GameStop 2005 Annual Report Download - page 83

Download and view the complete annual report

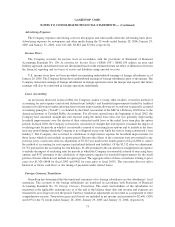

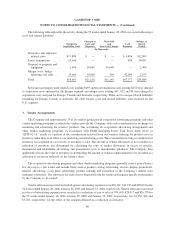

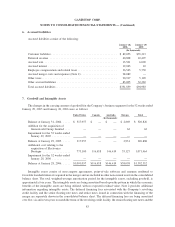

Please find page 83 of the 2005 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The merger with Electronics Boutique has significantly increased our exposure to foreign currency fluctu-

ations because a larger amount of our business is now transacted in foreign currencies. While Historical GameStop

generally did not enter into derivative instruments with respect to foreign currency risks, Electronics Boutique

routinely used forward exchange contracts and cross-currency swaps to manage currency risk and had a number of

open positions designated as hedge transactions as of the merger date. The Company discontinued hedge

accounting treatment for all derivative instruments acquired in connection with the merger.

The Company follows the provisions of Statement of Financial Accounting Standards No. 133, Accounting for

Derivative Instruments and Hedging Activities (“SFAS 133”), as amended by Statement of Financial Accounting

Standards No. 138, Accounting for Certain Derivative Instruments and Certain Hedging Activities (“SFAS 138”).

SFAS 133 requires that all derivative instruments be recorded on the balance sheet at fair value. Changes in the fair

value of derivatives are recorded each period in current earnings or other comprehensive income, depending on

whether the derivative is designated as part of a hedge transaction, and if it is, depending on the type of hedge

transaction.

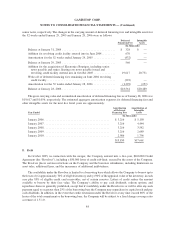

The Company uses forward exchange contracts and cross-currency swaps to manage currency risk primarily

related to intercompany loans denominated in non-functional currencies and certain foreign currency assets and

liabilities. These forward exchange contracts and currency swaps are not designated as hedges and, therefore,

changes in the fair values of these derivatives are recognized in earnings, thereby offsetting the current earnings

effect of the re-measurement of related intercompany loans and foreign currency assets and liabilities. The

aggregate fair value of these forwards and swaps at January 28, 2006 was a loss of $7,083, of which $6,513 is

included in accrued liabilities and the remainder is included in other long-term liabilities in the accompanying

consolidated balance sheet. The Company had no forward exchange contracts and currency swaps prior to

October 8, 2005.

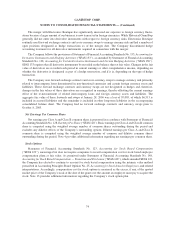

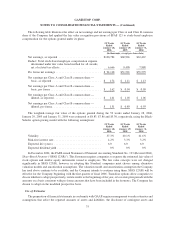

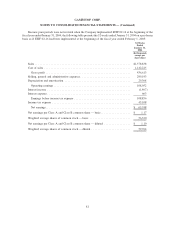

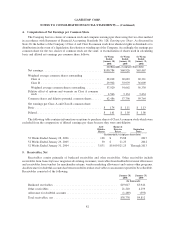

Net Earnings Per Common Share

Net earnings per Class A and Class B common share is presented in accordance with Statement of Financial

Accounting Standards No. 128, Earnings Per Share (“SFAS 128”). Basic earnings per Class A and Class B common

share is computed using the weighted average number of common shares outstanding during the period and

excludes any dilutive effects of the Company’s outstanding options. Diluted earnings per Class A and Class B

common share is computed using the weighted average number of common and dilutive common shares

outstanding during the period. Note 4 provides additional information regarding net earnings per common share.

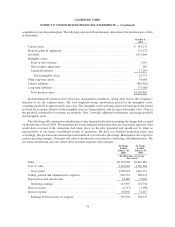

Stock Options

Statement of Financial Accounting Standards No. 123, Accounting for Stock Based Compensation

(“SFAS 123”), encourages but does not require companies to record compensation cost for stock based employee

compensation plans at fair value. As permitted under Statement of Financial Accounting Standards No. 148,

Accounting for Stock Based Compensation — Transition and Disclosure (“SFAS 148”), which amended SFAS 123,

the Company has elected to continue to account for stock based compensation using the intrinsic value method

prescribed in Accounting Principles Board Opinion No. 25, Accounting for Stock Issued to Employees, and related

interpretations. Accordingly, compensation cost for stock options is measured as the excess, if any, of the quoted

market price of the Company’s stock at the date of the grant over the amount an employee must pay to acquire the

stock. Note 13 provides additional information regarding the Company’s stock option plan.

74

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)