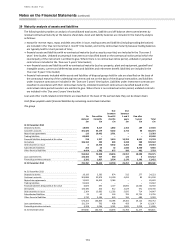

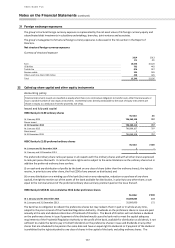

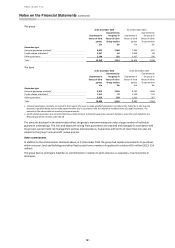

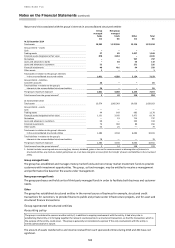

At 31 December 2013

Due within

one year

Due after more

than one year

Total

£m

£m

£m

Assets

Financial assets designated at fair value

734

15,927

16,661

Loans and advances to banks

19,531

3,482

23,013

Loans and advances to customers

116,400

157,322

273,722

Reverse repurchase agreements – non trading

60,811

714

61,525

Financial investments

10,484

64,546

75,030

Other financial assets

4,899

128

5,027

At 31 December 2013

212,859

242,119

454,978

Liabilities

Deposits by banks

27,998

771

28,769

Customer accounts

342,317

4,041

346,358

Reverse repurchase agreements – non trading

65,573

-

65,573

Financial liabilities designated at fair value

4,045

29,991

34,036

Debt securities in issue

26,394

6,501

32,895

Other financial liabilities

4,629

782

5,411

Subordinated liabilities

80

10,705

10,785

At 31 December 2013

471,036

52,791

523,827

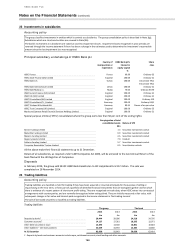

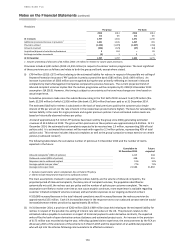

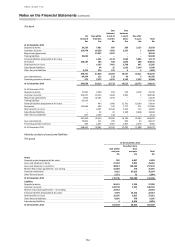

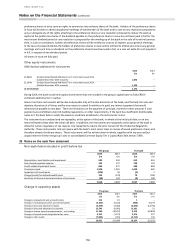

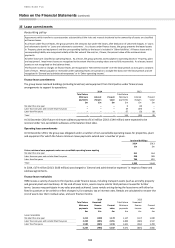

The bank

At 31 December 2014

Due within

one year

Due after more

than one year

Total

£m

£m

£m

Assets

Financial assets designated at fair value

9

–

9

Loans and advances to banks

16,464

2,312

18,776

Loans and advances to customers

77,945

123,726

201,671

Reverse repurchase agreements – non trading

36,391

–

36,391

Financial investments

14,239

34,199

48,438

Other financial assets

5,093

12

5,105

At 31 December 2014

150,141

160,249

310,390

Liabilities

Deposits by banks

27,843

3,540

31,383

Customer accounts

280,361

2,326

282,687

Reverse repurchase agreements – non trading

18,293

–

18,293

Financial liabilities designated at fair value

3,195

12,932

16,127

Debt securities in issue

11,578

3,372

14,950

Other financial liabilities

3,479

11

3,490

Subordinated liabilities

–

7,854

7,854

At 31 December 2014

344,749

30,035

374,784

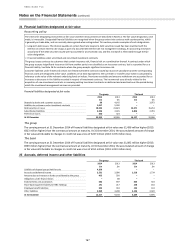

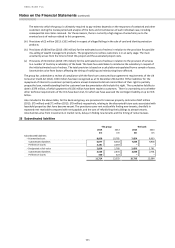

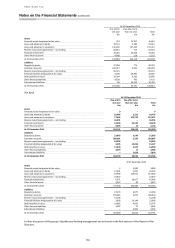

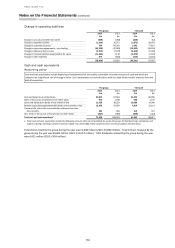

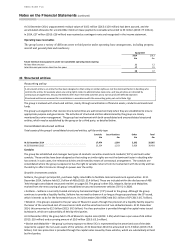

At 31 December 2013

Assets

Financial assets designated at fair value

2

3,981

3,983

Loans and advances to banks

14,501

1,831

16,332

Loans and advances to customers

97,990

119,577

217,567

Reverse repurchase agreements – non trading

47,847

-

47,847

Financial investments

6,571

38,477

45,048

Other financial assets

3,637

20

3,657

At 31 December 2013

170,548

163,886

334,434

Liabilities

Deposits by banks

27,479

4,977

32,456

Customer accounts

276,683

4,257

280,940

Reverse repurchase agreements – non trading

51,198

-

51,198

Financial liabilities designated at fair value

1,858

20,148

22,006

Debt securities in issue

14,885

4,691

19,576

Other financial liabilities

3,587

75

3,662

Subordinated liabilities

–

9,903

9,903

At 31 December 2013

375,690

44,051

419,741

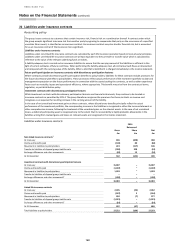

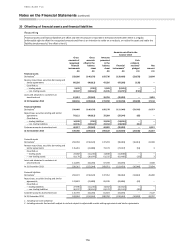

Further discussion of the group’s liquidity and funding management can be found in the Risk section of the Report of the

Directors.