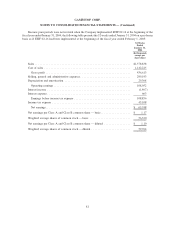

GameStop 2005 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2005 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

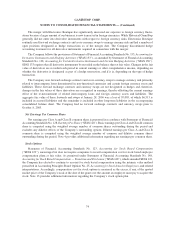

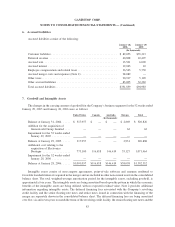

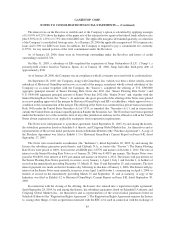

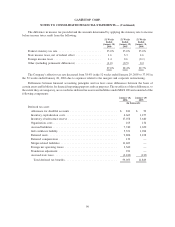

senior notes, respectively. The changes in the carrying amount of deferred financing fees and intangible assets for

the 52 weeks ended January 29, 2005 and January 28, 2006 were as follows:

Deferred

Financing Fees

Intangible

Assets

(In thousands)

Balance at January 31, 2004 .................................. $ 328 $ —

Addition for revolving credit facility entered into in June 2004......... 670 —

Amortization for the 52 weeks ended January 29, 2005 .............. (432) —

Balance at January 29, 2005 .................................. 566 —

Addition for the acquisition of Electronics Boutique, including senior

notes payable and senior floating rate notes payable issued and

revolving credit facility entered into in October 2005 .............. 19,617 20,731

Write-off of deferred financing fees remaining on June 2004 revolving

credit facility ............................................ (393) —

Amortization for the 52 weeks ended January 28, 2006 .............. (1,229) (251)

Balance at January 28, 2006 .................................. $18,561 $20,480

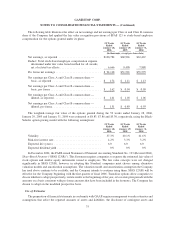

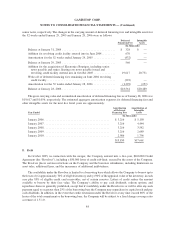

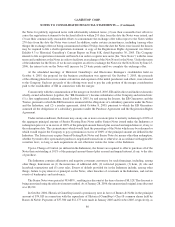

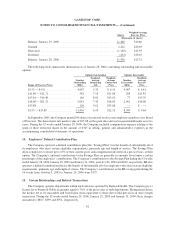

The gross carrying value and accumulated amortization of deferred financing fees as of January 28, 2006 was

$19,617 and $1,056, respectively. The estimated aggregate amortization expenses for deferred financing fees and

other intangible assets for the next five fiscal years are approximately:

Year Ended

Amortization

of Deferred

Financing Fees

Amortization of

Intangible

Assets

(In thousands)

January 2006 .......................................... $ 3,216 $ 5,150

January 2007 .......................................... 3,216 4,444

January 2008 .......................................... 3,216 3,582

January 2009 .......................................... 3,216 2,689

January 2010 .......................................... 2,986 1,796

$15,850 $17,661

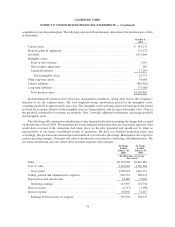

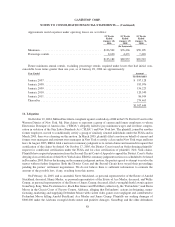

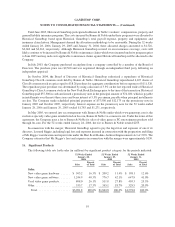

8. Debt

In October 2005, in connection with the merger, the Company entered into a five-year, $400,000 Credit

Agreement (the “Revolver”), including a $50,000 letter of credit sub-limit, secured by the assets of the Company.

The Revolver places certain restrictions on the Company and the borrower subsidiaries, including limitations on

asset sales, additional liens, and the incurrence of additional indebtedness.

The availability under the Revolver is limited to a borrowing base which allows the Company to borrow up to

the lesser of (x) approximately 70% of eligible inventory and (y) 90% of the appraisal value of the inventory, in each

case plus 85% of eligible credit card receivables, net of certain reserves. Letters of credit reduce the amount

available to borrow by their face value. The Company’s ability to pay cash dividends, redeem options, and

repurchase shares is generally prohibited, except that if availability under the Revolver is or will be after any such

payment equal to or greater than 25% of the borrowing base the Company may repurchase its capital stock and pay

cash dividends. In addition, in the event that credit extensions under the Revolver at any time exceed 80% of the

lesser of the total commitment or the borrowing base, the Company will be subject to a fixed charge coverage ratio

covenant of 1.5:1.0.

84

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)