HSBC 2014 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK PLC

Strategic Report: Business Review (continued)

17

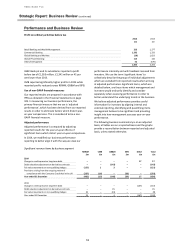

Other assets increased by 27 per cent due to the

reclassification of the UK pension insurance business as

‘Held for sale’, the transfer of the precious metal

business to the bank and an increase in the surplus of

the defined benefit scheme.

Liabilities

Deposits by banks decreased by 4 per cent, reflecting a

decrease in money market balances across a number of

banks.

Customer accounts remained stable year-on-year.

Growth in the Payments and Cash Management business

and a rise in RBWM balances reflecting customers’

continued preference for holding balances in current and

savings accounts was offset by the reduction in deposit

balances which were previously subject to net interest

arrangements.

Repurchase agreements – non trading decreased by 64

per cent. This reflected maturing repo positions that

were not replaced due to lower funding requirements

and a higher number of repo trades eligible for netting.

Trading liabilities decreased by 10 per cent due to a

reduction in net short bond and stock lending positions

and maturing repo held for trading positions.

Financial liabilities designated at fair value decreased by

34 per cent predominately due to the reclassification of

the UK pension insurance business as ‘Held for sale’

reported as part of ‘Other liabilities’. In addition, as

aforementioned, the termination and derecognition of

back-to-back structured trades led to a decline in the

amount of financial liabilities designated at fair value.

The derivative businesses are managed within market

risk limits and the increase in the value of ‘Derivative

liabilities’ broadly matched that of ‘Derivative assets’.

Debt securities in issue decreased by 15 per cent due to

net redemptions of debt securities in issue.

Liabilities under insurance contracts decreased by 9 per

cent as a result of the agreed sale of the UK pension

insurance business.

Other liabilities increased by 7 per cent predominantly

due to the reclassification of the UK pension insurance

business as ‘Held for sale’ partially offset by net

redemptions of subordinated liabilities.

Equity

Total shareholders’ equity increased by 11 per cent

principally due to the issuance of new tier 1 capital

instruments during the year, as well as increases in

retained earnings.