HSBC 2014 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Financial Statements

105

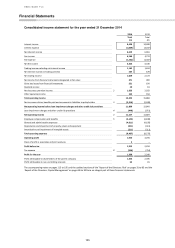

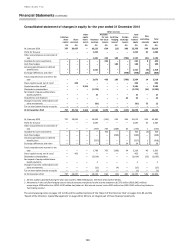

Consolidated income statement for the year ended 31 December 2014

2014

2013

Total

Total

£m

£m

Interest income

9,438

10,008

Interest expense

(2,809)

(3,047)

Net interest income

6,629

6,961

Fee income

4,568

4,723

Fee expense

(1,302)

(1,387)

Net fee income

3,266

3,336

Trading income excluding net interest income

1,142

1,694

Net interest income on trading activities

467

679

Net trading income

1,609

2,373

Net income from financial instruments designated at fair value

371

900

Gains less losses from financial investments

321

100

Dividend income

20

18

Net insurance premium income

2

1,823

2,022

Other operating income

163

158

Total operating income

14,202

15,868

Net insurance claims, benefits paid and movement in liabilities to policyholders

3

(2,316)

(3,028)

Net operating income before loan impairment charges and other credit risk provisions

11,886

12,840

4

Loan impairment charges and other credit risk provisions

4

(449)

(971)

Net operating income

4

11,437

11,869

Employee compensation and benefits

5

(4,144)

(3,838)

General and administrative expenses

(4,811)

(4,195)

Depreciation and impairment of property, plant and equipment

(321)

(331)

Amortisation and impairment of intangible assets

(211)

(211)

Total operating expenses

(9,487)

(8,575)

Operating profit

1,950

3,294

Share of profit in associates and joint ventures

3

–

Profit before tax

1,953

3,294

Tax expense

8

(564)

(754)

Profit for the year

1,389

2,540

Profit attributable to shareholders of the parent company

1,354

2,495

Profit attributable to non-controlling interests

35

45

The accompanying notes on pages 113 to 195 and the audited sections of the ‘Report of the Directors: Risk’ on pages 31 to 83 and the

‘Report of the Directors: Capital Management’ on pages 84 to 93 form an integral part of these financial statements.