HSBC 2014 Annual Report Download

Download and view the complete annual report

Please find the complete 2014 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC Bank plc

Annual Report and Accounts 2014

Table of contents

-

Page 1

HSBC Bank plc Annual Report and Accounts 2014 -

Page 2

...Strategic priorities Strategic direction Key performance indicators Business review Economic background Financial summary Income Statement Presentation of Information This document comprises the Annual Report and Accounts 2014 for HSBC Bank plc ('the bank') and its subsidiaries (together 'the group... -

Page 3

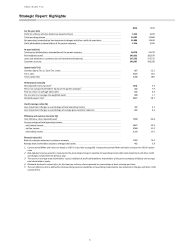

... company At year-end (£m) Total equity attributable to shareholders of the parent company Risk weighted assets1 Loans and advances to customers (net of impairment allowances) Customer accounts Capital ratios1 (%) Common Equity Tier 1 / Core Tier 1 ratio Tier 1 ratio Total capital ratio Performance... -

Page 4

... of credit to buy goods or invest in businesses. By these means, we help the economy to convert savings which may be individually short-term into financing which is, in aggregate, longer term. We bring together investors and people looking for investment funding and we develop new financial products... -

Page 5

... and its competitive advantages, the Group strategy has two parts: • A network of businesses connecting the world. HSBC is well positioned to capture growing international trade and capital flows. The Group's global reach and range of services place HSBC in a strong position to serve clients as... -

Page 6

... BANK PLC Strategic Report: Purpose and Strategic Objectives (continued) business principles delineate our character and define who we are as an organisation and what makes us distinctive. We bring these values and business principles to life through our day-to-day actions. The emphasis we place... -

Page 7

... and global transaction banking services including payments, collections, account services, e-commerce and liquidity management via e-enabled platforms to address the needs of our customers. - Insurance and Investments: we offer business and financial protection, trade insurance, employee benefits... -

Page 8

... execution, and corporate lending and specialised structured financing solutions such as leveraged and acquisition finance, asset and structured finance, real estate, infrastructure and project finance, and export credit. - Payments and Cash Management helps clients move, control, access and invest... -

Page 9

... strong relationships across all global businesses to meet clients' needs. We aim to build on HSBC's commercial banking heritage to be the leading private bank for high net worth business owners. Relationship managers are the dedicated points of contact for our clients, tailoring services to... -

Page 10

... international connectivity products such as Payments and Cash Management, Global Trade and Receivables Finance and Foreign Exchange have all improved consistently over the past three years. For three consecutive years, including 2014, HSBC has been voted the top global cash manager for corporate... -

Page 11

... work as the Monitor in July 2013 charged with evaluating and reporting upon the effectiveness of the Group's internal controls, policies and procedures as they relate to ongoing compliance with applicable AML, sanctions, terrorist financing and proliferation financing obligations, over a five-year... -

Page 12

... customers through a business model organised around global customer segments and products; • utilising our distinctive geographical network to support and facilitate global trade and capital flows; • delivering excellence in our core flow products - specifically in Trade and Payments and Cash... -

Page 13

... time to time the group reviews its key performance indicators ('KPIs') in light of its strategic objectives and may adopt new or refined measures to better align the KPIs to HSBC's strategy and strategic priorities. Financial KPIs 2014 % (3.6) 79.8 0.8 8.7 2013 % 5.6 66.8 1.7 12.1 Risk adjusted... -

Page 14

... Bank for Corporates and Financial Institutions for the third consecutive year' - (Euromoney 2014) • 'Bonds and Derivatives House of the year' - (International Finance Review 2014) • 'Best Family Office Offering' - (Private Banker International Global Wealth Awards ) • 'UK Number 1 Trade Bank... -

Page 15

...BANK PLC Strategic Report: Business Review Financial summary Summary consolidated income statement for the year ended 2014 £m 2013 £m Net interest income Net fee income Trading income Net income from financial instruments designated at fair value Gains less losses from financial investments Net... -

Page 16

... further support and lending to SME customers. Lending in Global Trade and Receivables Finance also grew. In France, the Payments and Cash Management business implemented the Single Euro Payments Area platform ('SEPA') for euro-denominated credit transfer and direct debit payments across European... -

Page 17

... insurance ('PPI') policies and £175 million (2013: £166 million) in respect of interest rate protection products. During 2014 the group maintained its strict cost control discipline and benefited from the delivery of organisational effectiveness programmes. The number of employees, expressed... -

Page 18

... higher placements with financial institutions. Loans and advances to customers decreased by 6 per cent, as we aligned our approach in our Payments and Cash Management business to be more globally consistent, resulting in a reduction in corporate overdraft balances as clients reduced their overdraft... -

Page 19

... PLC Strategic Report: Business Review (continued) Other assets increased by 27 per cent due to the reclassification of the UK pension insurance business as 'Held for sale', the transfer of the precious metal business to the bank and an increase in the surplus of the defined benefit scheme. Debt... -

Page 20

HSBC BANK PLC Strategic Report: Business Review (continued) Performance and Business Review Profit on ordinary activities before tax 2014 £m 2013 £m Retail Banking and Wealth Management Commercial Banking Global Banking and Markets Global Private Banking Other/Intersegment 213 1,592 (19) 115 ... -

Page 21

... BANK PLC Strategic Report: Business Review Significant cost items by business segment (continued) RBWM £m 2014 UK customer redress programmes Restructuring and other related costs Madoff related litigation costs Settlements and provisions in conncection with foreign exchange investigations Year... -

Page 22

... in the improved economic environment and as customers continued to reduce outstanding credit card and loan balances. This was partly offset by an increase in Turkey due to regulatory changes adversely impacting the card portfolio. Net interest income Net fee income Trading income Other income... -

Page 23

... loan applications. Business Banking launched a campaign to offer support and lending to SME customers, making £5.8 billion of future lending available to help finance growth across the UK. Lending in Global Trade and Receivables Finance grew by 3 per cent, building on our position in Trade Finance... -

Page 24

... Loan impairment charges and other credit risk provisions Net operating income Total operating expenses Operating profit Share of profit in associates and joint ventures Profit before tax 140 1 The bank's Balance Sheet Management business, reported within GB&M, provides funding to the trading... -

Page 25

HSBC BANK PLC Strategic Report: Business Review (continued) Global Private Banking 2014 £m 203 112 11 (2) 324 4 328 (213) 115 - 115 2013 £m 224 100 10 (4) 330 (14) 316 (176) 140 - 140 Review of adjusted performance Revenue (£m) 26 350 330 Net interest income Net fee income Trading income ... -

Page 26

HSBC BANK PLC Strategic Report: Business Review (continued) Other 2014 £m (42) 2 24 17 323 324 1 325 (273) 52 - 52 2013 £m (73) 3 (22) (167) 102 (157) - (157) (222) (379) - (379) Net interest income Net fee income Trading income Change in credit spread on longterm debt Other income Net ... -

Page 27

HSBC BANK PLC Strategic Report: Principal Risks and Uncertainties Principal Risks and Uncertainties The group continuously monitors and identifies risks. This process, which is informed by its risk factors and the results of its stress testing programme, gives rise to the classification of certain ... -

Page 28

...in a number of countries of credit controls on mortgage lending and unsecured portfolios. The continued risk of further changes to regulation relating to taxes affecting financial service providers, including financial transaction taxes. The continued focus of competition law enforcement agencies at... -

Page 29

... US DPA at any time during its term may allow the DoJ to prosecute HSBC Holdings or HSBC Bank USA in relation to the matters which are the subject of the US DPA. • The design and execution of AML and sanctions remediation plans is complex and requires major investments in people, systems and other... -

Page 30

... the UK. To date their main focus has been on retail banking markets but this is expected to widen to wholesale markets in 2015. The markets subjected to extensive review so far include: personal current accounts and SME banking services; consumer cash savings; and consumer credit cards. Details of... -

Page 31

...line with our strategy. Potential impact on the group • These factors may affect the successful delivery of our strategic priorities. • The potential risks of disposals include regulatory breaches, industrial action, loss of key personnel and interruption to systems and processes during business... -

Page 32

...the possibility of losses from fraud. Information security risk The security of our information and technology infrastructure is crucial for maintaining our banking applications and processes while protecting our customers and the HSBC brand. HSBC and other multinational organisations continue to be... -

Page 33

..., the bank's risk appetite, tolerance and strategy, systems of risk management, internal control and compliance. Additionally, members of the Risk Committee attend meetings of the Chairman's Nominations and Remuneration Committee at which the alignment of the reward structures to risk appetite is... -

Page 34

... Statement, which describes the types and levels of risk that the group is prepared to accept in executing its strategy. Quantitative and qualitative metrics are assigned to nine key categories: earnings, capital, liquidity and funding, securitisations, cost of risk, intragroup lending, strategic... -

Page 35

... required to hold additional capital, may have restrictions placed on their planned capital actions including the payment of dividends or may have to implement other remedial measures. The Group created a Stress Testing Management Board in early 2014, chaired by the Group Finance Director, to ensure... -

Page 36

...resolution of UK banks and international banks operating in the UK. These rules were modified as part of the implementation of the EU Bank Recovery and Resolution Directive from January 2015. HSBC resolution strategy and corporate structure changes The Group has been working with the Bank of England... -

Page 37

... to the Greek economy as it is mainly dependent on international trade. Our Greece in-country funding exposure is negligible and is set out in the table below. Exposures to Spain, Ireland, Italy, Portugal and Cyprus were also limited. At 31 December 2014, the group's loans and advances in these... -

Page 38

HSBC BANK PLC Report of the Directors: Risk (continued) Key risks associated with an exit by a Eurozone member include: • Foreign exchange losses: an exit would probably be accompanied by the passing of laws in the country concerned establishing a new local currency and providing for a ... -

Page 39

... direct lending, trade finance and leasing business, but also from off-balance sheet products such as guarantees and credit derivatives, and from the group's holdings of debt securities. There were no material changes to our policies and practices for the management of credit risk in 2014. This year... -

Page 40

... directly. For further details on the accounting policy for impairment of available-for-sale debt and equity securities, see accounting policies in Note 1. A range of forbearance strategies is employed in order to improve the management of customer relationships, maximise collection opportunities... -

Page 41

... facilities. The group 2014 Maximum exposure £m Cash and balances at central banks Items in the course of collection from other banks Trading assets1 treasury and other eligible bills debt securities loans and advances to banks loans and advances to customers Financial assets designated at... -

Page 42

... Cash and balances at central banks Items in the course of collection from other banks Trading assets1 treasury and other eligible bills debt securities loans and advances to banks loans and advances to customers Financial assets designated at fair value1 debt securities loans and advances to banks... -

Page 43

...on many transactions, particularly those involving securities and equities, by settling through assured payment systems, or on a delivery-versus-payment basis. Loans and advances The following tables analyse loans and advances by industry sector. Concentrations of credit risk arise when a number of... -

Page 44

... sector (Audited) The group 2014 Gross loans and advances to customers £m Personal Residential mortgages Other personal Corporate and commercial Commercial, industrial and international trade Commercial real estate Other property-related Government Other commercial Financial Non-bank financial... -

Page 45

HSBC BANK PLC Report of the Directors: Risk (continued) Credit quality of financial instruments (Audited) The five credit quality classifications defined below each encompass a range of more granular, internal credit rating grades assigned to wholesale and retail lending business, as well as the ... -

Page 46

... The group 2014 Neither past due nor impaired Medium Strong £m Cash and balances at central banks Items in the course of collection from other banks Trading assets - treasury and other eligible bills - debt securities - loans and advances to banks - loans and advances to customers Financial assets... -

Page 47

... The group 2013 Neither past due nor impaired Medium Strong £m Cash and balances at central banks Items in the course of collection from other banks Trading assets - treasury and other eligible bills - debt securities - loans and advances to banks - loans and advances to customers Financial assets... -

Page 48

... Cash and balances at central banks Items in the course of collection from other banks Trading assets - treasury and other eligible bills - debt securities - loans and advances to banks - loans and advances to customers Financial assets designated at fair value - debt securities - loans and advances... -

Page 49

...) The bank 2013 Neither past due nor impaired Medium Strong £m Cash and balances at central banks Items in the course of collection from other banks Trading assets - treasury and other eligible bills - debt securities - loans and advances to banks - loans and advances to customers Financial assets... -

Page 50

... described below. Ageing analysis of days past due but not impaired gross financial instruments The group Up to 29 days £m At 31 December 2014 Loans and advances held at amortised cost Personal Corporate and commercial Financial Other assets At 31 December 2013 Loans and advances held at amortised... -

Page 51

... lending, our credit risk management policy sets out restrictions on the number and frequency of renegotiations, the minimum period an account must have been opened before any renegotiation can be considered and the number of qualifying payments that must be received. The application of this policy... -

Page 52

... roll rates or historical experience, these risk factors are taken into account by adjusting the impairment allowances derived solely from statistical or historical experience. In the corporate and commercial sectors, renegotiated loans are typically assessed individually. Credit risk ratings are... -

Page 53

...mortgages - other personal Corporate and commercial - manufacturing and international trade and services - commercial real estate and other property-related - other commercial Financial Total loan impairment charge at 31 December Individually assessed impairment allowances - new allowances - release... -

Page 54

...Wholesale lending Total wholesale lending (Unaudited) 2014 £m Corporate and commercial (A) - manufacturing - international trade and services - commercial real estate - other property-related - government - other commercial Financial (non-bank financial institutions) (B) Loans and advances to banks... -

Page 55

HSBC BANK PLC Report of the Directors: Risk (continued) Commercial real estate lending (Unaudited) Commercial real estate lending includes the financing of corporate, institutional and high net worth individuals investing primarily in income producing assets and, to a lesser extent construction ... -

Page 56

..., commercial and financial (non-bank) Other Corporate, commercial and financial (non-bank) is analysed separately below reflecting the difference in collateral held on the portfolios. For financing activities in corporate and commercial lending that are not predominantly commercial real estate... -

Page 57

... and similar instruments which are supported by underlying pools of financial assets. Credit risk associated with ABSs is reduced through the purchase of CDS protection; • trading assets include loans and advances held with trading intent. These mainly consist of cash collateral posted to satisfy... -

Page 58

...LTV thresholds with the maximum upper limit for new loans set between 75% and 95%. Specific LTV thresholds and debt-to-income ratios are managed at regional and country levels and, although the parameters must comply with Group policy, strategy and risk appetite, they differ in the various locations... -

Page 59

HSBC BANK PLC Report of the Directors: Risk (continued) where the collateral is cash or can be realised by sale in an established market. The LTV ratio is calculated as the gross on-balance sheet carrying amount of the loan and any off-balance sheet loan commitment at the balance sheet date ... -

Page 60

... exposures and other structured products (Audited) For further information on structured entities please refer to note 36. Overall exposure Carrying amount1 2014 2013 £bn £bn Asset-backed securities Fair value through profit and loss Available for sale Held to maturity Loans and receivables At 31... -

Page 61

... clearly defined internal and regulatory guidelines and limits. The limits place formal restrictions on the transfer of resources between group entities and reflect the range of currencies, markets and time zones within which the group operates. The group's liquidity and funding management process... -

Page 62

... calculate our principal liquidity risk metrics. Advances to core funding ratio The group emphasises the importance of core customer deposits as a source of funds to finance lending to customers and discourages reliance on short-term wholesale funding. This is achieved by placing limits on banking... -

Page 63

... Trinkaus & Burkhardt AG, HSBC Bank Malta plc and HSBC Bank A.S. (Turkey). Core funding represents the core component of customer deposits and any term wholesale funding with a residual contractual maturity beyond one year. Capital is excluded from our definition of core funding. Stressed coverage... -

Page 64

... PLC Report of the Directors: Risk (continued) 1 Stressed one-month and three-month coverage ratios (Audited) Stressed one-month coverage ratios at 31 December 2014 2013 (%) (%) HSBC UK Year end Maximum Minimum Average HSBC France Year end Maximum Minimum Average Total of other principal group... -

Page 65

..., reflecting the fact that we separately manage interest rate risk and liquidity and funding risk under different assumptions. They have been developed to be consistent with our risk management frameworks. Each operating entity is required to apply the Group's transfer pricing policy framework to... -

Page 66

HSBC BANK PLC Report of the Directors: Risk (continued) transferred to ALCO to be managed centrally. ALCO monitors and manages the advances to core funding ratio and delegates the management of the liquid asset portfolio and execution of the wholesale term debt funding plan to BSM, requiring BSM ... -

Page 67

... the level of loans and advances to customers. The positive Funding sources and uses (Audited) funding gap was predominantly deployed in liquid assets; cash and balances with central banks and financial investments, as required by the LFRF. The group 2014 £m Sources Customer accounts Deposits by... -

Page 68

Wholesale funding cash flows payable by the group under financial liabilities by remaining contractual maturities (Unaudited) Report of the Directors: Risk (continued) Due within 1 month £m Debt securities issued - unsecured CDs and CP - unsecured senior MTNs - unsecured senior structured notes -... -

Page 69

... manage and control market risk exposures in order to optimise return on risk while maintaining a market profile consistent with the status as one of the world's largest banking and financial services organisations. The nature of the hedging and risk mitigation strategies performed across the Group... -

Page 70

... strategies to address a combination of risk factors arising at portfolio level. Value at risk (Audited) M arket risk governance (Audited) Market risk is managed and controlled through limits approved by the RMM of the Group Management Board ('GMB') for HSBC Holdings and the global businesses... -

Page 71

... on a daily basis across asset classes and products, such as dividend risk and correlation risks. Risk factors are reviewed on a regular basis and either incorporated directly in the VaR models, where possible, or quantified through the VaR -based RNIV approach or a stress test approach within... -

Page 72

... the Directors: Risk (continued) Daily VaR (trading portfolios), 99% 1 day (£m) (Unaudited) HSBC Bank Plc's trading VaR for the year is shown in the table below. Trading value at risk, 99% 1 day (Audited) Foreign exchange and commodity £m At 31 December 2014 Average Maximum At 31 December 2013... -

Page 73

...non-traded VaR. Any market risk that cannot be neutralised in the market is managed by local ALCO in segregated ALCO books. The funds transfer pricing policies give rise to a two stage funds transfer pricing approach. For details see page 63. Credit spread risk for available-for-sale debt securities... -

Page 74

... the group's consolidated capital ratios and the capital ratios of individual banking subsidiaries are largely protected from the effect of changes in exchange rates. This is usually achieved by ensuring that, for each subsidiary bank, the ratio of structural exposures in a given currency to risk... -

Page 75

... net interest income of anticipated differences in changes between interbank interest rates and interest rates over which the entity has discretion in terms of the timing and extent of rate changes. Defined benefit pension scheme (Audited) Market risk also arises within the group's defined benefit... -

Page 76

HSBC BANK PLC Report of the Directors: Risk (continued) The present value of the group's defined benefit pension schemes' liabilities was as follows: 2014 £bn At 31 December Liabilities (present value) Assets: Equities Debt securities Other (including property) 20.1 % 16 65 19 100 2013 £bn 18.5 ... -

Page 77

... banking applications and processes while protecting our customers and the HSBC brand. A failure of the control framework which protects this could have implications for the wider financial sector and result in direct financial loss, and / or the loss of customer data and other sensitive information... -

Page 78

...in place are designed to ensure we have the appropriate people, processes and procedures to manage emerging risks and new products and business. Enhanced global AML and Sanctions policies, incorporating risk appetite, were approved by the Board in January 2014. The policies adopt and seek to enforce... -

Page 79

... regulations applicable from 2016. The group's bancassurance model We operate an integrated bancassurance model which provides wealth and protection insurance products principally for customers with whom the group has a banking relationship. Insurance products are sold through all global businesses... -

Page 80

...sale. During 2014 the Irish insurance entity HSBC Life (Europe) Limited's portfolio of insurance policies has been transferred to HSBC Life Assurance (Malta) Limited. from fluctuations in variables such as interest rates, foreign exchange rates and equity prices; • Credit risk - risk of financial... -

Page 81

... and maturities give rise to interest rate risk. The main features of products manufactured by the group's insurance manufacturing companies which Sensitivity of the group's insurance companies to market risk factors (Audited) 2014 Effect on profit after tax £m + 100 basis points parallel shift in... -

Page 82

... PLC Report of the Directors: Risk (continued) Treasury bills, other eligible bills and debt securities in the group's insurance manufacturing companies (Audited) 2014 Good/ Satisfactory £m 135 135 1,522 - 1,522 1,657 2013 Good/ Satisfactory £m 151 - 151 1,650 - 1,650 1,801 Strong £m Financial... -

Page 83

... factors, including mortality and morbidity experience, lapse and surrender rates, expense rates and, if the policy has a savings element, the performance of the assets held to support the liabilities. The following tables analyse the group's insurance risk exposures by type of business. Analysis... -

Page 84

... investments delivering an inadequate return, economic conditions leading to corporate failures, adverse changes in interest rates or inflation, or members living longer than expected (longevity risk). The group operates a number of pension plans throughout Europe. Some of them are defined benefit -

Page 85

... for investment strategy rests with either the trustees or, in certain circumstances, a management committee. The degree of independence of the trustees from the group varies in different jurisdictions. The HSBC Bank (UK) Pension Scheme (the principal plan) has both defined benefit and defined... -

Page 86

... risk mitigating actions, in advance of conditions starting to reflect the stress scenarios identified. The actual market stresses experienced by the financial system in recent years have been used to inform the capital planning process and further develop the stress scenarios employed by the group... -

Page 87

HSBC BANK PLC Report of the Directors: Capital Management (continued) • Additional tier 1 capital comprises eligible noncommon equity capital securities and any related share premium; it also includes other qualifying instruments subject to certain limits. Holdings of additional tier 1 ... -

Page 88

... our business strategy, risk profile, risk appetite and capital plan. This process incorporates the group's risk management processes and governance framework. A range of stress tests are applied to our base capital plan. These, coupled with our economic capital framework and other risk management... -

Page 89

...Under CRD IV transitional rules net unrealised gains on available-for-sale securities must be excluded from capital resources 4 CRD IV rules require banks to exclude from capital resources any surplus in a defined benefit pension scheme. 5 Mainly comprises investment in insurance entities. Under CRD... -

Page 90

... RWA movement by business by key driver - non-counterparty credit risk - IRB only (Unaudited) RBWM £bn RWAs at 1 January 2014 on Basel 2.5 basis Foreign exchange movement Acquisitions and disposals Book size Book quality Model new/updated Methodology and policy - external updates - regulatory - CRD... -

Page 91

... each quarter of 2014 this calculation was performed for each HSBC company with an IRB portfolio by global businesses, split by the main Basel categories of credit exposures, as described in the table below: The total of the results is shown in book size within the RWA movement by key driver table... -

Page 92

... with a view to mitigate structural macro-prudential risk. In January 2015, the legislative changes necessary to transpose the SRB into UK legislation were implemented. The SRB is to be applied to ring fenced banks and building societies (over a certain threshold), which are together defined as 'SRB... -

Page 93

... banks and financial sector entities would be moved to the foundation approach from June 2015. Secondly, a proposal to introduce stricter criteria for the application of the standardised risk weight for certain commercial real estate ('CRE') exposures located in non-EEA countries dependent upon loss... -

Page 94

... additional leverage ratio buffer (for G-SIBs, major UK banks and building societies including ring fenced banks) and a CCLB. HM Treasury did not however provide any views on the calibration. The consultation paper included legislative changes to provide the FPC with new powers. In February 2015, HM... -

Page 95

...consultation on the Pillar 3 disclosures. The final EBA guidelines were issued on 23 December 2014 and entail additional processes and governance around the Pillar 3 report, as well as semi-annual or quarterly disclosure of key capital, ratio, risk-weighted asset, leverage and risk model information... -

Page 96

... to the Board: 28 March 2014 Samir joined HSBC in 1994. A Group Managing Director since 2011. Chief Executive, Global Banking and Markets, HSBC Holdings plc. He is Chairman of the Global Financial Markets Association and HSBC France and a director of HSBC Trinkaus & Burkhardt AG. Former appointments... -

Page 97

... of Strategy and Planning. Rosemary M artin, 54 Independent non-executive Director Chairman of the IT Infrastructure Committee and a member of the Chairman's Nominations and Remuneration Committee. Appointed to the Board: 2005 Rosemary is General Counsel and Company Secretary of Vodafone Group plc... -

Page 98

... is accountable to the Board and has non-executive responsibility for oversight of and advice to the Board on financial reporting related matters and internal controls over financial reporting. The Audit Committee meets regularly with the bank's senior financial and internal audit management and... -

Page 99

...year and up to 23 February 2015, the date of approval of the Annual Report and Account 2014. This guidance was amended following consultations undertaken by the Financial Reporting Council in November 2013 and April 2014, resulting in revised guidance on risk management, internal control and related... -

Page 100

... compliance, financial crime compliance, fiduciary, information security, security and fraud, systems and people risk). Authorities to enter into credit and market risk exposures are delegated with limits to line management of group companies. The concurrence of the appropriate global function is... -

Page 101

...-19 year old individuals, we offer 500 work experience placements per year. We connect with 4000 schools and colleges in the UK via the Financial Sector Skills Council, to help ensure applications are received 99 from students from as many diverse backgrounds as possible. In 2013, HSBC established... -

Page 102

...'s day-to-day communications, specific mechanisms are in place to explain and familiarise employees with internal and external factors affecting the company's performance. These include regular editorials from HSBC's economists, business reviews by senior managers, financial news stories and a share... -

Page 103

... hours to volunteer in work time. In 2014, the UK business gave £4.2 million in charitable donations and in addition the Group Community Investment spend in the UK was £20.8 million. Auditor Following a tender process for the audit of HSBC Holdings plc and its subsidiaries that took place in 2013... -

Page 104

... of the group's strategic direction and principal risks and uncertainties. • A summary of financial performance and review of business performance. • The group's approach to capital management and allocation. In addition, the objectives, policies and processes for managing credit, liquidity and... -

Page 105

... parent company financial statements for HSBC Bank plc (the 'bank') in accordance with applicable laws and regulations. Company law requires the Directors to prepare a Strategic Report, a Report of the Directors and group and parent company financial statements for each financial year. The Directors... -

Page 106

... Reporting Council's website at www.frc.org.uk/auditscopeukprivate. Opinion on financial statements In our opinion: • the financial statements give a true and fair view of the state of the group's and of the parent company's affairs as at 31 December 2014 and of the group's profit for the year... -

Page 107

HSBC BANK PLC Financial Statements Consolidated income statement for the year ended 31 December 2014 2014 Total £m Interest income Interest expense Net interest income Fee income Fee expense Net fee income Trading income excluding net interest income Net interest income on trading activities Net ... -

Page 108

... or loss Actuarial gains/(losses) on defined benefit plans - before income taxes - income taxes Other comprehensive income for the year, net of tax Total comprehensive income for the year Total comprehensive income for the year attributable to: - shareholders of the parent company - non-controlling... -

Page 109

...) Consolidated statement of financial position at 31 December 2014 Notes Assets Cash and balances at central banks Items in the course of collection from other banks Trading assets Financial assets designated at fair value Derivatives Loans and advances to banks Loans and advances to customers... -

Page 110

... from sale of associates Net cash disposed of on sale of subsidiaries Purchases of HSBC Holdings plc shares to satisfy share-based payment transactions Net cash used in investing activities Cash flows from financing activities Issue of ordinary share capital Issue of capital securities Subordinated... -

Page 111

... (net of tax) Available-for-sale investments Cash flow hedges Actuarial gains/(losses) on defined benefit plans Exchange differences and other Total comprehensive income for the year Share capital issued, net of costs1 Dividends to shareholders Net impact of equity-settled sharebased payments Change... -

Page 112

...) HSBC Bank plc statement of financial position at 31 December 2014 Notes Assets Cash and balances at central banks Items in the course of collection from other banks Trading assets Financial assets designated at fair value Derivatives Loans and advances to banks Loans and advances to customers... -

Page 113

... sale of property, plant and equipment Purchase of goodwill and intangible assets Net cash outflow from acquisition of businesses and subsidiaries Proceeds from disposal and liquidation of businesses Net cash used in investing activities Cash flows from financing activities Issue of ordinary share... -

Page 114

... HSBC Bank plc statement of changes in equity for the year ended 31 December 2014 Other reserves Called up share capital £m At 1 January 2014 Profit for the year Other comprehensive income (net of tax) Available-for-sale investments Cash flow hedges Actuarial gains on defined benefit plans Exchange... -

Page 115

... the 2011-2013 Cycle, and a narrow-scope amendment to IAS 19 Employee Benefits. The group has not early applied any of these amendments and it expects they will have an immaterial effect, when applied, on the consolidated financial statements of the group and the separate statements of HSBC Bank plc... -

Page 116

...'s credit risk for the year, with no effect on net assets. Further information on change in fair value attributable to changes in credit risk, including the group's credit risk, is disclosed in Note 12. The group is assessing the impact that the rest of IFRS 9 will have on the financial statements... -

Page 117

... relating to the group's securitisation activities and structured products have been included in the audited section of 'Report of the Directors: Risk' on pages 58. In publishing the parent company financial statements together with the group financial statements, the bank has taken advantage... -

Page 118

...where it is probable that the group will incur a loss. On inception of the loan, the loan to be held is recorded at its fair value and subsequently measured at amortised cost. For certain transactions, such as leveraged finance and syndicated lending activities, the cash advanced may not be the best... -

Page 119

..., loan product features, economic conditions such as national and local trends in housing markets, the level of interest rates, portfolio seasoning, account management policies and practices, changes in laws and regulations, and other influences on customer payment patterns. Different factors are... -

Page 120

HSBC BANK PLC Notes on the Financial Statements (continued) Loans considered as individually significant are typically to corporate and commercial customers, are for larger amounts and are managed on an individual basis. For these loans, the group considers on a case-by-case basis at each balance ... -

Page 121

HSBC BANK PLC Notes on the Financial Statements (continued) - management's judgment as to whether current economic and credit conditions are such that the actual level of inherent losses at the balance sheet date is likely to be greater or less than that suggested by historical experience. The ... -

Page 122

...changes in credit ratings are of secondary importance. - Available-for-sale equity securities. Objective evidence of impairment may include specific information about the issuer as detailed above, but may also include information about significant changes in technology, markets, economics or the law... -

Page 123

HSBC BANK PLC Notes on the Financial Statements (continued) interest method. The effective interest rate is the rate that exactly discounts estimated future cash receipts or payments through the expected life of the financial instrument or, where appropriate, a shorter period, to the net carrying ... -

Page 124

HSBC BANK PLC Notes on the Financial Statements (continued) 2 Net insurance premium income Accounting policy Premiums for life insurance contracts are accounted for when receivable, except in unit-linked insurance contracts where premiums are accounted for when liabilities are established. ... -

Page 125

... employee compensation 2014 £m Wages and salaries Social security costs Post-employment benefits Year ended 31 December 3,357 468 319 4,144 2013 £m 3,358 475 5 3,838 Average number of persons employed by the group during the year 2014 Retail Banking and Wealth Management Commercial Banking Global... -

Page 126

...plan, are charged as an expense as the employees render service. The defined benefit pension costs and the present value of defined benefit obligations are calculated at the reporting date by the schemes' actuaries using the Projected Unit Credit Method. The net charge to the income statement mainly... -

Page 127

...are members of defined benefit pension plans, as well as certain other employees of the group and HSBC, are provided principally by the HSBC Bank (UK) Pension Scheme (the 'Scheme'), the assets of which are held in a separate trust fund. The Pension Scheme is administered by a corporate trustee, HSBC... -

Page 128

...the plan member profile. The following table shows the effect of changes in these and the other key assumptions on the principal plan: HSBC Bank (UK) Pension Scheme 2014 2013 £m £m Discount rate Change in pension obligation at year end from a 25bps increase Change in pension obligation at year end... -

Page 129

HSBC BANK PLC Notes on the Financial Statements (continued) Present value of defined benefit obligations Fair value of plan assets Net benefit asset/(liability) HSBC Bank HSBC Bank HSBC Bank (UK) Pension Other (UK) Pension Other (UK) Pension Other Scheme plans Scheme plans Scheme plans £m £m £m ... -

Page 130

... are based on a combination of individual and corporate performance and are determined by the Remuneration Committee of the bank's parent company, HSBC Holdings plc. The cost of any conditional awards under the HSBC Share Plan 2011 are recognised through an annual charge based on the fair value... -

Page 131

HSBC BANK PLC Notes on the Financial Statements (continued) which the award relates. Details of the Plans are contained within the Directors' Remuneration Report of HSBC Holdings plc. Of these aggregate figures, the following amounts are attributable to the highest paid Director: 2014 £000 Fees ... -

Page 132

HSBC BANK PLC Notes on the Financial Statements (continued) 7 Share-based payments Accounting policy The group enters into both equity-settled and cash-settled share-based payment arrangements with its employees as compensation for services provided by employees. The cost of share-based payment ... -

Page 133

... of share options are calculated using a Black-Scholes model. The fair value of a share award is based on the share price at the date of the grant. M ovem ent on HSBC share option plans Savings-related share option plans Number WAEP1 (000s) £ 2014 Outstanding at 1 January Granted during the year... -

Page 134

... authority, and when the group has a legal right to offset. Deferred tax relating to actuarial gains and losses on post-employment benefits is recognised in other comprehensive income. Deferred tax relating to share-based payment transactions is recognised directly in equity to the extent that the... -

Page 135

HSBC BANK PLC Notes on the Financial Statements (continued) The following table reconciles the tax expense which would apply if all profits had been taxed at the UK corporation tax rate: 2014 £m Taxation at UK corporation tax rate of 21.5% (2013: 23.25%) Effect of taxing overseas profit at ... -

Page 136

HSBC BANK PLC Notes on the Financial Statements (continued) The bank Loan Property, Retirement impairment Unused tax plant and benefits allowances losses equipment £m £m £m £m Assets Liabilities At 1 January Income statement Other comprehensive income Equity Foreign exchange and other At 31 ... -

Page 137

... 'Report of the Directors: Operating and Financial Review - Products and Services'. Profit/(loss) for the year Year ended 31 December 2014 RBWM £m Net interest income Net fee income Net trading income Other income Net operating income before loan impairment charges and other credit risk provisions... -

Page 138

HSBC BANK PLC Notes on the Financial Statements (continued) Other inform ation about the profit/(loss) for the year RBWM £m Year ended 31 December 2014 Net operating income: - external - inter-segment Year ended 31 December 2013 Net operating income: - external - inter-segment 4,046 3,724 322 4,... -

Page 139

HSBC BANK PLC Notes on the Financial Statements (continued) 11 Trading assets Accounting policy Financial assets are classified as held for trading if they have been acquired principally for the purpose of selling in the near term, or form part of a portfolio of identified financial instruments ... -

Page 140

... to a profit and loss analysis process. This process disaggregates changes in fair value into three high level categories; (i) portfolio changes, such as new transactions or maturing transactions, (ii) market movements, such as changes in foreign exchange rates or equity prices, and (iii) other... -

Page 141

HSBC BANK PLC Notes on the Financial Statements (continued) The following table sets out the financial instruments by fair value hierarchy Financial instrum ents carried at fair value The group Level 1 quoted market price £m Recurring fair value measurement at 31 December 2014 Assets Trading ... -

Page 142

HSBC BANK PLC Notes on the Financial Statements (continued) Transfers between Level 1 and Level 2 fair values: Assets Designated at fair value Held for through profit trading or loss £m £m 11,024 - - - Liabilities Designated at fair value Held for through profit trading or loss £m £m 18,989 - -... -

Page 143

HSBC BANK PLC Notes on the Financial Statements (continued) counterparty, to the expected positive exposure of the counterparty to the group and multiplying by the loss expected in the event of default. Both calculations are performed over the life of the potential exposure. For most products, the ... -

Page 144

HSBC BANK PLC Notes on the Financial Statements (continued) The bank Availablefor-sale £m Private equity investments Asset-backed securities Structured notes Derivatives Other portfolios At 31 December 2014 415 1,946 - - - 2,361 Assets Held for trading £m 68 275 7 - 1,782 2,132 At fair value £m... -

Page 145

... Issues Sales Settlements Transfer out Transfer in Exchange differences At 31 December 2013 Unrealised gains/(losses) recognised in profit or loss relating to and liabilities held at 31 December - trading income excluding net interest income - loan impairment charges and other credit risk provisions... -

Page 146

... Issues Sales Settlements Transfer out Transfer in Exchange differences At 31 December 2013 Unrealised gains/(losses) recognised in profit or loss relating to and liabilities held at 31 December - trading income excluding net interest income - loan impairment charges and other credit risk provisions... -

Page 147

... Reflected in profit or loss Favourable Unfavourable changes changes £m £m At 31 December 2014 Private equity investments Asset-backed securities Structured notes Derivatives Other portfolios At 31 December 2013 Private equity investments Asset-backed securities Structured notes Derivatives Other... -

Page 148

... of the categories of key unobservable inputs is given below. Fair value Assets Liabilities £m £m Valuation technique At 31 December 2014 Private equity including strategic investments Asset-backed securities CLO/CDO1 Other ABSs Structured notes Equity-linked notes Fund-linked notes FX-linked... -

Page 149

HSBC BANK PLC Notes on the Financial Statements (continued) Private equity including strategic investments The group's private equity and strategic investments are generally classified as available for sale and are not traded in active markets. In the absence of an active market, an investment's ... -

Page 150

... and liabilities not held for sale at 31 December 2013 Assets Loans and advances to banks Loans and advances to customers Reverse repurchase agreements - non-trading Liabilities Deposits by banks Customer accounts Repurchase agreements - non-trading Debt securities in issue Subordinated liabilities... -

Page 151

...for sale at 31 December 2013 Assets Loans and advances to banks Loans and advances to customers Reverse repurchase agreements - non-trading Liabilities Deposits by banks Customer accounts Repurchase agreements - non-trading Debt securities in issue Subordinated liabilities Quoted market price Level... -

Page 152

HSBC BANK PLC Notes on the Financial Statements (continued) Deposits by banks and customer accounts Fair values are estimated using discounted cash flows, applying current rates offered for deposits of similar remaining maturities. The fair value of a deposit repayable on demand is approximated by ... -

Page 153

HSBC BANK PLC Notes on the Financial Statements (continued) 15 Derivatives Accounting policy Derivatives Derivatives are initially recognised, and are subsequently remeasured, at fair value. Fair values of derivatives are obtained either from quoted market prices or by using valuation techniques. ... -

Page 154

HSBC BANK PLC Notes on the Financial Statements (continued) Fair values of derivatives by product contract type held by The group Trading £m Foreign exchange Interest rate Equities Credit Commodity and other Gross total fair values Offset At 31 December 2014 Foreign exchange Interest rate Equities... -

Page 155

HSBC BANK PLC Notes on the Financial Statements (continued) Notional contract amounts of derivatives held for trading purposes by product type The group 2014 £m Foreign exchange Interest rate Equities Credit Commodity and other At 31 December 2,520,473 11,609,407 362,678 269,376 40,030 14,801,964 ... -

Page 156

... to the hedged risk Year ended 31 December (1,013) 1,033 20 2013 £m 472 (439) 33 The bank 2014 £m (673) 687 14 2013 £m 514 (480) 34 The gains and losses on ineffective portions of fair value hedges are recognised immediately in 'Net trading income'. Cash flow hedges HSBC's cash flow hedges... -

Page 157

... sale and repurchase price or between the purchase and resale price is treated as interest and recognised in net interest income over the life of the agreement for loans and advances to banks and customers. Securities lending and borrowing transactions are generally secured against cash or non-cash... -

Page 158

... plus any directly attributable transaction costs, and are subsequently measured at amortised cost, less any impairment losses. The accounting policy relating to impairments of available-for-sale securities is presented in Note 1(j). Financial investments: The group 2014 £m Financial investments... -

Page 159

... exposure to loss is the carrying amount of the notes. Financial assets pledged to secure liabilities Group assets pledged at 31 December 2014 2013 £m £m Treasury bills and other eligible securities Loans and advances to banks Loans and advances to customers Debt securities Equity shares Other... -

Page 160

...the Financial Statements (continued) a fixed price at a future date is recognised on the balance sheet. As a result of these transactions, the Group is unable to use, sell or pledge the transferred assets for the duration of the transaction. The Group remains exposed to interest rate risk and credit... -

Page 161

HSBC BANK PLC Notes on the Financial Statements (continued) 19 Prepayments, accrued income and other assets Accounting policy Assets held for sale Assets and liabilities of disposal groups and non-current assets are classified as held for sale ('HFS') when their carrying amounts will be recovered ... -

Page 162

HSBC BANK PLC Notes on the Financial Statements (continued) 20 Interests in associates and joint ventures Accounting policy Investments in which the group, together with one or more parties, has joint control of an arrangement set up to undertake an economic activity are classified as joint ... -

Page 163

HSBC BANK PLC Notes on the Financial Statements (continued) Goodwill Accounting policy Goodwill arises on the acquisition of subsidiaries, when the aggregate of the fair value of the consideration transferred, the amount of any non-controlling interest and the fair value of any previously held ... -

Page 164

... the discount rates derived using the internally-generated CAPM with cost of capital rates produced by external sources. The group uses externally-sourced cost of capital rates where, in management's judgement, these rates reflect more accurately the current market and economic conditions. For 2014... -

Page 165

HSBC BANK PLC Notes on the Financial Statements (continued) The present value of in-force long-term assurance business Movement in PVIF The group 2014 £m At 1 January Addition from current year new business Movement from in-force business (including investment return variances and changes in ... -

Page 166

HSBC BANK PLC Notes on the Financial Statements (continued) Sensitivity to changes in non-economic assumptions PVIF 2014 £m 10% increase in mortality and/or morbidity rates 10% decrease in mortality and/or morbidity rates 10% increase in lapse rates 10% decrease in lapse rates 10% increase in ... -

Page 167

HSBC BANK PLC Notes on the Financial Statements (continued) The bank Internally generated software £m Cost At 1 January 2014 Additions1 Other changes At 31 December 2014 Accumulated amortisation and impairment At 1 January 2014 Amortisation charge for the year2 Other changes At 31 December 2014 ... -

Page 168

... HSBC Bank A.S. HSBC Bank International Limited HSBC Bank Malta p.l.c. HSBC Invoice Finance (UK) Limited HSBC Life (UK) Limited HSBC Private Bank (UK) Limited HSBC Private Bank (C.I.) Limited HSBC Trinkaus & Burkhardt AG HSBC Trust Company (UK) Limited Marks and Spencer Retail Financial Services... -

Page 169

... incremental costs directly related to the acquisition of new investment contracts or renewing existing investment contracts are deferred and amortised over the period during which the investment management services are provided. Financial liabilities designated at fair value The group 2014 £m 86... -

Page 170

HSBC BANK PLC Notes on the Financial Statements (continued) 26 Liabilities under insurance contracts Accounting policy The group issues contracts to customers that contain insurance risk, financial risk or a combination thereof. A contract under which the group accepts significant insurance risk ... -

Page 171

HSBC BANK PLC Notes on the Financial Statements (continued) Gross £m Non-linked insurance contracts1 At 1 January Claims and benefits paid Movement in liabilities to policyholders Exchange differences and other movements At 31 December Investment contracts with discretionary participation ... -

Page 172

... identified as systemically mis-sold, the redress cost per policy and the number of policies per customer complaint. The main assumptions are likely to evolve over time as root cause analysis continues, more experience is available regarding customer initiated complaint volumes received, and we... -

Page 173

HSBC BANK PLC Notes on the Financial Statements (continued) The extent to which the group is ultimately required to pay redress depends on the responses of contacted and other customers during the review period and analysis of the facts and circumstances of each individual case, including ... -

Page 174

... loans provided by HSBC Holdings plc and issued two new GBP denominated Additional Tier 1 (AT1) capital instruments which are accounted for as "other equity instruments" in Note 32. Footnotes 1 to 5 all relate to instruments that are redeemable at the option of the issuer on the date of the change... -

Page 175

... investors are entitled to give. Where there is no contractual notice period, undated contracts are included in the 'Due over 5 years' time bucket. Loan and other credit-related commitments are classified on the basis of the earliest date they can be drawn down. Cash flows payable under financial... -

Page 176

... analysis of assets and liabilities The group At 31 December 2014 Due after more Due within than one year one year £m £m Assets Financial assets designated at fair value Loans and advances to banks Loans and advances to customers Reverse Repurchase agreements- non trading Financial investments... -

Page 177

... Loans and advances to customers Reverse repurchase agreements - non trading Financial investments Other financial assets At 31 December 2013 Liabilities Deposits by banks Customer accounts Reverse repurchase agreements - non trading Financial liabilities designated at fair value Debt securities... -

Page 178

... as: - trading assets - non-trading assets Loans and advances to customers at amortised cost At 31 December 2014 Financial liabilities Derivatives2 Repurchase, securities lending and similar agreements Classified as: - trading liabilities - non-trading liabilities Customer accounts at amortised cost... -

Page 179

HSBC BANK PLC Notes on the Financial Statements (continued) 31 Foreign exchange exposures The group's structural foreign currency exposure is represented by the net asset value of its foreign currency equity and subordinated debt investments in subsidiary undertakings, branches, joint ventures and ... -

Page 180

...the cash flow statement Non-cash item s included in profit before tax The group 2014 £m Depreciation, amortisation and impairment Share-based payment expense Credit-related impairment losses Provisions raised Impairment of investments Charge/(credit) for defined benefit plans Accretion of discounts... -

Page 181

HSBC BANK PLC Notes on the Financial Statements (continued) Change in operating liabilities The group 2014 £m Change in accruals and deferred income Change in deposits by banks Change in customer accounts Change in repurchase agreements - non-trading Change in debt securities in issue Change in ... -

Page 182

HSBC BANK PLC Notes on the Financial Statements (continued) 34 Contingent liabilities, contractual commitments and guarantees Accounting policy Contingent liabilities Contingent liabilities, which include certain guarantees and letters of credit pledged as collateral security as well as contingent ... -

Page 183

... with the group's overall credit risk management policies and procedures. Guarantees with terms of more than one year are subject to the group's annual credit review process. Other commitments In addition to the commitments disclosed above, at 31 December 2014 the group had capital commitments to... -

Page 184

HSBC BANK PLC Notes on the Financial Statements (continued) 35 Lease commitments Accounting policy Agreements which transfer to counterparties substantially all the risks and rewards incidental to the ownership of assets are classified as finance leases. As a lessor under finance leases, the group ... -

Page 185

... Solitaire, the group's principal SIC, purchases highly rated ABSs to facilitate tailored investment opportunities. At 31 December 2014, Solitaire held £5.1 billion of ABSs (2013: £5.4 billion). These are included within the disclosures of ABS 'held through consolidated structured entities' on... -

Page 186

... and for capital efficiency purposes. The loans and advances are transferred by the group to the structured entities for cash or synthetically through credit default swaps, and the structured entities issue debt securities to investors. Group managed funds The group has established a number of money... -

Page 187

HSBC BANK PLC Notes on the Financial Statements (continued) Nature and risks associated with the group's interests in unconsolidated structured entities Group managed funds £m At 31 December 2014 Total assets Group interest - assets Cash Trading assets Financial assets designated at fair value ... -

Page 188

...new Madoff-related actions were filed. The first is a purported class action brought by direct investors in Madoff Securities who were holding their investments as of December 2008, asserting various common law claims and seeking to recover damages lost to Madoff Securities' fraud on account of HSBC... -

Page 189

... in relation to claims for mistake, recovery of fees, and damages for breach of contract. The third set of actions seeks return of fees from HSBC Bank Bermuda Limited and HSBC Securities Services (Bermuda). There has been little progress in these actions for several years, although in January 2015... -

Page 190

... relating to HSBC's compliance with applicable AML, BSA and sanctions laws or other regulatory or law enforcement actions for AML, BSA or sanctions matters not covered by the various agreements. In November 2014, a complaint was filed in the US District Court for the Eastern District of New York... -

Page 191

...regulators and competition and law enforcement authorities around the world including in the UK, the US, the EU and elsewhere, are conducting investigations and reviews into a number of firms, including HSBC, related to trading on the foreign exchange markets. In November 2014, HSBC Bank plc entered... -

Page 192

...2015, numerous putative class actions were filed in the New York District Court naming HSBC Bank USA and other members of The London Platinum and Palladium Fixing Company Limited as defendants. The complaints allege that, from January 2007 to the present, defendants conspired to manipulate the price... -

Page 193

... of the Group financial statements may be obtained from the following address: HSBC Holdings plc 8 Canada Square London E14 5HQ The group's related parties include the parent, fellow subsidiaries, associates, joint ventures, post-employment benefit plans for HSBC employees, Key Management Personnel... -

Page 194

...the Key Management Personnel of the bank's parent company, HSBC Holdings plc. The table below sets out transactions which fall to be disclosed under section 413 of Companies Act 2006. The group Balance at 31 December 2014 £000 Directors Loans Credit cards 12,975 61 Balance at 31 December 2013 £000... -

Page 195

HSBC BANK PLC Notes on the Financial Statements (continued) 2014 £m Income Statement Interest income Interest expense Fee income Dividend income Trading income Other operating income General and administrative expenses 47 189 1 1 1 66 37 2013 £m 71 177 1 1 10 20 76 1 The disclosure of the year-... -

Page 196

... is considered the most meaningful information to represent transactions during the year. In December 2010, the bank received two guarantees from HSBC Holdings plc in respect of monies owing to the bank by its structured investment conduits ('SICs'). The first guarantee covers due but unpaid monies... -

Page 197

... business and on substantially the same terms, including interest rates and security, as for comparable transactions with third party counterparties. Pension funds At 31 December 2014, fees of £5 million (2013: £9 million) were earned by group companies for management services related to the group... -

Page 198

-

Page 199

... England with limited liability. Registered in England: number 14259 REGISTERED OFFICE 8 Canada Square, London E14 5HQ, United Kingdom Web: www.hsbc.co.uk  Copyright HSBC Bank plc 2015 All rights reserved No part of this publication may be reproduced, stored in a retrieval system, or transmitted... -

Page 200

HSBC Bank plc 8 Canada Square London E14 5HQ United Kingdom Telephone: 44 020 7991 8888 www.hsbc.co.uk