GameStop 2005 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2005 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

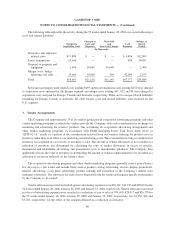

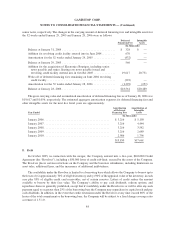

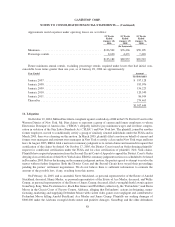

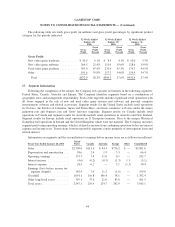

The difference in income tax provided and the amounts determined by applying the statutory rate to income

before income taxes result from the following:

52 Weeks

Ended

January 28,

2006

52 Weeks

Ended

January 29,

2005

52 Weeks

Ended

January 31,

2004

Federal statutory tax rate ........................... 35.0% 35.0% 35.0%

State income taxes, net of federal effect ................ 1.6 3.3 4.6

Foreign income taxes .............................. 1.4 0.6 (0.1)

Other (including permanent differences) ................ (1.0) (0.5) 0.2

37.0% 38.4% 39.7%

The Company’s effective tax rate decreased from 38.4% in the 52 weeks ended January 29, 2005 to 37.0% in

the 52 weeks ended January 28, 2006 due to expenses related to the mergers and corporate restructuring.

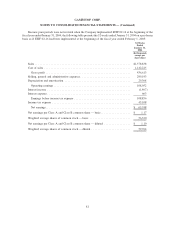

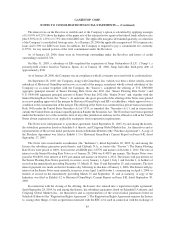

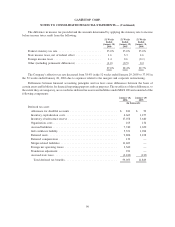

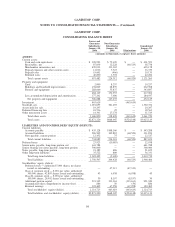

Differences between financial accounting principles and tax laws cause differences between the bases of

certain assets and liabilities for financial reporting purposes and tax purposes. The tax effects of these differences, to

the extent they are temporary, are recorded as deferred tax assets and liabilities under SFAS 109 and consisted of the

following components:

January 28,

2006

January 29,

2005

(In thousands)

Deferred tax asset:

Allowance for doubtful accounts .............................. $ 841 $ 59

Inventory capitalization costs . . . .............................. 4,663 1,157

Inventory obsolescence reserve . .............................. 17,078 3,640

Organization costs......................................... 165 134

Accrued liabilities ......................................... 7,740 1,650

Gift certificate liability ..................................... 5,351 1,984

Deferred rents ............................................ 9,806 3,438

Deferred compensation ..................................... 139 —

Merger-related liabilities .................................... 11,403 —

Foreign net operating losses . . . .............................. 3,360 —

Translation adjustment...................................... 931 —

Accrued state taxes ........................................ (2,422) (213)

Total deferred tax benefits . . . .............................. 59,055 11,849

90

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)