HSBC 2014 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Report of the Directors: Risk (continued)

37

Credit risk

Credit risk is the risk of financial loss if a customer or

counterparty fails to meet a payment obligation under a

contract. It arises principally from direct lending, trade

finance and leasing business, but also from off-balance

sheet products such as guarantees and credit derivatives,

and from the group’s holdings of debt securities.

There were no material changes to our policies and

practices for the management of credit risk in 2014.

This year we have redesigned the credit risk section in

order to enhance clarity and reduce duplication. It now

begins with an overview of our credit risk policies

followed by an overview of our gross exposures. We

describe various measures of credit quality such as past

due status, renegotiated loans and impaired loans before

analysing impairment allowances. There are specific

sections on wholesale lending and personal lending

where additional detail is provided and we cover areas of

special interest such as our exposure to commercial real

estate in wholesale lending. This is followed by a section

describing our securitisation exposures and other

structured products.

Following the change in balance sheet presentation

explained on page 155, non-trading reverse repos are

shown separately on the balance sheet and are no longer

included in ‘Loans and advances to customers’ and

‘Loans and advances to banks’. Comparative data have

been re-presented accordingly. As a result, any analysis

that references loans and advances to customers or

banks excludes non-trading reverse repos. The amount

of the non-trading reverse repos to customers and banks

is set out on page 55.

Credit Risk Management

(Audited)

Of the risks in which we engage, credit risk generates the

largest regulatory capital requirements.

The principal objectives of our credit risk management

are:

• to maintain across the group a strong culture of

responsible lending and a robust risk policy and

control framework;

• to both partner and challenge Global Businesses in

defining, implementing, and continually re-evaluating

our risk appetite under actual and scenario

conditions; and

• to ensure there is independent, expert scrutiny of

credit risks, their costs and mitigation.

Within the bank, the Credit Risk function is headed by

the European Chief Risk Officer and reports to the Chief

Executive Officer, with a functional reporting line to the

Group Chief Risk Officer. Its responsibilities include:

• formulating credit policy. Compliance, subject to

approved dispensations, is mandatory for all

operating companies which must develop local credit

policies consistent with group policies that very

closely reflect Group policy;

• guiding operating companies on the group’s appetite

for credit risk exposure to specified market sectors,

activities and banking products and controlling

exposures to certain higher-risk sectors;

• undertaking an independent review and objective

assessment of risk. Credit risk assesses all commercial

non-bank credit facilities and exposures over

designated limits, prior to the facilities being

committed to customers or transactions being

undertaken;

• monitoring the performance and management of

portfolios across the group;

• controlling exposure to sovereign entities, banks and

other financial institutions, as well as debt securities

which are not held solely for the purpose of trading;

• setting policy on large credit exposures, ensuring that

concentrations of exposure by counterparty, sector or

geography do not become excessive in relation to the

group’s capital base, and remain within internal and

regulatory limits;

• maintaining and developing the group’s risk rating

framework and systems through the Regional Model

Oversight Committees (‘RMOC’), which report to the

Risk Management Meeting (‘RMM’) and oversees risk

rating system governance for both wholesale and

retail businesses;

• reporting on retail portfolio performance, high risk

portfolios, risk concentrations, large impaired

accounts, impairment allowances and stress testing

results and recommendations to the group’s RMM,

the group’s Risk Committee and the Board; and

• acting on behalf of the group as the primary interface,

for credit-related issues, with the Bank of England,

the PRA, local regulators, rating agencies, analysts

and counterparts in major banks and non-bank

financial institutions.

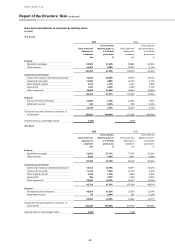

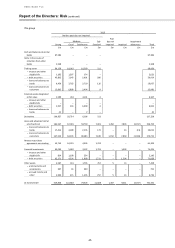

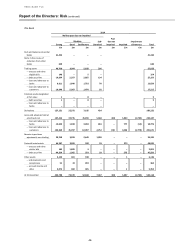

Credit quality of financial instruments

(Audited)

Our credit risk rating systems and processes differentiate

exposures in order to highlight those with greater risk

factors and higher potential severity of loss. In the case

of individually significant accounts, risk ratings are

reviewed regularly and any amendments are

implemented promptly. Within the group’s retail

business, risk is assessed and managed using a wide

range of risk and pricing models to generate portfolio

data.

Our risk rating system facilitates the internal ratings-

based (‘IRB’) created under Basel 2 (and as updated in

Basel 3) adopted by the Group to support calculation of

the minimum credit regulatory capital requirement. For

further details, see ‘Credit quality classification of

financial instruments’ on page 43.

Special attention is paid to problem exposures in order

to accelerate remedial action. Where appropriate,

operating companies use specialist units to provide

customers with support in order to help them avoid

default wherever possible.

The Credit Review and Risk Identification team reviews

the robustness and effectiveness of key management,

monitoring and control activities.