GameStop 2005 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2005 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(13) Of these shares, 22,000 are issuable upon exercise of stock options and 19,600 are restricted shares. Of the

remaining 1,000 shares, 500 shares are owned by Mr. Volkwein’s wife, and 250 shares each are owned by

Mr. Volkwein’s two children.

(14) Of these shares, 7,111,000 are issuable upon exercise of stock options and 307,400 are restricted shares.

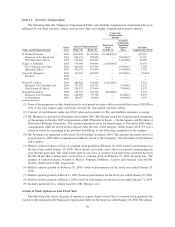

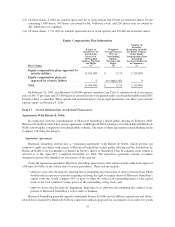

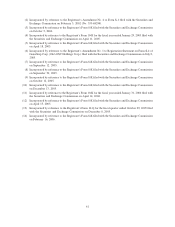

Equity Compensation Plan Information

Plan Category

Number of

Securities to be

Issued upon

Exercise of

Outstanding

Options, Warrants

and Rights

(a)

Weighted-

Average Exercise

Price of

Outstanding

Options,

Warrants and

Rights

(b)

Number of

Securities

Remaining Available

for Future Issuance

Under Equity

Compensation Plans

(Excluding

Securities Reflected

in Column(a))

(c)

Equity compensation plans approved by

security holders .................. 11,506,000 $ 12.31 3,329,000

Equity compensation plans not

approved by security holders ....... 0 notapplicable 0

Total ............................ 11,506,000 $ 12.31 3,329,000

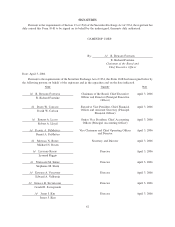

On February 10, 2006, an additional 1,630,000 options to purchase our Class A common stock at an exercise

price of $41.37 per share and 257,400 shares of restricted stock were granted under our Amended and Restated 2001

Incentive Plan, as amended. These options and restricted shares vest in equal increments over three years and the

options expire on February 9, 2016.

Item 13. Certain Relationships and Related Transactions

Agreements With Barnes & Noble

In connection with the consummation of Historical GameStop’s initial public offering in February 2002,

Historical GameStop entered into various agreements with Barnes & Noble relating to its relationship with Barnes &

Noble following the completion of its initial public offering. The terms of these agreements remain binding on the

Company following the mergers.

Separation Agreement

Historical GameStop entered into a “separation agreement” with Barnes & Noble, which governs our

respective rights and duties with respect to Historical GameStop’s initial public offering and the distribution by

Barnes & Noble to its stockholders of Barnes & Noble’s shares of GameStop Class B common stock (which is

referred to as the “spin-off”), completed November 12, 2004. The separation agreement contains covenants

designed to protect the intended tax-free nature of the spin-off.

Under the separation agreement, Historical GameStop agreed not to take certain actions without the approval

of Barnes & Noble or the satisfaction of certain procedures. These actions include:

• until two years after the spin-off, entering into or permitting any transaction or series of transactions which

would result in a person or persons acquiring or having the right to acquire shares of Historical GameStop’s

capital stock that would comprise 50% or more of either the value of all outstanding shares of the capital

stock or the total combined voting power of the outstanding voting stock; and

• until two years after the spin-off, liquidating, disposing of, or otherwise discontinuing the conduct of any

portion of Historical GameStop’s active trade or business.

Historical GameStop generally agreed to indemnify Barnes & Noble and its affiliates against any and all tax-

related losses incurred by Barnes & Noble in connection with any proposed tax assessment or tax controversy with

55