GameStop 2005 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2005 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

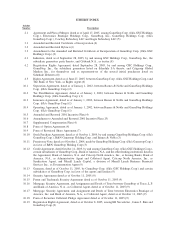

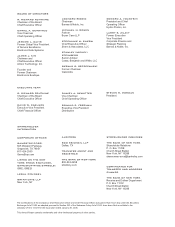

EXHIBIT INDEX

Exhibit

Number Description

2.1 Agreement and Plan of Merger, dated as of April 17, 2005, among GameStop Corp. (f/k/a GSC Holdings

Corp.), Electronics Boutique Holdings Corp., GameStop, Inc., GameStop Holdings Corp. (f/k/a

GameStop Corp.), Cowboy Subsidiary LLC and Eagle Subsidiary LLC.(5)

3.1 Amended and Restated Certificate of Incorporation.(6)

3.2 Amended and Restated Bylaws.(6)

3.3 Amendment to the Amended and Restated Certificate of Incorporation of GameStop Corp. (f/k/a GSC

Holdings Corp.).(9)

4.1 Indenture, dated as of September 28, 2005, by and among GSC Holdings Corp., GameStop, Inc., the

subsidiary guarantors party thereto, and Citibank N.A., as trustee.(8)

4.2 Registration Rights Agreement, dated September 28, 2005, by and among GSC Holdings Corp.,

GameStop, Inc., the subsidiary guarantors listed on Schedule I-A thereto, and Citigroup Global

Markets Inc., for themselves and as representatives of the several initial purchasers listed on

Schedule II thereto.(8)

4.3 Rights Agreement, dated as of June 27, 2005, between GameStop Corp. (f/k/a GSC Holdings Corp.) and

The Bank of New York, as Rights Agent.(6)

10.1 Separation Agreement, dated as of January 1, 2002, between Barnes & Noble and GameStop Holdings

Corp. (f/k/a GameStop Corp.)(2)

10.2 Tax Disaffiliation Agreement, dated as of January 1, 2002, between Barnes & Noble and GameStop

Holdings Corp. (f/k/a GameStop Corp.)(1)

10.3 Insurance Agreement, dated as of January 1, 2002, between Barnes & Noble and GameStop Holdings

Corp. (f/k/a GameStop Corp.)(1)

10.4 Operating Agreement, dated as of January 1, 2002, between Barnes & Noble and GameStop Holdings

Corp. (f/k/a GameStop Corp.)(1)

10.5 Amended and Restated 2001 Incentive Plan.(4)

10.6 Amendment to Amended and Restated 2001 Incentive Plan.(13)

10.7 Supplemental Compensation Plan.(4)

10.8 Form of Option Agreement.(4)

10.9 Form of Restricted Share Agreement.(7)

10.10 Stock Purchase Agreement, dated as of October 1, 2004, by and among GameStop Holdings Corp. (f/k/a

GameStop Corp.), B&N Gamestop Holding Corp. and Barnes & Noble.(3)

10.11 Promissory Note, dated as of October 1, 2004, made by GameStop Holdings Corp. (f/k/a Gamestop Corp.)

in favor of B&N GameStop Holding Corp.(3)

10.12 Credit Agreement, dated October 11, 2005, by and among GameStop Corp. (f/k/a GSC Holdings Corp.),

certain subsidiaries of GameStop Corp., Bank of America, N.A. and the other lending institutions listed in

the Agreement, Bank of America, N.A. and Citicorp North America, Inc., as Issuing Banks, Bank of

America, N.A., as Administrative Agent and Collateral Agent, Citicorp North America, Inc., as

Syndication Agent, and Merrill Lynch Capital, a division of Merrill Lynch Business Financial

Services Inc., as Documentation Agent.(9)

10.13 Guaranty, dated as of October 11, 2005, by GameStop Corp. (f/k/a GSC Holdings Corp.) and certain

subsidiaries of GameStop Corp. in favor of the agents and lenders.(9)

10.14 Security Agreement dated as of October 11, 2005.(9)

10.15 Patent and Trademark Security Agreement dated as of October 11, 2005.(9)

10.16 Mortgage, Security Agreement, and Assignment and Deeds of Trust between GameStop of Texas, L.P.

and Bank of America, N.A., as Collateral Agent, dated as of October 11, 2005.(9)

10.17 Mortgage, Security Agreement, and Assignment and Deeds of Trust between Electronics Boutique of

America, Inc. and Bank of America, N.A., as Collateral Agent, dated as of October 11, 2005.(9)

10.18 Form of Securities Collateral Pledge Agreement dated as of October 11, 2005.(9)

10.19 Registration Rights Agreement, dated as of October 8, 2005, among EB Nevada Inc., James J. Kim and

GameStop Corp.(9)